Aptos – New ‘all-time highs’ for the network, but where does that leave APT?

- Aptos’s stablecoin marketcap and TVL soared to new historic highs

- Assessing the level of network activity and its potential impact is important to gauge APT’s price action

Aptos turned out to be one of the most interesting blockchain networks this week. In case you missed it, the network hit multiple all-time highs during the week, underpinned by robust utility.

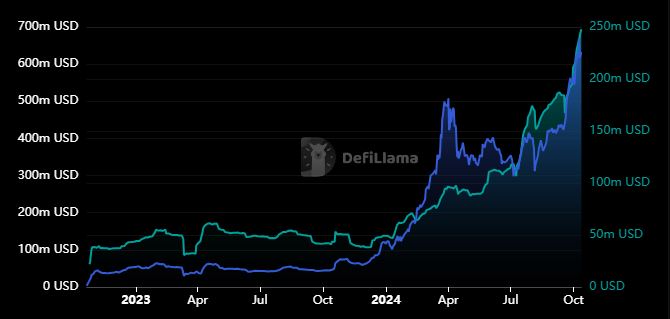

According to DeFiLlama, the total value locked in Aptos peaked at $668.42 million on 9 October – An ATH TVL figure for the network. For perspective, the network’s TVL has risen by over 4,700% in the last 12 months alone.

Now, while the TVL appears to have adopted an exponential curve, especially after June, it is not the only metric to hit new highs. In fact, Aptos’s stablecoin marketcap peaked at $247.97 million in the last 24 hours too.

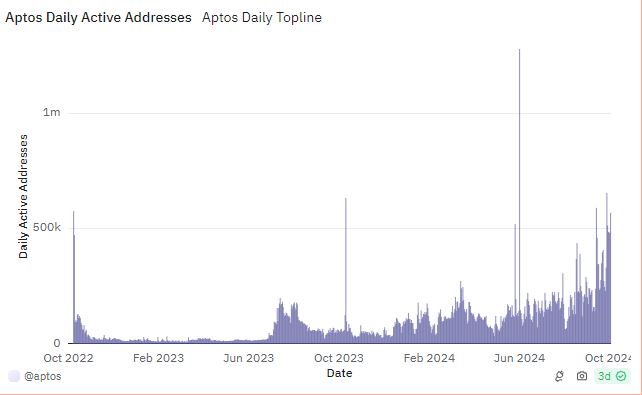

These achievements, together, underscore the state of the Aptos network. Robust stablecoin and TVL growth usually have a direct correlation with utility and address growth. Unsurprisingly, Aptos daily active addresses have recorded a significant uptick over the last few months.

Aptos averaged less than 100,000 daily active addresses towards the start of 2024. However, according to Dune Analytics, daily active data has been pushing higher than 500,000 on some days lately.

The hike in daily active addresses confirms that the Aptos network has been seeing more usage, especially from around June. But, what about the potential impact on APT’s demand?

Aptos recent growth underscores APT strength

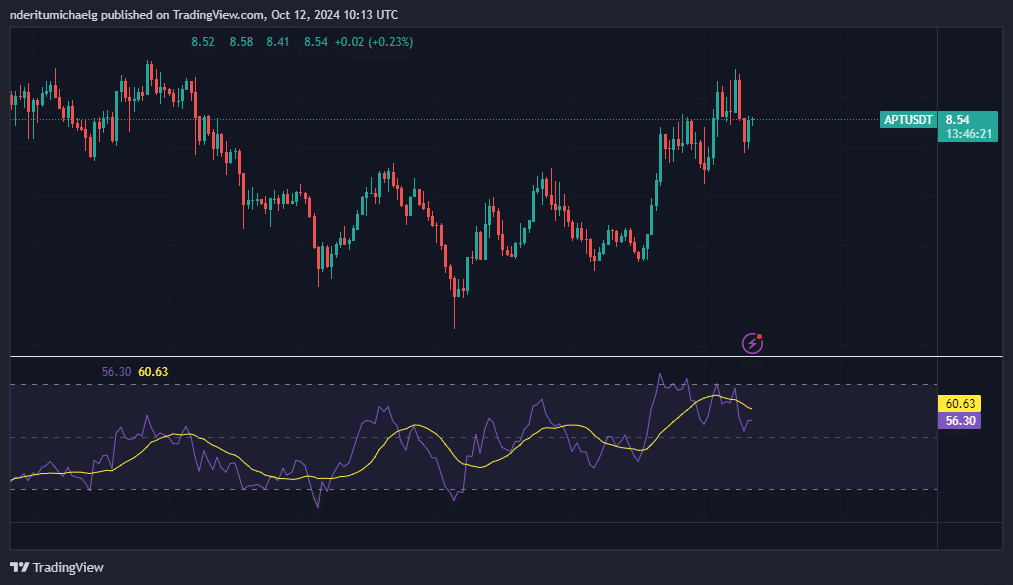

APT’s latest performance might be a reflection of the network’s robust on-chain activity. APT pushed higher in the first week of October, building on its September gains. This was around the same time that most of the top cryptocurrencies struggled with sell pressure.

APT achieved a 30% upside in the first 8 days of October, peaking at $9.56. Now, while it has since pulled back to a $8.54 press time price, it has continued to demonstrate some bullish momentum.

This performance suggests that the rapidly expanding Aptos network’s usage has been fueling demand for APT. Worth noting, however, that despite this performance, APT is still trading at a 55% discount, when compared to its 2024 high.

The surge in network utility and other related network milestones may pave the way for more positive sentiment. This, because investors will likely view robust Aptos network activity as a sign that more value will flow into the native coin.