APE wipes out all gains from the recent rally, what can traders expect next?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ApeCoin has a strong higher timeframe downtrend

- The recent rally was not sustainable due to a lack of demand for the token

ApeCoin [APE] noted a strong bounce from the $1.1 support level last week, but those gains were wiped out within three days. The recent losses came after Bitcoin’s [BTC] rejection from $28.5k and was in keeping with APE’s higher timeframe downtrend.

Read ApeCoin’s [APE] Price Prediction 2023-24

A recent analysis of ApeCoin’s price movement by AMBCrypto revealed that the $1.09 was an HTF support level. However, the rise in the Market Value to Realized Value (MVRV) ratio was pointed to as evidence that we could see a drop in prices, which came over the past 48 hours.

The retracement back to the $1.1 support highlighted bullish fragility

At the time of writing the market structures of ApeCoin on both the four-hour chart and the one-day chart were bearish. A move above $1.37 would have flipped the daily bullish but the rejection at $1.3 put a swift end to those hopes.

The drop in APE prices was accompanied by a sudden slide southward on the On-Balance Volume (OBV). This showcased the strong selling pressure. It revealed that holders were keen to book profits or limit their losses after the recent rally.

The Relative Strength Index (RSI) was also below neutral 50 and noted a shift in the trend in favor of the bears. APE’s drop from $1.3 to $1.09 was used to plot a set of Fibonacci retracement levels (pale yellow). It underlined the $1.2-$1.26 as a zone where short-sellers can look to enter the market targeting the southward Fib extension levels.

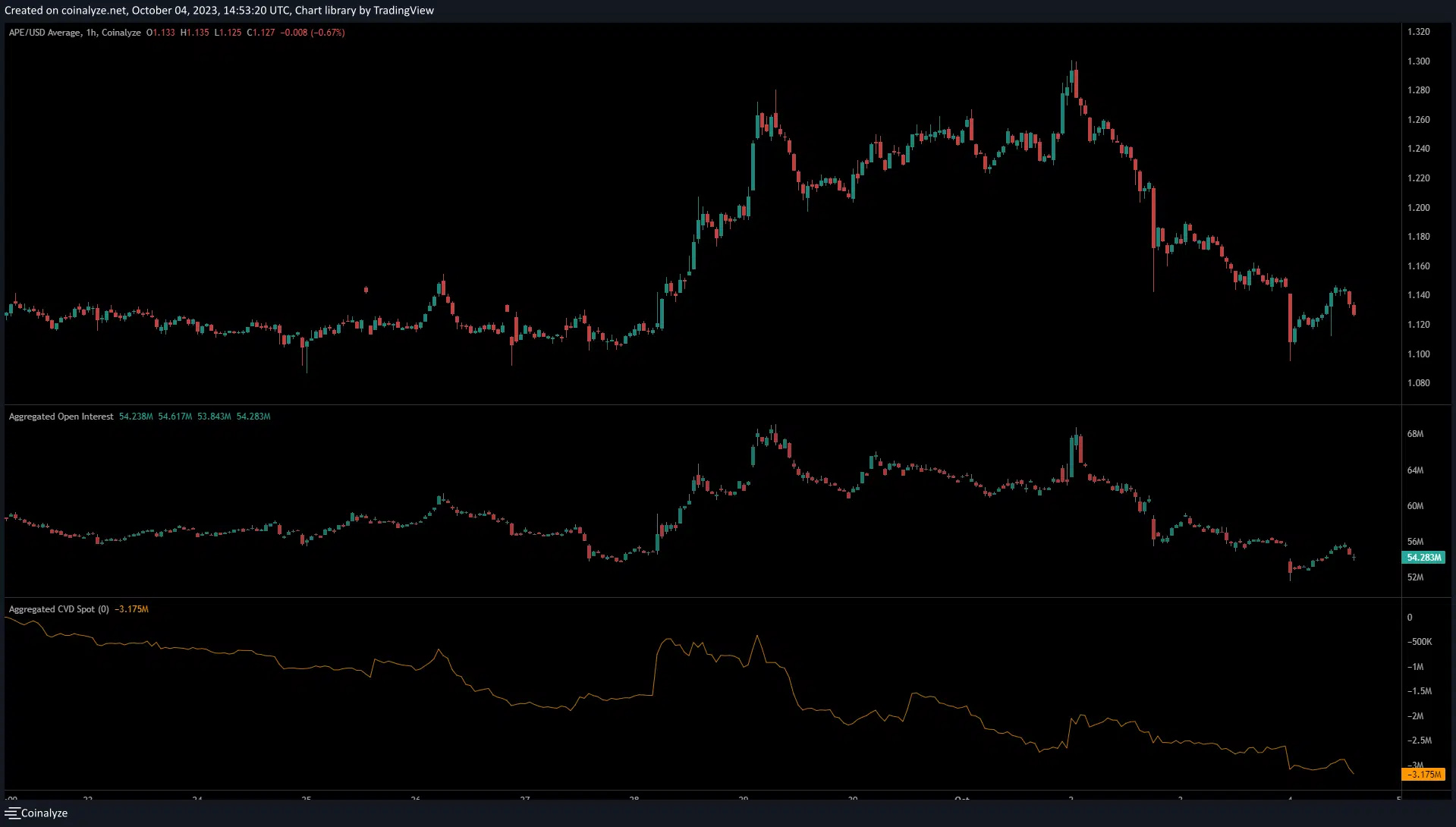

Coinalyze data throws into the spotlight the depth of the bearish pressure

Source: Coinalyze

On 2 October, when the prices peaked at $1.3, the Open Interest sat at $68.15 million. Since then the OI has slid to $54 million. Short-term bulls taking profits was a likely factor that contributed to the falling OI. Bulls from last week forced to close as prices turned against them was another.

Realistic or not, here’s APE’s market cap in BTC’s terms

The spot Cumulative Volume Delta (CVD) has been in decline since mid-September and was a key piece of evidence that showed that the rally was not borne by genuine demand. Until this trend changes in the short-term, bulls can be wary of opening long positions.