Apecoin: Will traders shorting APE see more gains?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- No respite for bulls, as APE’s price dwindled toward the $1 price zone.

- Market speculators are positioned to maximize shorting gains.

Apecoin’s [APE] dwindling price action extended its bearish momentum to a new low with the price hitting the $1.4 price zone. Apecoin’s on-chain metrics did little to help its price as APE was the biggest loser among leading metaverse-based projects, according to data from CoinMarketCap.

Realistic or not, here’s APE’s market cap in BTC terms

With sellers firmly in control on the higher timeframes and bulls unable to push past the $1.5 level over the past week, APE could be primed for another downward move toward $1-$1.2.

APE traders poised for another price dip

The 12-hour timeframe showed the intense tussle between buyers and sellers over a two-month period with the price ranging between $1.7 to $2.3.

The break of the bullish defense of the $1.7 level on 17 August signified a major milestone for bears. Furthermore, overwhelmed buyers could do little to stop sellers from flipping the $1.7 level to resistance.

Bullish attempts didn’t see much momentum at the reversal. This was because APE sellers were seen extending control. This was evidenced by the price action between 19-22 August.

Additionally, this extended the On Balance Volume’s (OBV) downtrend and kept the Relative Strength Index (RSI) under the neutral 50. Both signified a lack of demand for APE, despite the sideways structure on the lower timeframes.

Shorts positioned to extend gains

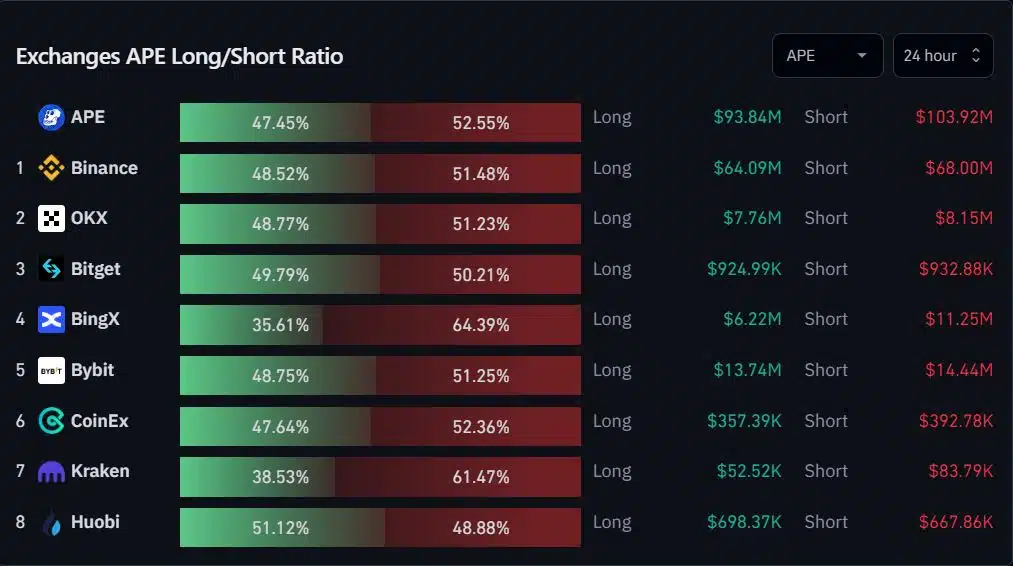

The firmly bearish bias saw traders in the futures market increase their short positions. Data from Coinglass showed that shorts held a significant ratio of the open contracts on the exchange long/short ratio.

How much are 1,10,100 APEs worth today?

Sellers held 52.5% of all contracts over the past 24 hours with short positions worth $103.9 million. This could see APE touch the $1.2 price level over the next week.