Here’s the ‘but’ to Aptos’s shorting opportunity

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The range formation of the past three weeks was something to watch out for.

- Bears can wait for a rejection to short, but caution was warranted due to the strong short-term upward momentum.

In a recent analysis, Aptos’ [APT] trend was highlighted as bearish on the higher timeframes. There was a bullish order block on the daily timeframe at $8. At the time of writing, Aptos beat the $8 resistance level and was close to the $8.5 mark.

Read Aptos’s [APT] Price Prediction 2023-24

However, range highs remained untested. It was thus possible that Aptos could see a move toward this zone to collect liquidity by trapping the late buyers. Can traders look to short APT soon?

Range highs and liquidity hunts

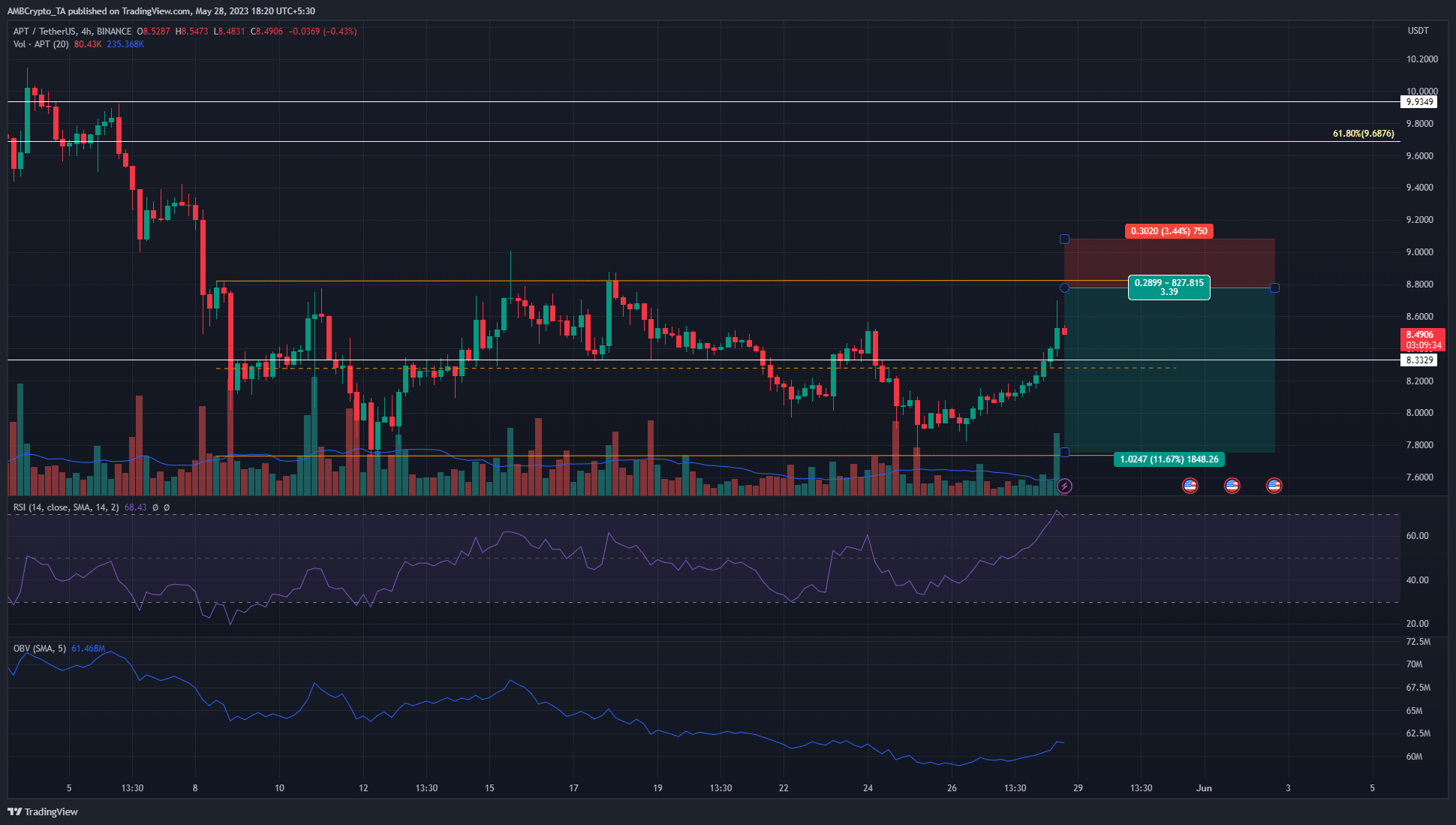

Analysis of multiple timeframes can sometimes get tricky. The higher timeframe bearish bias meant traders can look for shorting opportunities as they will likely be the safer option. Yet, if Aptos climbs above $8.56, it will break the bearish market structure on the 4-hour chart.

Will the bias be bullish then? Technically, yes, but context is important. Over the past three weeks, Aptos has traded within a range (orange). The range extended from $7.73 to $8.82, with the mid-point at $8.3.

The price action has respected the mid-point as well as the range extremes, in recent times. Therefore, a shorting opportunity could arise at the $8.8 level, with a run up to $9 also a possibility to fake out the late bulls.

The RSI showed strong bullish momentum, and the OBV rose higher as well. This reflected the bullish momentum of the past few days. But it was unlikely that the bulls could keep it up, especially if Bitcoin [BTC] faces a rejection from $27.8k on 29 May.

Is your portfolio green? Check the Aptos Profit Calculator

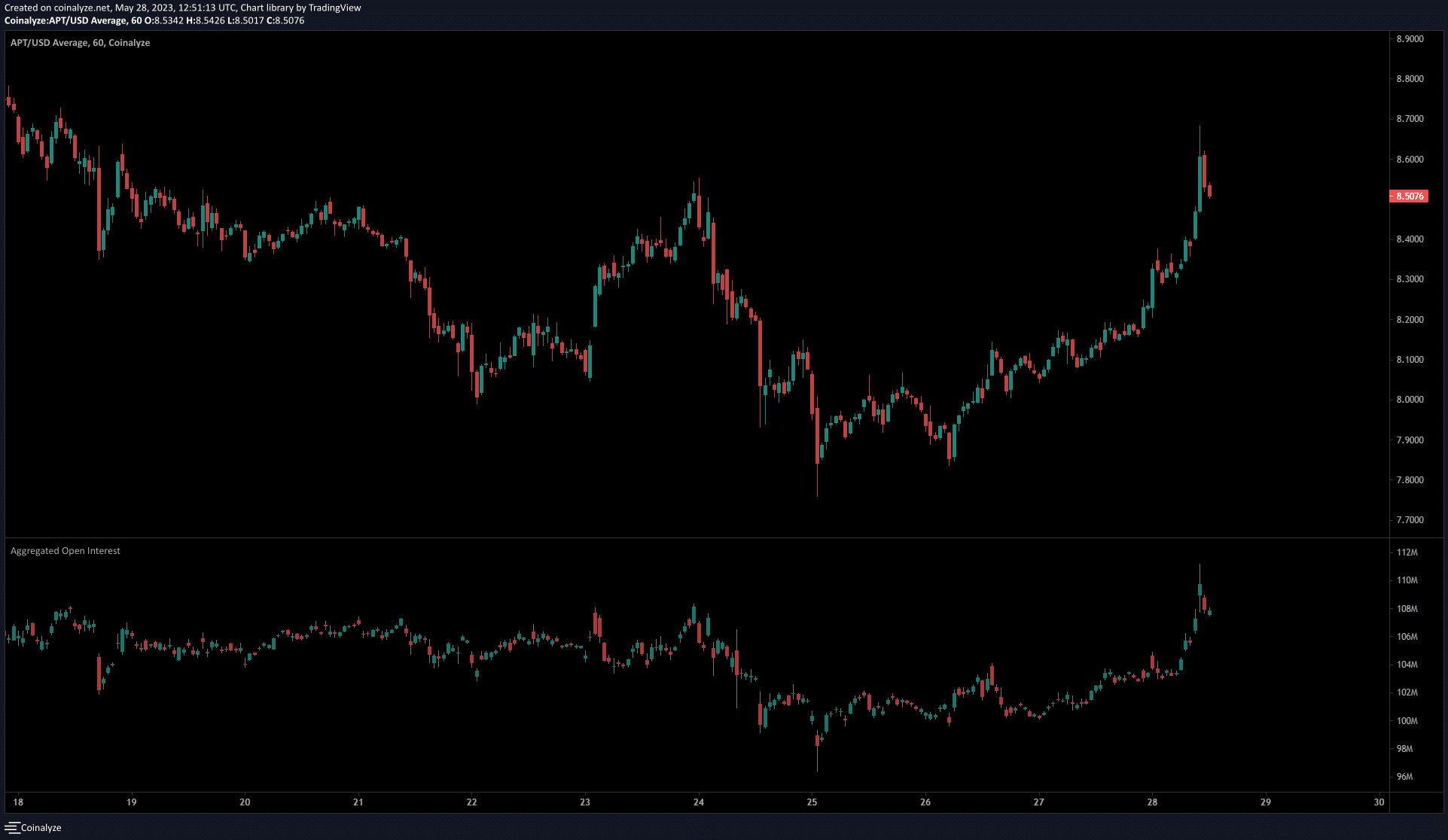

The speculator sentiment leaned strongly in favor of bulls

Source: Coinalyze

Measured from the swing low on Friday at $7.82 to the swing high on Sunday at $8.7, Aptos has registered gains of 11.27% within three days. This was good reason for the futures market participants to have a bullish view of the market.

This was seen on the Open Interest chart from Coinalyze. The OI formed a steady series of higher lows since Thursday, 25 May, and surged by around $8 million on 28 May. It remained to be seen if the bulls can keep up the pressure. The past month’s price action implied that a reversal at the range highs was the more likely outcome.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)