Aptos [APT] market weakened further- Will bears enjoy more benefits?

![Aptos [APT] market weakened further - Will bears enjoy more benefits?](https://ambcrypto.com/wp-content/uploads/2023/03/kamil-pietrzak-G0FsO2Ca8nQ-unsplash-scaled-e1677932009324.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

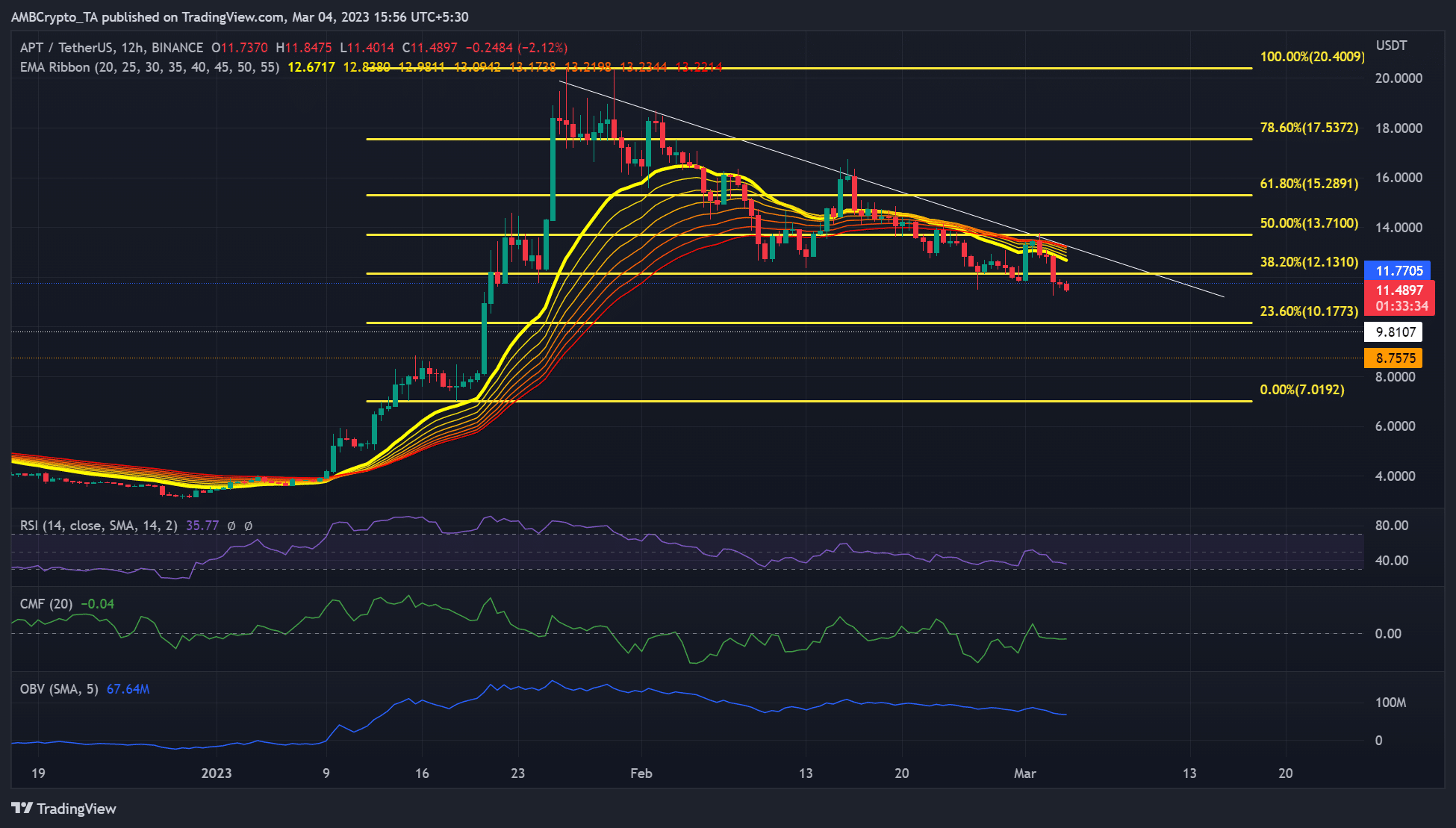

- APT toiled below a descending line.

- APT registered an OI (open interest)/price divergence.

Aptos [APT] market structure declined further and breached key support. It is worth noting that APT posted about a 500% hike in the January rally, rising from $3.4 to $20.4.

But the extended correction after price rejection at $20.4 has seen the token clear over 44% of the gains. APT traded at $11 at the time of writing, way below a key support level.

Is your portfolio green? Check out the APT Profit Calculator

The bulls failed to defend the $12 support

APT has been struggling below descending line (white line), delaying any strong recovery that could flip the market into a bullish structure.

Bitcoin’s [BTC] sharp drop on Thursday (2 March) saw APT break below the 38.2% Fib support level ($12.1310). The support level prevented steep declines previously. But the bulls failed to defend it at the time of writing, which could tip the scale in favor of bears.

Bears could sink APT to the 23.6% Fib level ($10.1773), especially if BTC retests or breaks below $21.60K. Long-term bears could place stop losses above the 38.2% Fib level ($12.1310) and target the $10.1773 price level.

Alternatively, bulls could seek entry into the market if APT closes above the 38.2% Fib level ($12.1310). The immediate target would be the EMA ribbon level of $12.6717 or the descending line.

A close above the descending line and 50% Fib level would give bulls more leverage to target the 78.6% Fib level ($17.5372). The upswing could be accelerated if BTC reclaims the $23K level.

The RSI (Relative Strength Index) was in the lower range as OBV (On Balance Volume) declined, showing buying pressure reduced significantly. Moreover, the CMF (Chaikin Money Flow) moved southwards below the zero mark, indicating bears’ leverage.

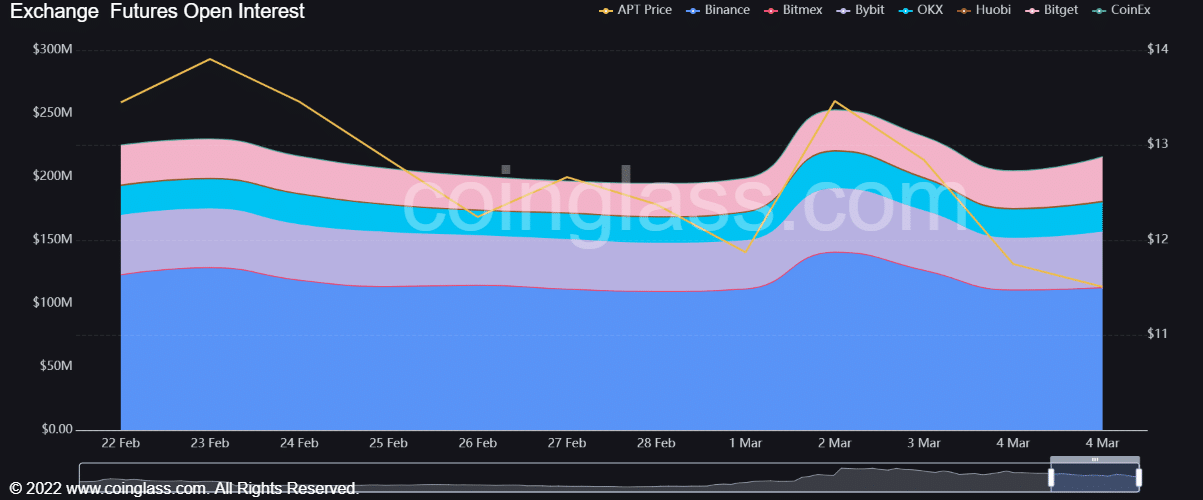

APT recorded an OI/price divergence

As per Coinglass, APT’s open interest (OI) peaked on 2 March and declined afterward. However, the OI increased at the time of writing despite the price decline, forming a divergence. It suggests that a price reversal could be imminent if demand for APT increases in the futures market.

Read Aptos [APT] Price Prediction 2023-24

However, more long positions were liquidated in the past 24 hours than short-positons, as per Coinalyze. It shows long positions were paying short positions, reiterating the bearish sentiment. Therefore, investors should exercise caution and take cues from BTC’s price action.