Analyzing how GMT, GST tokens have fared amid current market turmoil

As most move-to-earn blockchain-based projects reel under the impact of the tight market conditions, STEPN appears to have been hit the most. Apart from struggling to keep gamers interested, since the beginning of the month, the gaming company has been trailed by a series of unfortunate events.

At the end of May, a regulatory clampdown in China forced the company to suspend the provision of GPS services to users within mainland China. This forced its tokens GMT and GST to suffer a drop in their prices. Shortly after, the company revealed that its network was hit by 25 million DDOS attacks sent to its servers within a short period of time leading to downtime.

As the interest of runners continues to wane, the floor price of STEPN sneaker NFTs has started to plummet. Trading for as high as $1,200 a pair two months ago, the sneakers on the Magic Eden NFT marketplace now sell for as low as 4.10 SOL (about $112).

In a bid to save its already ailing enterprise and its dying tokens, STEPN announced the launch of its own multi-chain Decentralized Exchange (DEX) DOOAR, which will allow anyone to provide liquidity to GST/USDC & GMT/USDC pairs.

Amidst this series of events and general market downturn, how the network’s GMT & GST tokens have fared?

Price analysis

As the rest of the cryptocurrency market continues to writhe under pains inflicted by the bears, the STEPN’s GMT & GST tokens aren’t left out. Down 12% in the last 24 hours, the GMT token changed hands at $0.5919 during press time. In the last seven days, the token has seen a 38% drop. Within this period, the market capitalization also plummeted by 38% to be pegged at $354.08 million at the time of writing from the $571.93 million recorded a week ago.

Severely oversold at the time of writing, the Relative Strength Index (RSI) was positioned at 29. With the general market outlook and the ongoing disinterest in play-to-earn games, a retracement might be far in sight.

With a 17% decline in the last 24 hours, Stepn’s GST token did not fare any better. At press time, it traded for $0.2379. In the last seven days, the token registered a whopping 57% decline in price. The market capitalization also witnessed a drop from $45 million to $25.06 million at the time of press.

Price chart analysis revealed that the GST token had taken on a downward spiral since 13 May. Since then, its Relative Strength Index (RSI) has played with the bears deep in oversold territory. At press time, it was spotted at 23.12.

On-chain analysis

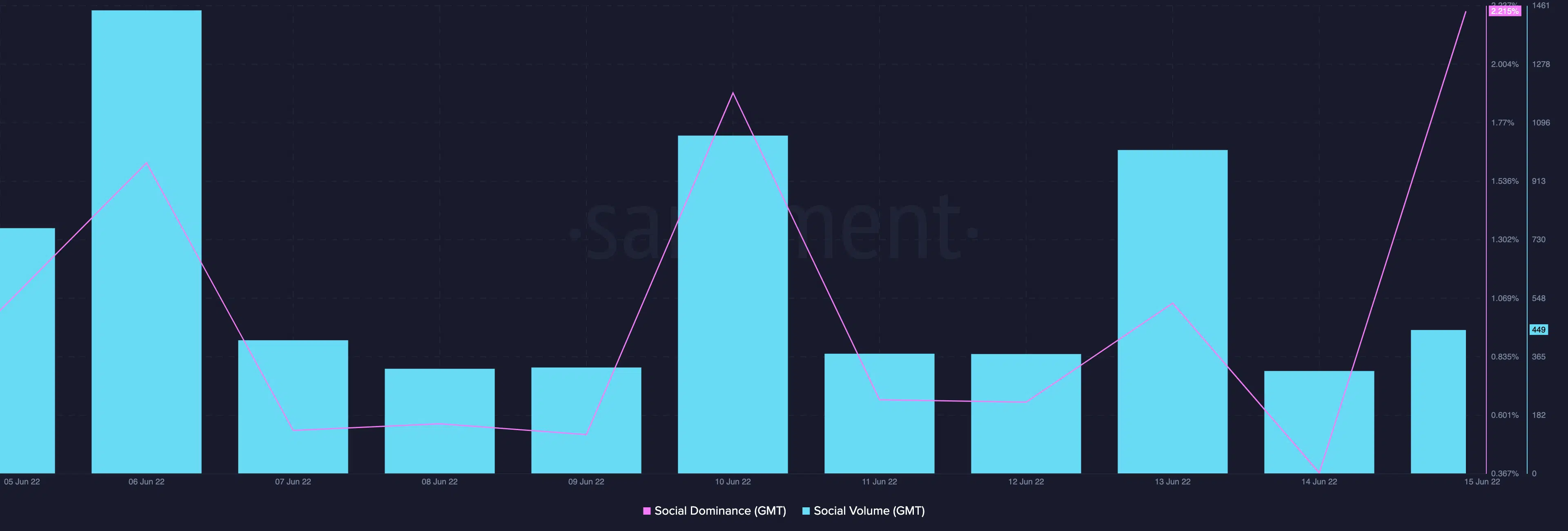

On a social front, GMT grew by 87% in social dominance in the last 24 hours. The social volume of the token also registered a 28% growth.

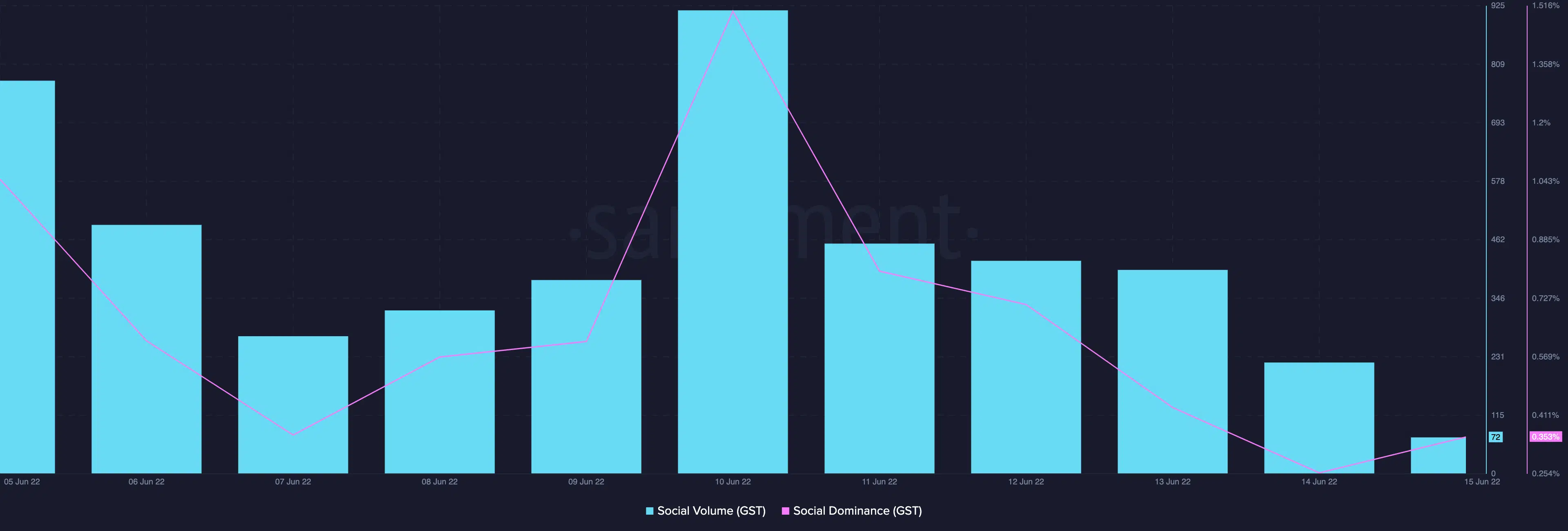

The GST token on the other hand registered a 25% spike in its social dominance in the last 24 hours. The social volume, on the other hand, saw a 67% decline within the same period.