Analyzing how Decentraland’s hype failed to aid MANA’s climb

- Decentraland dominated the social space over the weekend.

- MANA’s price remains in the bearish region amid chances to exit the zone.

A large part of the crypto ecosystem experienced unusual inaction in the just-ended 24- 26 March weekend.

Strange because almost all other weekends in the month were filled with evident price rises. Despite the market sluggishness, Decentraland [MANA] jumped to the top of the most discussed out of the thousands of crypto projects.

Read Decentraland’s [MANA] Price Prediction 2023-2024

Opium in the virtual land

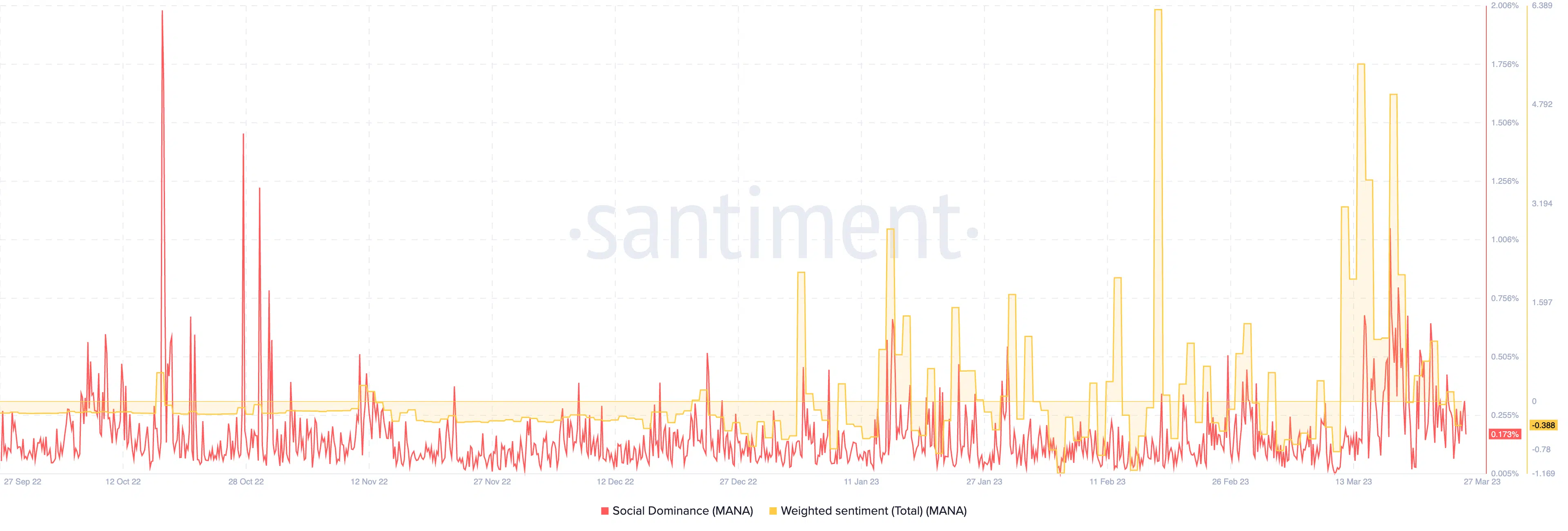

According to Santiment, MANA’s social dominance rose sharply on 26 March. At press time, Ethereum [ETH] virtual world project maintained the hike at 0.354%.

This increase implied that the Decentraland community actively participated in conversations around the token. And the depth of discussion was far above many others.

However, the rise in social activity is not an inescapable condition for a positive price action or perception. This was further revealed by the weighted sentiment. The sentiment takes into account the unique social volume and measures the average subjective information about an asset.

At the time of writing, MANA’s weighted sentiment was -0.388. This means that the impression that investors had towards the token was not necessarily optimistic. The MANA price decreased 1.74% in the last 24 hours, following a similar trend as most cryptocurrencies.

Regardless, it did not seem that the token would go for a trend reversal anytime soon, as indicated by the Awesome Oscillator (AO). Based on the daily chart, the AO was -0.0161, at press time.

This value suggested that the momentum was bearish. However, there was potential for a trend reversal with the emerging presence of green bars.

In terms of volatility, the Bollinger Bands (BB) showed that MANA was contracting. And with the price evading both the upper and lower band, it meant that the token was not oversold or overbought, at the time of publication.

No accolades yet

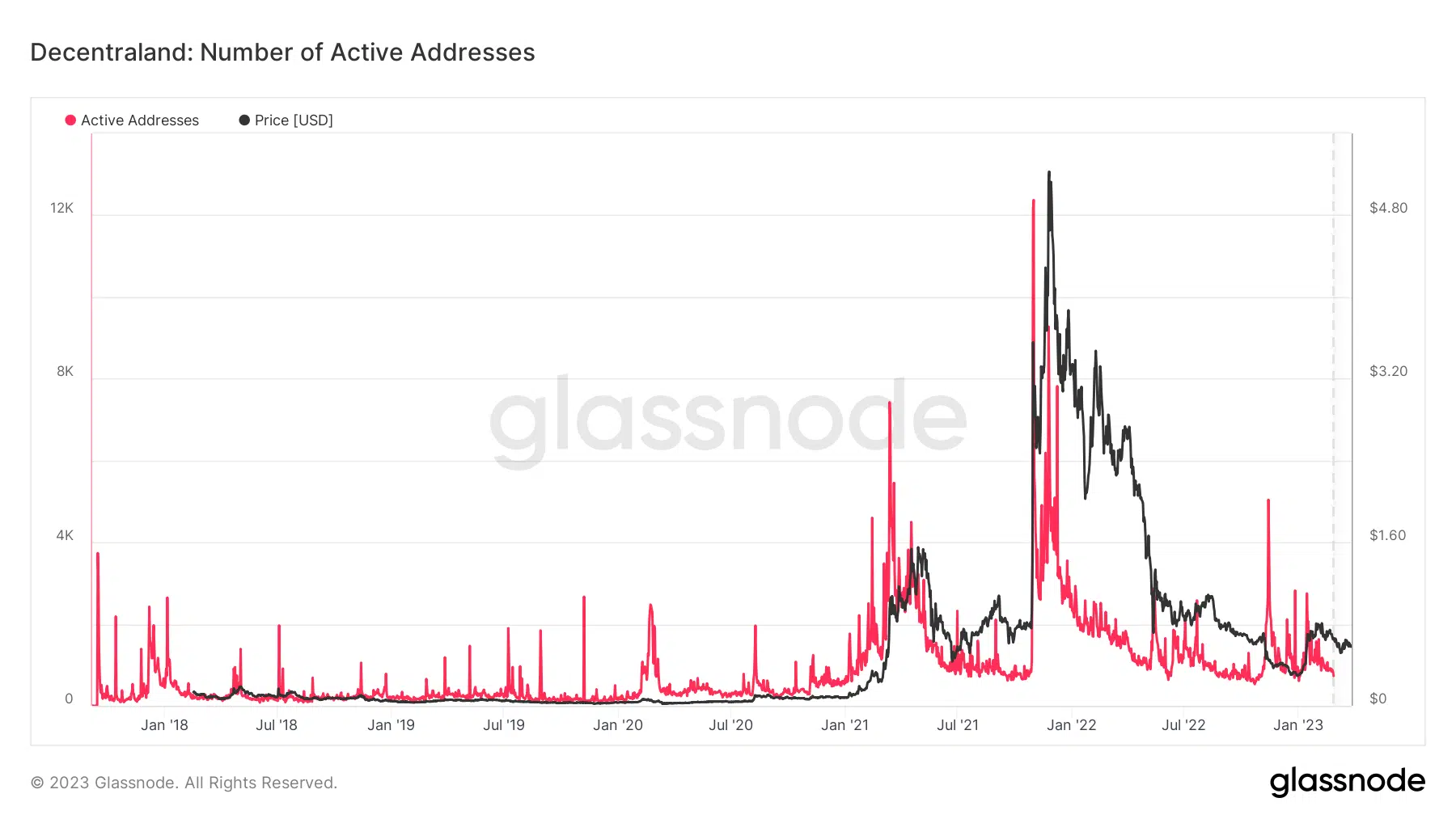

Furthermore, the number of active addresses on the Decentrand network had significantly reduced. Active addresses show the number of unique participants that had successful transactions within a network.

Is your portfolio green? Check the Decentraland Profit Calculator

According to Glassnode, the last time MANA had a notable hike in this regard was 17 January. But at press time, these addresses were down to 729.

Lastly, Decentrland has been somewhat quiet in this first quarter as there has been no notable development. Since this was the case, it is likely that MANA’s price action only responds to widespread crypto trends.