Aptos’ [APT] 350% performance could finally meet a stumbling block- Here’s why

![Aptos’ [APT] 350% performance could finally meet a stumbling block- Here’s why](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-07T080209.881.png.webp)

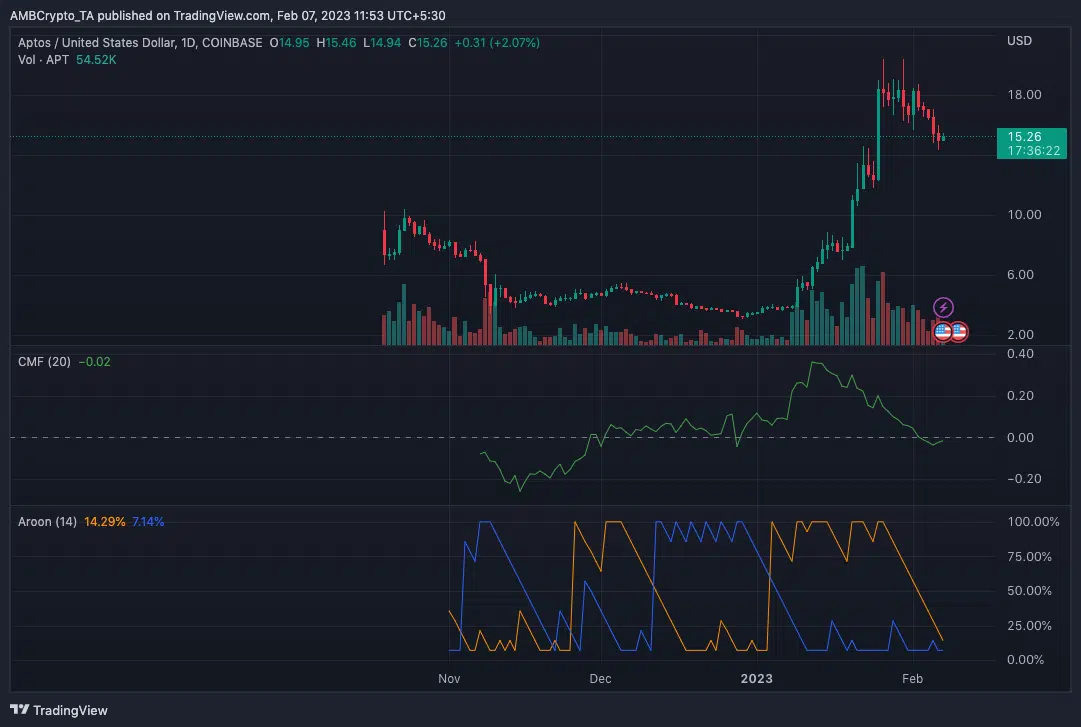

- The decline in CMF and Aroon shows that the APT rally was on the verge of an end.

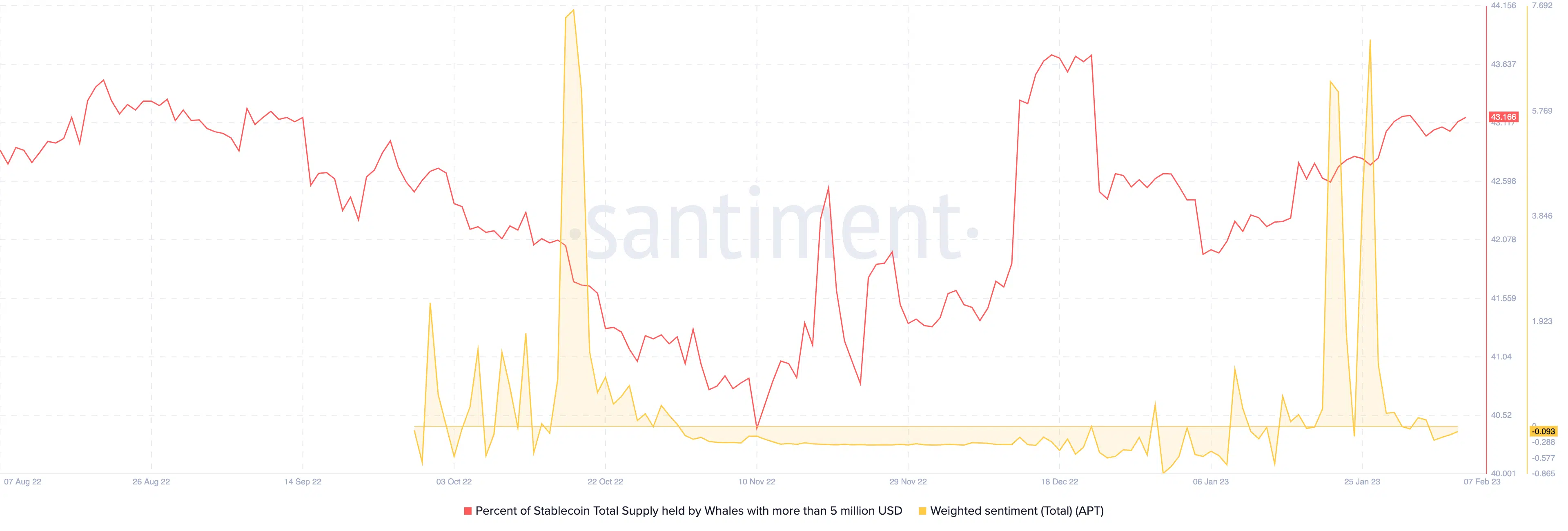

- Sentiment trended negative, but whales sustained buying momentum.

The incredible performance by Aptos [APT] since the start of 2023 could eventually come to a halt, as per a 6 February Santiment insight. For holders of the Layer-one (L1) token, the few days in 2023 would be that would last in their memory. According to CoinMarketCap, APT’s 30-day performance was a monumental 302.31% increase.

Is your portfolio green? Check out the Aptos Profit Calculator

APT holders, time to shed some gains?

This same price hike has been one reason the Aptos market cap could break into the top 30. This implied a lot of liquidity had circulation around the token with prospects of attracting more in the future.

However, APT has been one of the worst performers in the last seven days, Santiment rightly mentioned. Within the said period, the token had lost 6.28% of its value — the worst in the top 30 market cap bracket. But there has been a considerable rationale for this downturn.

Excerpts from the on-chain platform report that the Chaikin Money Flow (CMF) had decreased significantly. The indicator described the volume-weighted distribution and accumulation of an asset. In most cases, it takes a 21-day timeframe.

Although Santiment showed that the CMF was negative at -0.01, press time information revealed that it had subdued further to -0.02. This indicated a dip in buying pressure and weighty distribution of APT tokens.

The Aroon was another indicator also considered as displayed by the chart above. The indicator is one that measures a price trend and strength.

Interestingly, the Aroon Up line (orange) had trended downwards, positioning below 25%. A circumstance like this means that an uptrend, if any, could be a weak one. Hence, a fall in value could be imminent.

Read Aptos’ [APT] Price Prediction 2023-2024

Follow the benchmark to the ground

So, APT might only sustain the 3.91% uptick registered in the last 24 hours if the Bitcoin [BTC] strength is solid enough to accommodate the broader market.

Apart from the technical outlook, APT’s on-chain condition was also not in the best state. Moreso, investors’ perception of the token has become gloomy. This was the outcome of the massive fall in weighted sentiment.

For most of January, the sentiment towards APT was high at several intervals. But since 28 January inwards February, the enthusiasm has reduced. At press time, the weighted sentiment remained negative at -0.093.

However, the impact of whales on the APT performance cannot be disregarded, as on-chain data showed that they had been influential in keeping up the buying pressure. But as chances of a decline increase, whales have opted to sustain their supply.