Large USDT transfer between Tron and Ethereum results in…

- Tether’s USDT swap from Tron to Ethereum may be part of a collaboration to boost liquidity.

- Tether noted that the large transfer will not lead to an increase in the supply of USDT in circulation.

Tether recently announced plans for a major cross-chain swap that would transfer 1.6 billion USDT from the Tron network to Ethereum.

Such large transfers are cross-network transfers and are uncommon in the crypto space, so what could be the reason for this one?

Tether’s announcement brought forth a lot of speculation regarding the purpose of the transfer. The crypto company did not disclose the official reason, although it did offer its website’s explanation for chain swaps.

One of the potential reasons for such a large transfer is when a client requests to swap funds. Such a scenario may occur when funds surpass the amount of USDT that Tether holds in its treasury wallet for the destination blockchain.

In few minutes Tether will coordinate with Binance to perform a chain swap, converting from Tron to Ethereum ERC20, for 1.6B USDt.

The #tether total supply will not change during this process.Learn more about chain swaps ⬇️https://t.co/abfgnELSvi

— Tether (@Tether_to) March 4, 2023

There have been concerns about the USDT supply potentially increasing if Tether uses the large transfer to mint more USDT.

However, Tether noted that the large transfer will not lead to an increase in the supply of USDT in circulation. Tether’s swap mechanisms employ a mint mechanism, hence the concern.

However, it also has a burn mechanism that facilitates the burning of tokens from the blockchain from which the funds are transferred.

Is there more to the USDT transfer than meets the eye?

The Tron network’s latest announcement may provide more clarity with regard to the USDT transfer. The network expressed excitement in collaborations with other networks including BitTorrent and Huobi for a super network linking to major networks.

Excited about the collaboration with @HuobiGlobal and #BitTorrent Chain to build a “super network” connecting Ethereum, #TRON & @BNBCHAIN for seamless asset exchange and an open financial system.?

Let’s keep an eye out for more updates!?

Read More?https://t.co/3LCXK2bZYv

— TRON DAO (@trondao) March 4, 2023

Tron’s announcement is likely related to the large USDT transfer. More importantly, it might underscore a collaboration where the participating networks assist each other in maintaining a stablecoin supply balance.

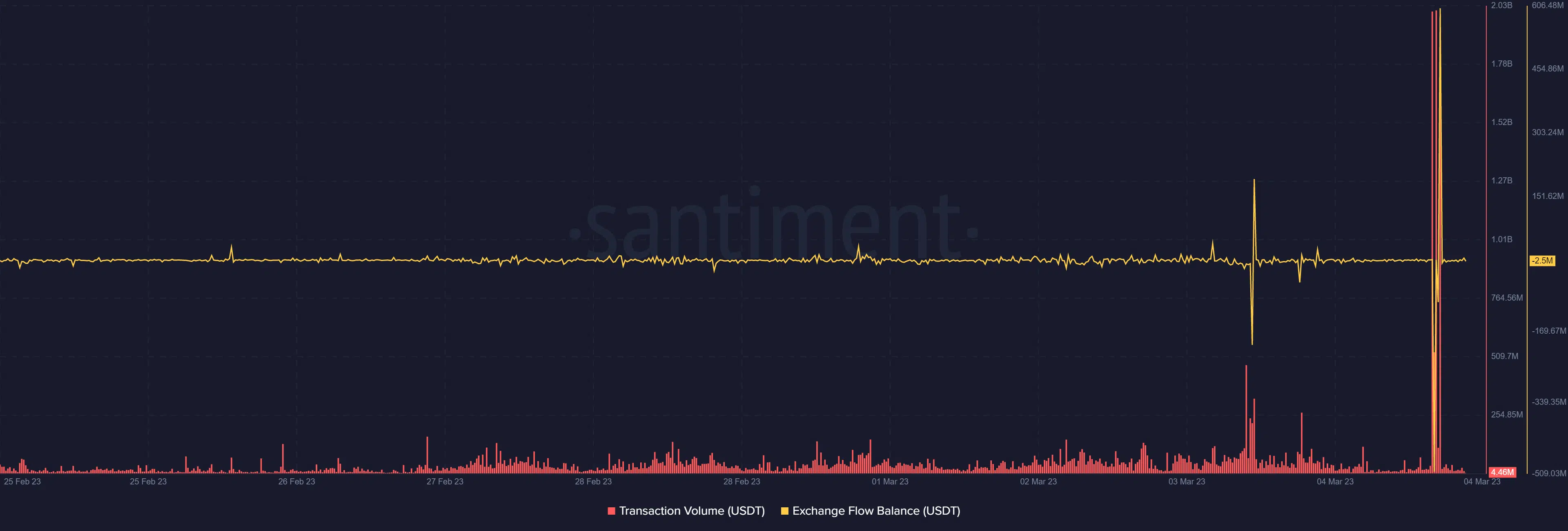

The large transfer registered in the form of the highest spike in USDT transaction volume that the Ethereum network has seen in the last four weeks. The same applies to the exchange flow balance which experienced its largest spike in the last 24 hours.

Concerns about USDT’s stablecoin minting are still active, despite Tether confirming that the recent transfer will not increase the supply.

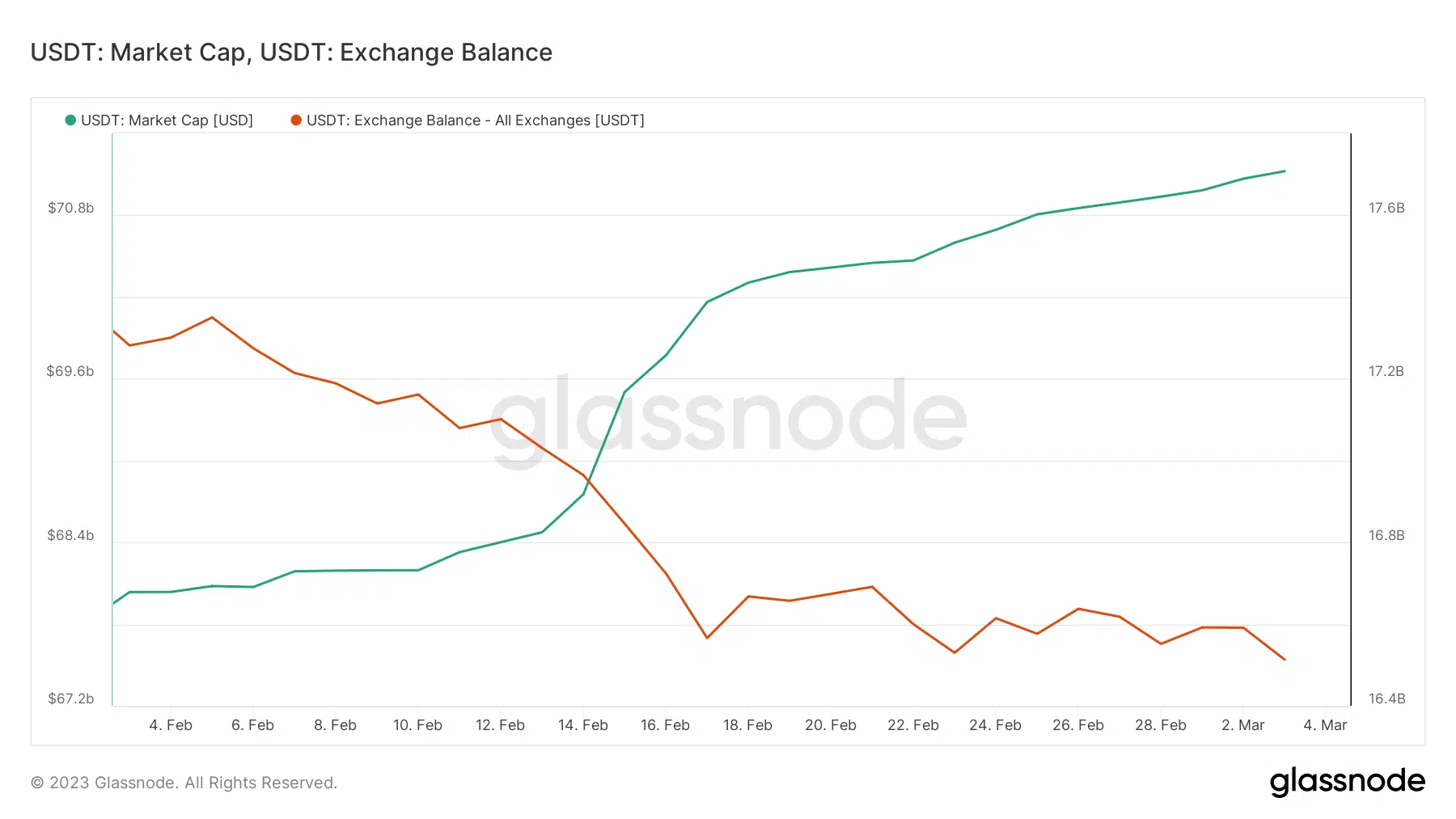

It had a $71.1 billion market cap according to the latest glassnode data. The market cap has increased by over $4 billion in the last 30 days.

USDT’s exchange balances have also dropped in the last 30 days. One possible explanation is the increased demand from private addresses as bearish market conditions prevail.