Bitcoin [BTC] breaks $26k, CPI drops – is the euphoria back

- BTC nudged past $26,000 following CPI’s data announcement.

- Maximalists reiterated that the traditional financial system could not stop Bitcoin’s growth.

Bitcoin [BTC] continued its unprecedented bullish run and climbed above $26,000 as the United States Bureau of Labor Statistics released its February Consumer Price Index (CPI) data. According to the country’s fact-finding agency, the CPI dropped to 6% on a Year-on-Year (YoY) basis.

Is your portfolio green? Check the Bitcoin Profit Calculator

The CPI expresses the change in the current prices of goods in a given year compared to the prices within a base period. The metric used to measure inflation rose to 6.4% per January’s data. However, the 14 March declaration implied that the CPI had dropped for the eighth consecutive month, hitting the lowest since September 2021.

Preparedness, backtracks, and the proceeds of caution

After the announcement, BTC only took a few minutes to reach the aforementioned price. But at press time, the coin had lost its hold on the region and was trading at $24,967.

However, CNBC’s report on the situation mentioned that Signature and Silicon Valley Bank crashes have now ignited the hypothesis that a hike in Fed rates would cease for a while.

The Fed meeting determines monetary policy and assesses the long-term objectives of price stability and economic growth. With the next one billed for 22 March, the consumer news and business channel pointed out:

“Banking sector turmoil in recent days has kindled speculation that the central bank could signal that it soon will halt the rate hikes.”

Prior to the announcement, BTC and many other cryptocurrencies were pricing at a peak. But before the coin hit its Year-To-Date (YTD) high, some investors were bullish on the reaction. According to Lookonchain, a pseudonymous whale named “Rewkang” increased his long BTC position hours before the CPI report.

2 hours before the #CPI announcement, the GMX whale(@Rewkang) increased their long positions of BTC.

Currently, his average entry price is $23,608, and the profit is $2.5M.https://t.co/M7t9jcxzYB pic.twitter.com/oqL5CsZGqS

— Lookonchain (@lookonchain) March 14, 2023

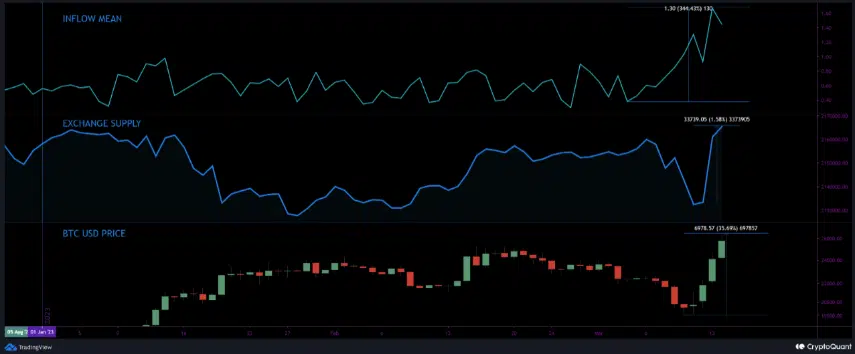

An hour after CPI, CryptoQuant analyst “Papi” took to the platform to warn investors, predicting that there could be a short retracement.

According to him, the $25,000 intraday recovery could trigger massive profit-taking due to the exchange flow spike. An increase in exchange flow usually translates to intent to sell. Sometimes, it leads to a price decline.

Papi acknowledged that the macroeconomic factors and developments from the banking arm were other aspects to watch.

How much are 1,10,100 BTCs worth today?

BTC loyalists: Never to surrender

However, it seemed that the Bitcoin trend has assured many of its faithful that neither banks nor regulators. Reacting to the price increase, CEO of Custodia Bank and Bitcoin maximalist Caitlin Long noted that the events of the past few days have proven why the king coin has a better working system than the traditional banks. She said:

“The Fed has now broken precedent, turning the entire banking system into “systemically important” effectively bailing out ALL banks. The Fed has just turned into a Leveraged Lender with a strong incentive to lower rates.”

Bank regulators: "chancellor on the brink of a second bailout for banks"?#Bitcoin: "hold my beer"? (up >30% since SVB bank run Thursday) pic.twitter.com/LaxYqr035l

— Caitlin Long ?⚡️? (@CaitlinLong_) March 14, 2023

Amid the banking industry crises, quite a number of investors look to have turned to Bitcoin for safety. It is surprising that it has repaid the trust within a short period despite its long-term underwhelming performance. However, seasoned trader Peter Brandt tweeted that he was not shocked that BTC got rejected at $26,000.

Not surprised 26,000 rejected advance pic.twitter.com/nUQkNAtI1t

— Peter Brandt (@PeterLBrandt) March 14, 2023