ApeCoin [APE] $4.849 support holds as bears struggle: Is a price reversal imminent?

![ApeCoin [APE] $4.849 support holds as bears struggle: Is a price reversal imminent?](https://ambcrypto.com/wp-content/uploads/2023/01/ape-benjamin.jpg.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- APE could find stable support and bounce back into recovery.

- APE’s increasing open interest rate could signal a pending trend reversal.

ApeCoin [APE] has been in a price correction in the past three days. It dropped from $5.532 and was hovering around an immediate support at the time of writing.

At press time, APE was trading at $4.871, and bears could struggle to push beyond this support level.

Read Apecoin’s [APE] Price Prediction 2023-24

Can the $4.849 support hold?

APE rallied from 17 December, 2022, and peaked on 14 January, 2022. APE bulls pulled it from its December low of $3.260 to a high of $5.552 on January 14, posting 70% gains.

The rally cooled off afterward, setting APE into a price correction. APE had dropped by 12% at the time of writing, but bulls could come in at $4.849 support.

APE’s daily chart showed the Relative Strength Index (RSI) retreated from the overbought zone but was still above 60 units. This indicated buying pressure declined, but APE was still in a bullish market structure.

Therefore, bulls could attempt a price recovery after retesting the $4.849 support. They could target the bearish order block at $5.192 or the overhead resistance of $5.552 in the next few days.

However, a breach below $4.849 would invalidate the above bullish bias. Such a downtrend could set APE to retest the 61.8% Fib level of $4.677, offering extra short-selling opportunities for short traders.

Is your portfolio green? Check out the APE Profit Calculator

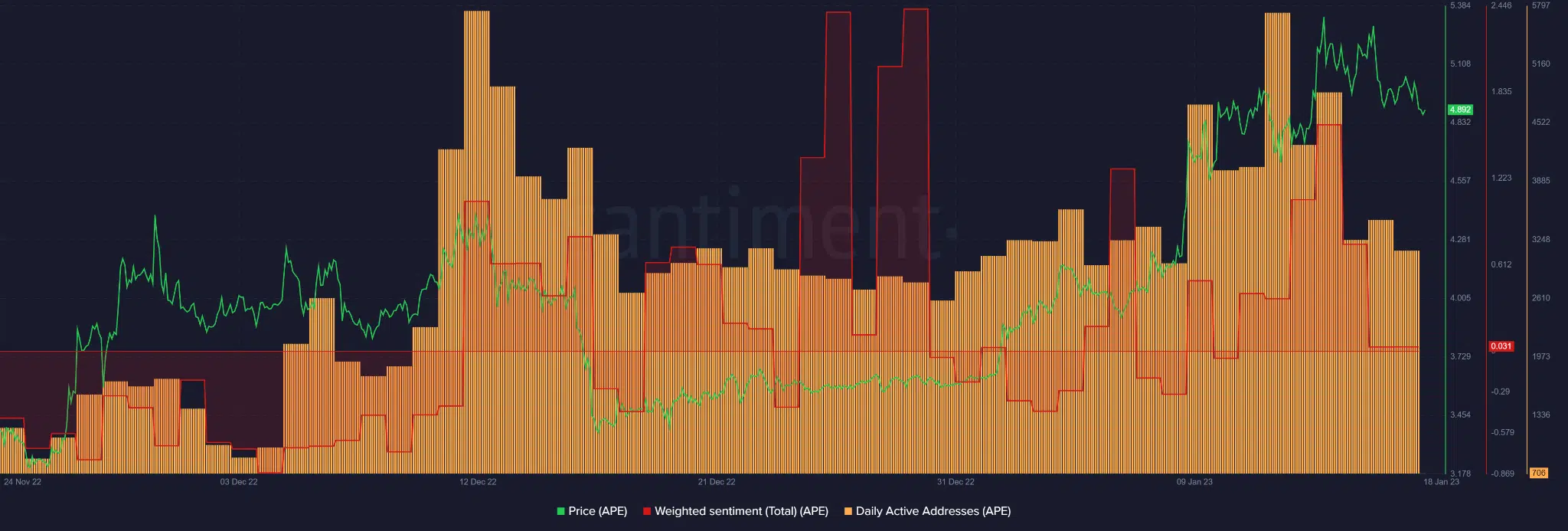

APE’s daily active addresses and weighted sentiment declined, but OI increased

Santiment’s data showed that APE’s daily active addresses fell. As a result, fewer accounts traded the asset, undermining trading volumes and any uptrend momentum.

In the same period, APE’s weighted sentiment retreated from its positive elevation and almost rested on the neutral line at the time of publication. It shows investors’ confidence fell, but remained positive.

APE’s open interest (OI) declined from 12 January but gradually increased on 18 January, as per Coinglass. The OI/price divergence from 13-15 January led to a price reversal on 16 January. The current OI/price divergence could set APE for another price reversal and influence an uptrend momentum.

Such a price reversal could set APE to secure the $4.849 support and target the overhead resistance at $5.552. However, a bearish BTC could extend APE’s price correction and invalidate the above bullish forecast.