Tracing ApeCoin’s next crack at this support level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

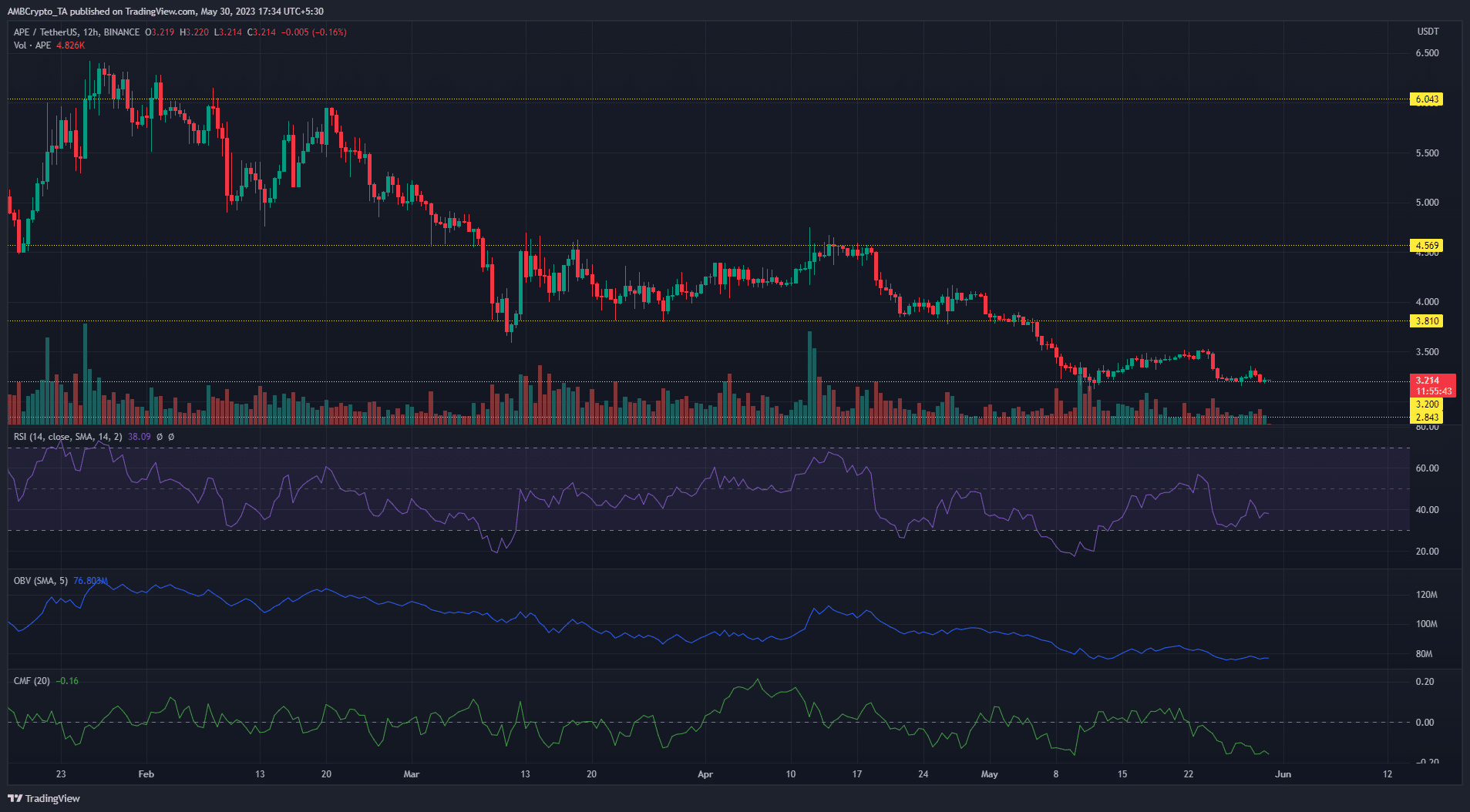

ApeCoin [APE] continued its bearish swing, depreciating from $3.81 to trade at $3.21, as of press time. This extended the value lost by ApeCoin since mid-February to over 46%. Furthermore, the current price hovered just above the key support level of $3.20 with sellers looking to extend the bearish trend.

With the general crypto market experiencing a mild bullish rally led by Bitcoin [BTC] surging into $28k, can APE rally again from $3.20, or will bears claim another support level?

Sellers maintain bearish momentum with a retest of key support level

A recent price report highlighted the possibility of a bullish reversal for ApeCoin from the $3.20 support level. However, the short-term bullish gains were quickly erased by the intense selling pressure that has seen bears crack the $4.56 and $3.81 support levels.

On the 12-hour chart, the RSI was in the lower range with a reading of 37 – evidence of heightened selling pressure. The OBV also continued its downward slide – confirming the decline in demand for APE. The CMF stood at -0.17 to highlight increased capital outflows.

Price consolidating at the $3.20 level over the past five days could signal a weakening of the support level. This could trigger bears to attempt another break of the level with the November 2022 low of $2.81 in sight. Conversely, buyers could use this retest to launch another rally toward the $3.81 resistance level.

Read Apecoin’s [APE] Price Prediction 2023-24

Declining daily addresses dampen buyers’ confidence

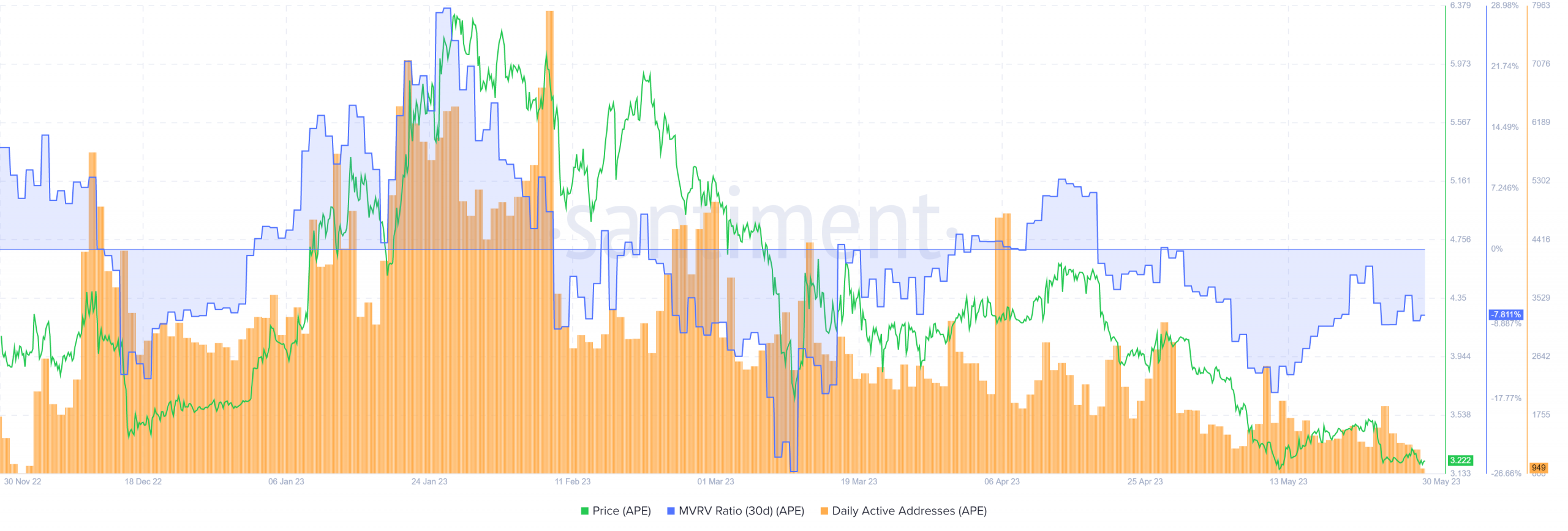

The daily active addresses have been on a decline since 10 May. Data from Santiment revealed that daily active addresses were below 1k, as of press time. This could hamper a bullish rally with sparse trading volume sabotaging buyers’ efforts.

The 30-day MVRV ratio remained negative which signaled that most traders will be realizing losses at the asset’s current price.

Furthermore, shorts held the upper hand in the long/short ratio with a 51.8% advantage. This suggested speculators were actively on the hunt to maximize gains from APE’s bearish trend.

Source: Coinglass