Analyzing performance of Polygon zkEVM and its on-chain metrics

- Polygon gains the upper hand in TVL growth thanks to zkEVM.

- MATIC escapes ranging performance after regaining bullish momentum.

It is usually more difficult for blockchain networks to achieve positive growth under slow market conditions. The Polygon network managed to overcome limitations thanks to one particular segment.

Polygon zkEVM has been receiving a lot of attention recently, subsequently fueling positive growth. This is evident by the impressive TVL it managed to achieve within a short period. To put this growth into perspective, Polygon zkEVM surged from $1.5 million to $14 million.

Polygon zkEVM has grown in TVL within a short period of time, rising from $1.5 million to $14 million.

But that's not the only thing that happened on Polygon zkEVM.

Here are some additional on-chain data highlighting Polygon zkEVM activity. pic.twitter.com/OYP49V0i0E

— DeFi Scholar ?? (@ModestusOkoye) May 29, 2023

One of the key reasons for this growth is that zkEVM provides Polygon with additional benefits. These include lower costs and better scalability. As such, many investors are confident that it is an ideal solution to supercharge Polygon’s growth.

For perspective, Polygon zkEVM had less than $500 million in total value locked. The TVL growth was initially off to a healthy start but it really took off after mid-May. The network added slightly over $12 million to its TVL in the last two weeks.

This growth may offer insights into how the market has reacted to zkEVM. A very positive response but will the same translate to demand for MATIC?

MATIC’s price action

MATIC may already be benefiting from the growth associated with the Polygon zkEVM hype. This is evident from its performance in the last few days. Like most top cryptocurrencies, MATIC went through a phase of lateral price movement but its price stagnation was short-lived unlike most of its counterparts.

MATIC has been on a bullish trajectory in the last five days which has helped the token overcome the ranging performance. It traded at $0.92 after failing to push back above $1.

MATIC’s upside might be short-lived now that its momentum is notably slowing down. This was evident in some of its on-chain metrics.

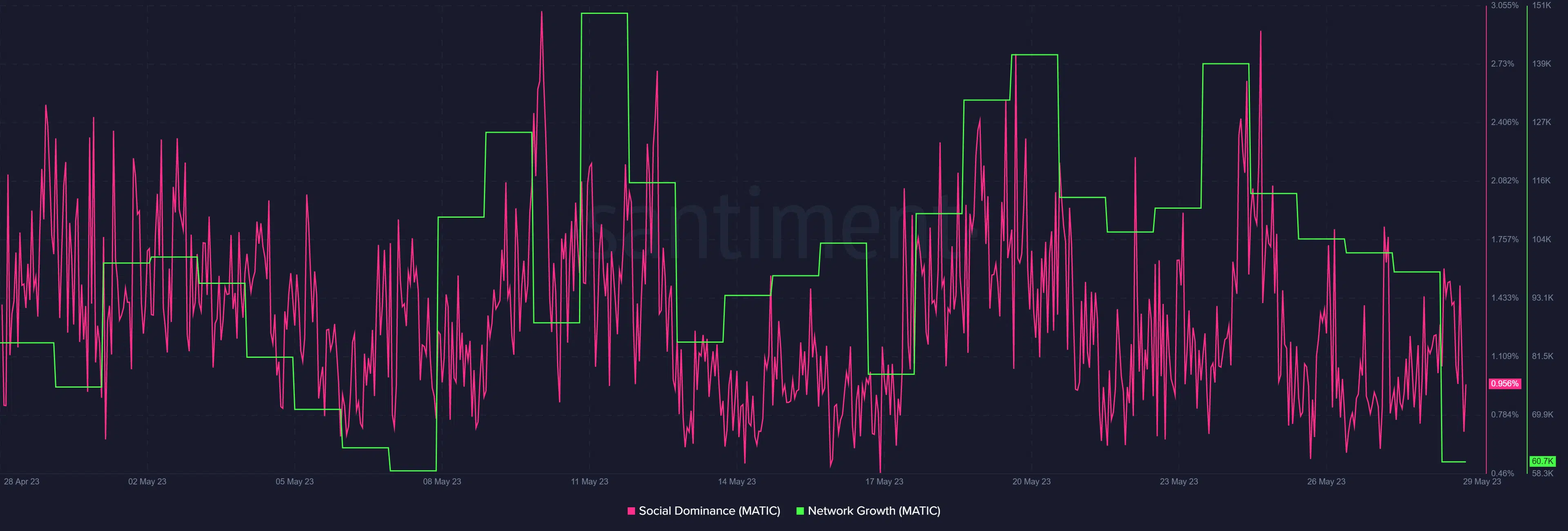

For example, Polygon’s network growth metric is almost at its lowest level in the last four weeks. The network growth peaked at the start of the recent rally which notably started with a spike in social dominance.

Is your portfolio green? Check out the MATIC Profit Calculator

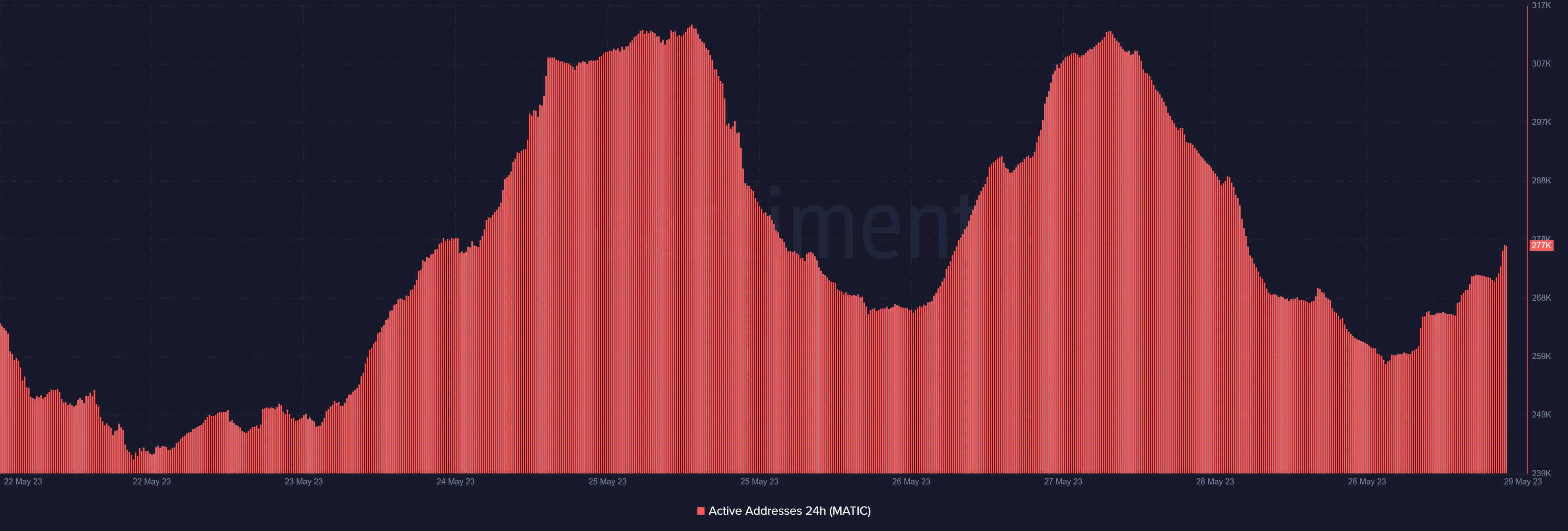

The recent rally was accompanied by a surge in daily active addresses from 23 May.

The tail end of the recent hype started on 27 May and addresses registered a notable slow-down since then.

This is reflected by some selling pressure in the last 24 hours. It is worth noting that there was a slight surge in the daily active addresses too.

The slight surge may indicate trading activity associated with profit-taking after the recent rally. This might be short-lived now that the market is regaining some confidence.