Another first for Ethereum that every trader needs to be aware of

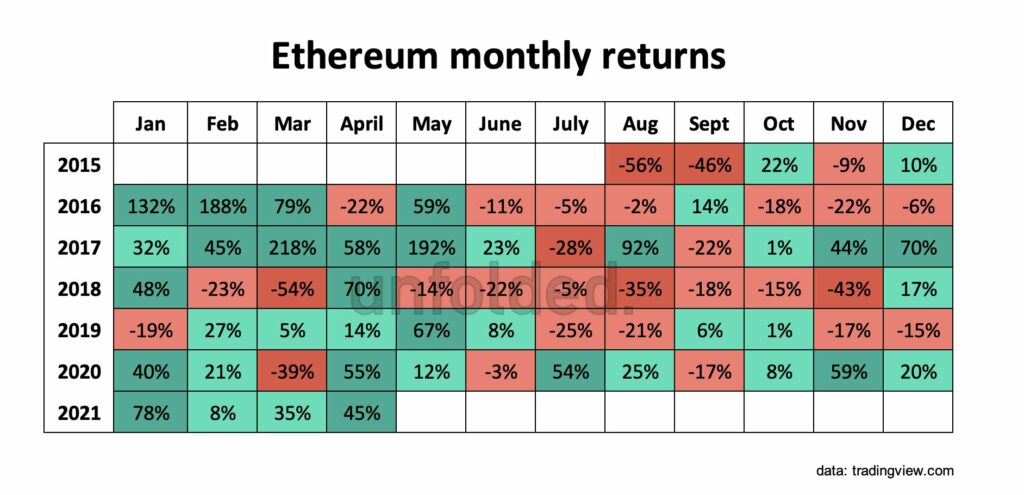

Trading above $3200 level, on-chain analysts would agree that Ethereum is no longer undervalued. The altcoin’s price was up nearly 30% in the past week and market capitalization is rising. The altcoin closed with 45% monthly returns in April, marking 7 consecutive positive months for the first time ever.

This streak of positive monthly returns emerged as a sign for booking unrealized profits, for HODLers and retail traders.

Source: Unfolded

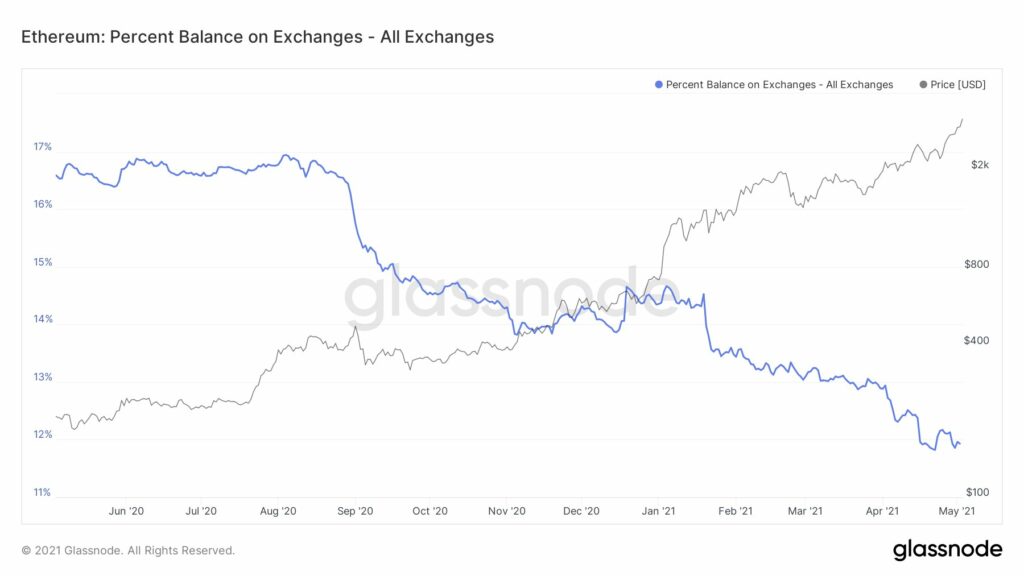

Blowing past the $3000 level, ETH made history since the funding is negative at the current price level. The volume of ETH held across spot exchanges dropped consistently while price continued rising, along with negative funding. This cross is shown in the below chart and was considered bullish for ETH’s price.

Source: Twitter

A series of events that contributed to ETH’s rally include the issuance of EIB’s first-ever ETH bond, ETH’s increasing dominance, and the consistent price rally. In the case of Bitcoin, trader greed has not factored in yet, however that is not the case with Ethereum.

It may set in soon, based on ETH’s on-chain activity. Ethereum exceeded $3000, but the miner fee income hit a new low for the first time since December 2020. This may be related to the recent optimization of the MEV mechanism, and the fact that traffic has shifted to BSC and led to a decrease in GAS.

Miners’ income dropped nearly 30% and this is significant when it comes to the sustainability of the current price rally and further price discovery for ETH. The current price move by ETH maybe its largest yet, against Bitcoin since the bull season started in 2020. Historically such significant price moves come right before the onset of an alt season with most top altcoins rallying and hitting new ATH.

At the current price level, there are traders who are underexposed to ETH, if they buy at the current price level, with adequate demand there may be new support for ETH above the $3000 level.

These traders, buying the dip, are less likely to exit at the first instance of a drop below the $3000, and that is true in the case of ETH, since the altcoin is also popular for notoriously large comebacks in price and trade volume. With increasing market capitalization, demand, and rallying price, ETH continues to maintain its dominance this alt season.