USDT: Deciphering the depegging mystery amid declining volatility

- USDT depeg sheds light on the other side of the coin as low volatility reveals impact.

- USDT remains in good spirits in terms of utility despite depegging concerns.

Stablecoin depegs are a common occurrence, particularly during periods of high volatility. It is thus, surprising that USDT has currently lost its peg during a low volatility period. In retrospect, USDT had a hard time maintaining its peg in August.

Kaiko Data analyst Riyad Carey recently conducted a thorough analysis of stablecoin depegs in the last four months. Stablecoin depegs have become more of a sensitive concern-raising issue ever since UST’s massive meltdown. So should USDT users be concerned about its recent struggle to sustain a peg?

Not all depegs are built the same. This warrants a look under the hood of USDT’s underlying operations and mechanisms. Riyad noted that USDT’s depeg problem has incentivized most holders to sell it on exchanges rather than redeeming for USD via Tether.

10/ USDT has a peg stability problem. Its redemption fee and minimum means it’s often rational for USDT holders to sell the token on the market rather than redeem it for USD with Tether.

— Riyad Carey (@riyad_carey) September 1, 2023

The long-lasting bearish conditions have also contributed to the pressure that USDT has been experiencing lately. Unlike in most past instances where depegs have occurred due to high liquidity, this time low liquidity was the main culprit behind USDT’s depeg. This was because the low volatility made it difficult for the market to absorb the sale of USDT.

A bird’s eye view of the stablecoin landscape

Riyad also highlighted an analysis of the market based on exchanges that contributed the most stablecoin sell pressure as well as the severity of the depegs. Based on the analysis, USDC has had the most severe outcome after its March depeg. USDT came in second after its depeg in August.

Binance contributed to most of USDT’s depeg pressure in August while Uniswap contributed to most of the pressure on USDC in March.

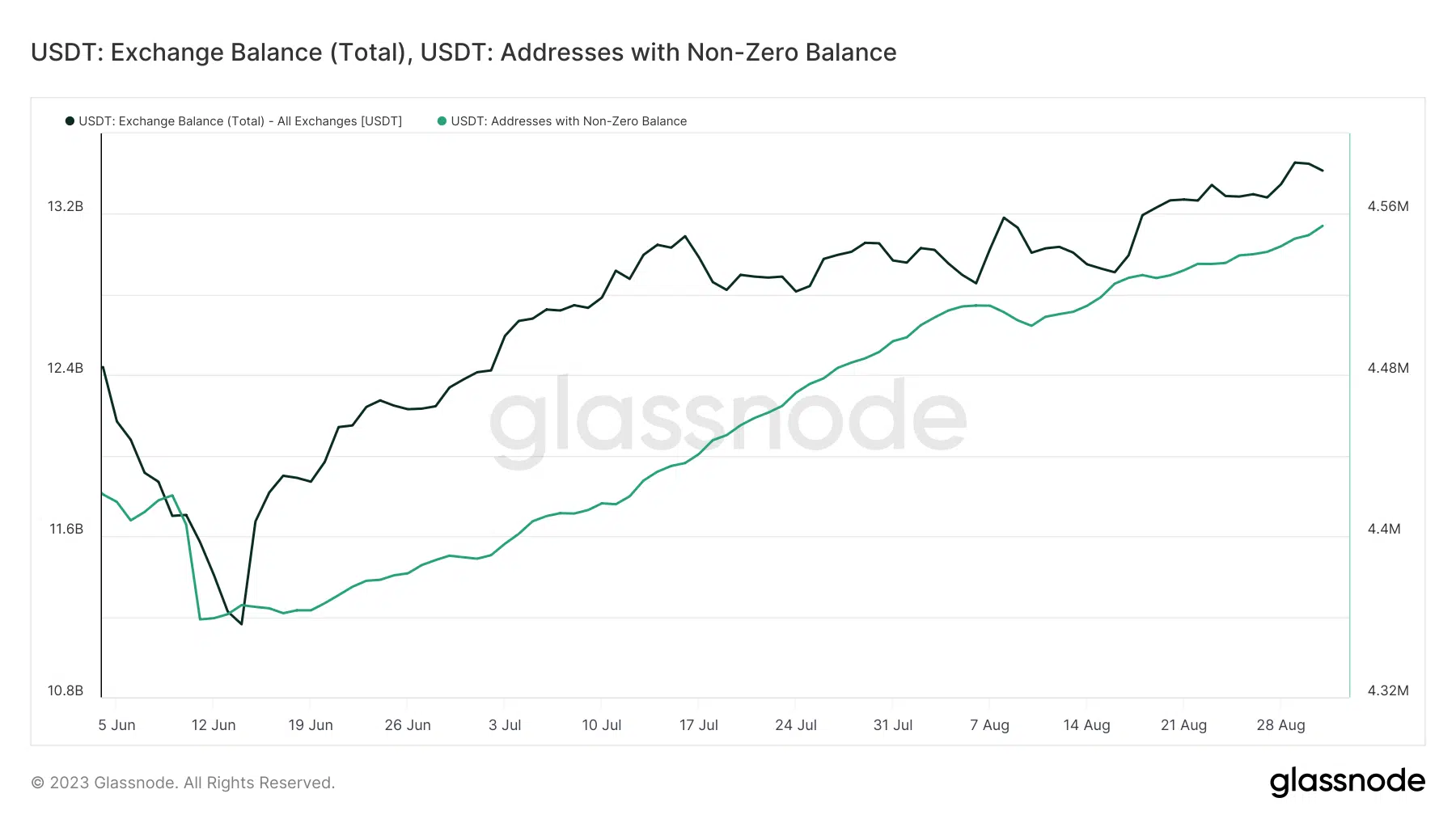

Evaluating USDT on-chain dynamics revealed that the stablecoin’s exchange balances have been on an upward trajectory for the last four months. This was in response to the growing sell pressure as noted earlier. This has not stopped USDT’s adoption or utility. The number of addresses holding the stablecoin also grew steadily during the same period.

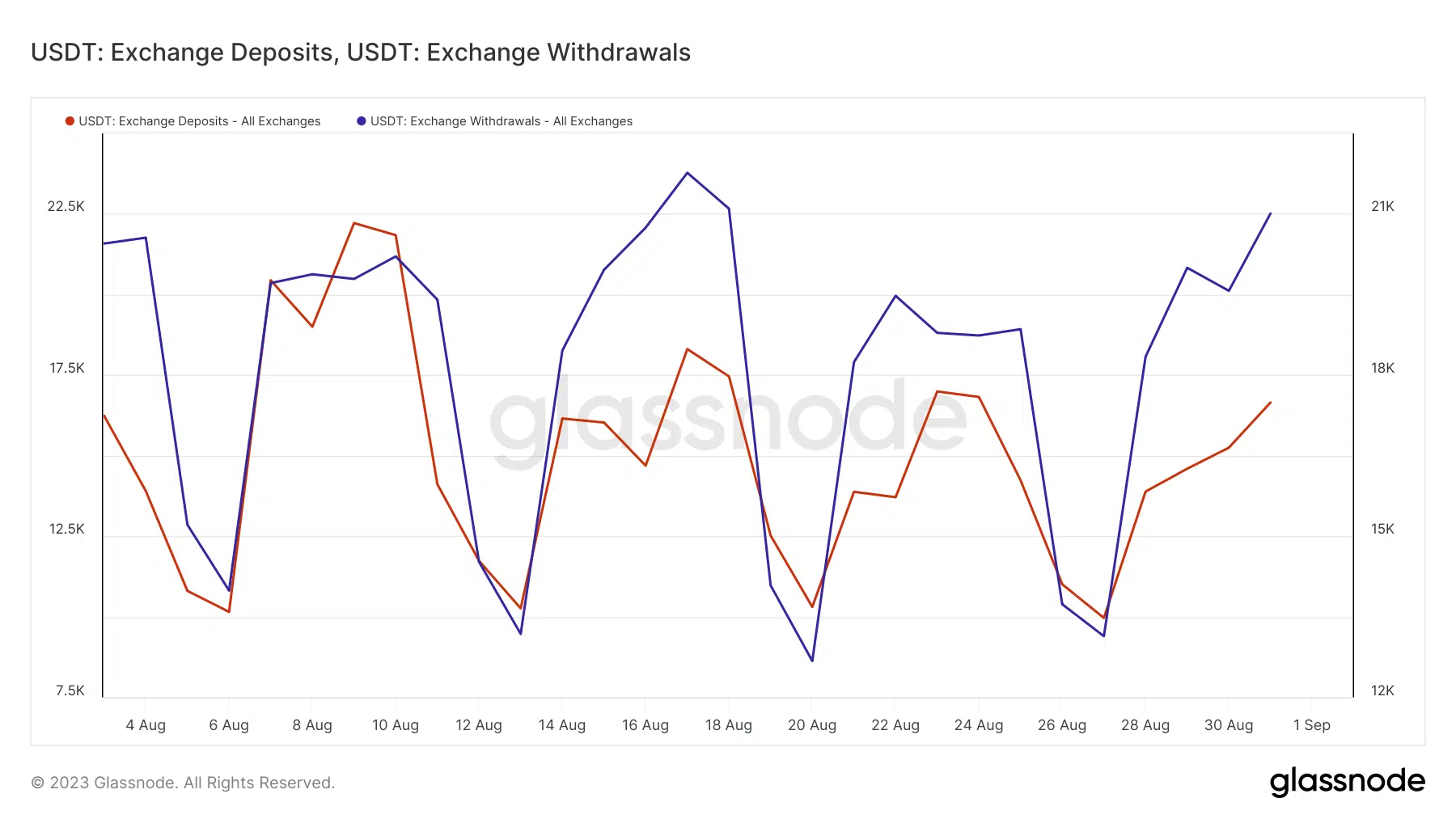

Despite the above findings, exchange withdrawals have outperformed exchange deposits for the most part in the last four weeks. This could largely be explained by the prevalence of sell pressure for Bitcoin and altcoins. As such, most traders have been opting to hold on to more dry powder.

USDT should technically regain its peg once the market volatility makes a strong comeback. This is because the demand for the same stablecoin and its counterparts will surge under such conditions.