Anatomy of Bitcoin’s current rally as Fed attempts to save the day

- Inflation fears fuel Bitcoin demand as investors shift attention to hard money.

- Assessing the probability of short-term sell pressure or sustained upside.

Bitcoin has regained strong bullish activity this week which has pushed it to a new 6-month high and a new YTD high. But the reason for this rally is far more interesting and may set the pace for Bitcoin’s performance for the rest of the year.

Bitcoin mostly attributes its latest rally to fears about traditional finance’s collapse. Those concerns have triggered a loss of confidence in the banking industry especially after Signature and SVB collapsed.

Concerns about traditional finance pressures may have prompted many to move their funds into Bitcoin.

The TradFi concerns have further been exasperated by inflation concerns. Recent reports reveal that the Federal Reserve reportedly printed $300 billion this week. The move puts the FED in a tough position and undermines recent efforts to combat inflation.

The US Federal Reserve printed $300 BILLION in the past week to save the banks

Half went to holding companies for Silicon Valley Bank & Signature Bank. The Fed didn't disclose the other half

The rich always get bailed out. The poor get told "work harder"https://t.co/eNCW2IV9HL pic.twitter.com/UDrhGP6BWc

— Ben Norton (@BenjaminNorton) March 17, 2023

Reports also claim that half of the printed amount was used to bail out SVB and Signature Bank after their recent woes. The weekly Bitcoin rally is important because it confirms a positive response to inflation concerns.

A preference for hard money is expected under such conditions, hence more BTC demand is expected if the FED continues to print money.

Evaluating the current Bitcoin demand

The latest surge in Bitcoin demand is more apparent, especially among retail buyers. The number of Bitcoin addresses currently holding at least 0.01 BTC recenty surged to a new historic high. This confirms that retail buyers have been accumulating.

? #Bitcoin $BTC Number of Addresses Holding 0.01+ Coins just reached an ATH of 11,676,610

Previous ATH of 11,676,567 was observed on 16 March 2023

View metric:https://t.co/oyguxpaA2y pic.twitter.com/jdHEUig9J3

— glassnode alerts (@glassnodealerts) March 17, 2023

Whales have also been accumulating BTC. The number of addresses holding over 1,000 BTC has been on the rise since 12 February. However, whale demand is still relatively low given that the market is still lower than its weekly high.

Can Bitcoin sustain the current rally?

Bitcoin exchange flows reveal that both exchange inflows and outflows have tanked significantly in the last 24 hours. This indicates a drop in the buying and selling pressure.

Nevertheless, exchange inflows were slightly higher than outflows at press time, confirming that there was some selling pressure.

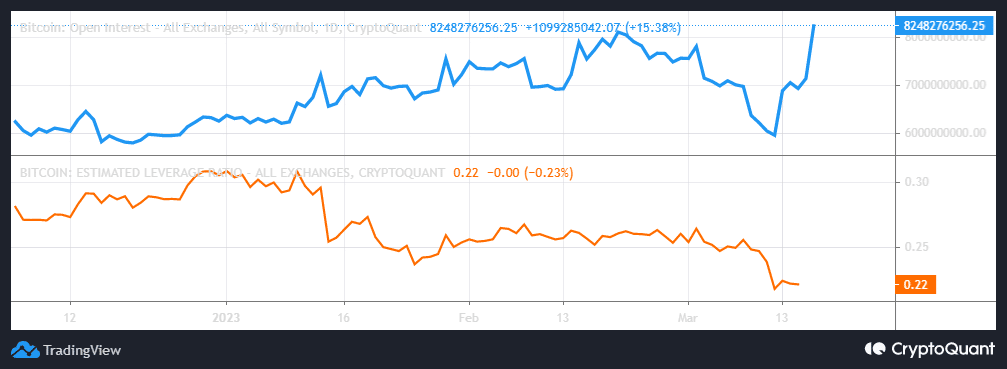

Moreover, there was a surge in demand for BTC derivatives this week. This was evident by the surge in open interest to a new weekly high.

However, despite this surge, the level of leverage in the market is still low, hinting at some level of uncertainty in the market.

The aforementioned uncertainty may suggest that investors are unsure as to whether BTC can sum up enough selling pressure. Or, whether it can sustain the current rally in the short term.