Bitcoin network activity is up, what about BTC?

- Bitcoin network activity rebounded, with the potential to reach one million active addresses in June.

- There was increased interest in Inscriptions, but cautionary signs emerged with declining MVRV ratio.

Bitcoin’s [BTC] activity rebounded following a recent slump, with Santiment’s data implying that the network’s active address count could increase to one million in June 2023.

? May's concerningly low #Bitcoin address activity is finally starting to rebound again. Increasing utility is necessary for #crypto assets to enjoy sustained rallies. Keep an eye on whether $BTC can head into June with 1M or more daily active addresses. https://t.co/LSa2slHWgt pic.twitter.com/zqTH9KGIqc

— Santiment (@santimentfeed) May 27, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Interest in Inscriptions rises

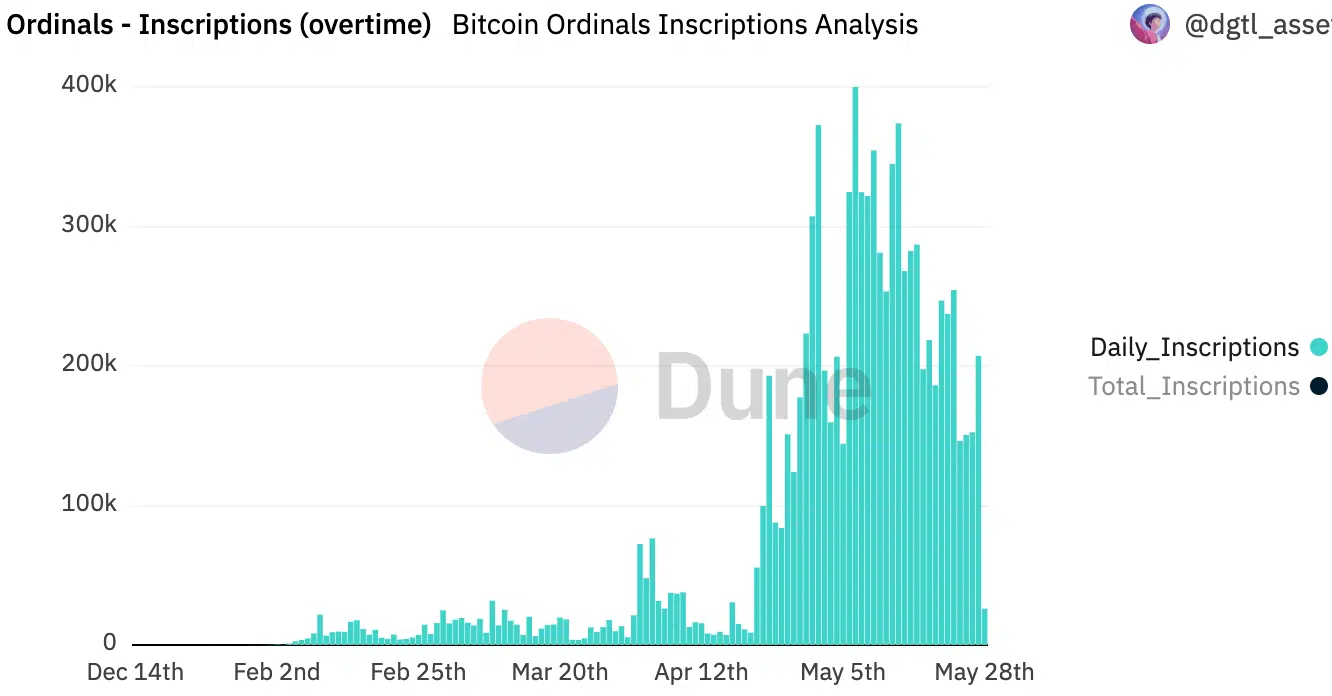

One of the primary reasons for the high activity on the network is the surge of interest in Bitcoin Inscriptions. Dune Analytics’ data revealed that the number of daily inscriptions experienced a significant increase from 150,000 to 200,000 over the last few days.

Moreover, an overwhelming majority of the inscription activity stems from the demand for text-based inscriptions, which accounts for approximately 90% of the overall activity.

Coupled with the increasing interest in Inscriptions, there has been a notable surge in the interest in holding Bitcoin. Glassnode’s data indicates that the number of non-zero addresses reached an all-time high on 28 May.

? #Bitcoin $BTC Number of Non-Zero Addresses just reached an ATH of 47,180,069

View metric:https://t.co/VtoChZbLsa pic.twitter.com/124aCwyEd4

— glassnode alerts (@glassnodealerts) May 28, 2023

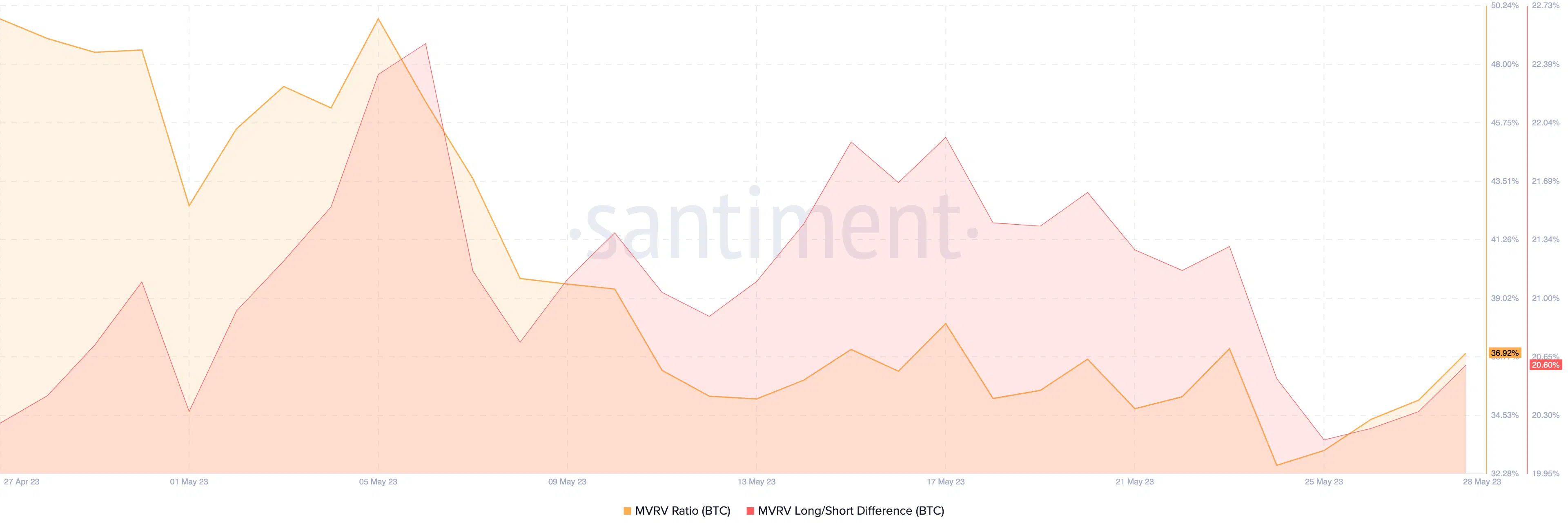

Additionally, the MVRV ratio of Bitcoin, which measures the average profit or loss of all holders, declined. This suggested that Bitcoin holders were becoming less profitable. If this trend continues, it could potentially lead to a decrease in selling pressure from holders.

While these developments bode well for Bitcoin, some cautionary signs have also emerged. The long/short difference of BTC has been decreasing, indicating that the number of new addresses were outnumbering the old addresses.

It is worth noting that new addresses are more likely to sell their holdings, potentially causing price fluctuations and challenges for Bitcoin’s stability in the future.

Bitcoin traders turn positive

Despite these potential concerns, the overall number of long positions for BTC has witnessed a significant increase in recent days, according to Coinglass. This increase indicates a growing bullish sentiment among investors, possibly driven by positive market indicators and the prospect of future price appreciation.

Is your portfolio green? Check out the Bitcoin Profit Calculator

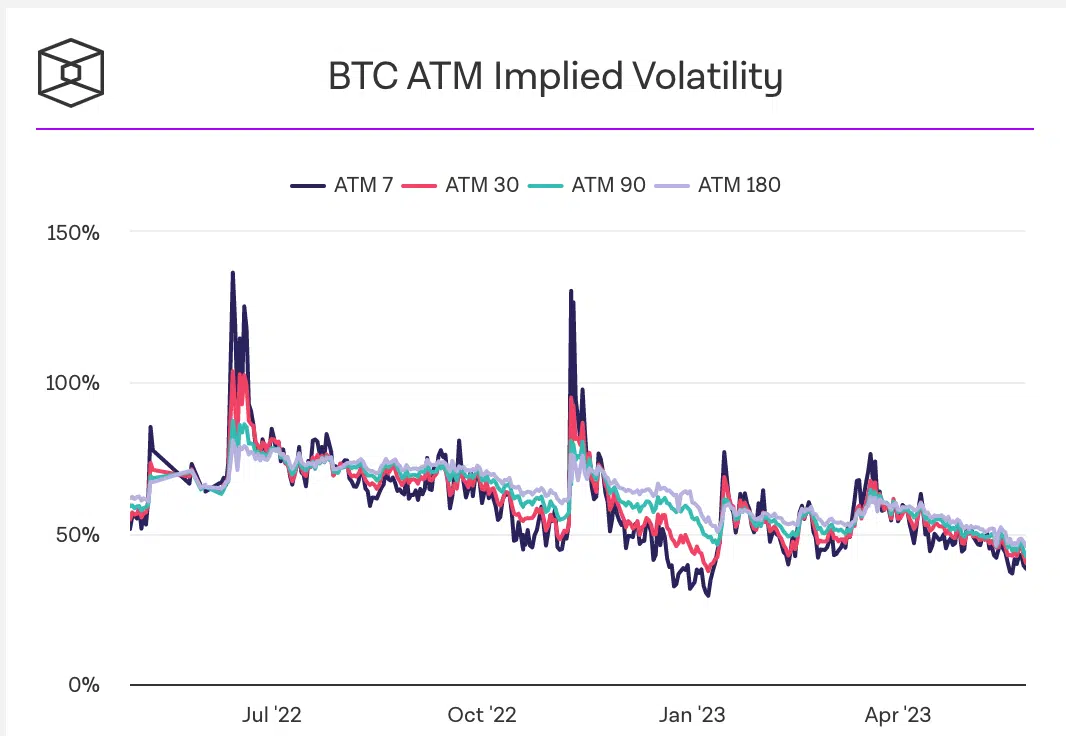

One reason for the spike in long positions favoring Bitcoin could be the declining Implied Volatility for the cryptocurrency. Decreasing volatility often encourages investors to take more favorable positions, expecting a period of price stability or upward movement.

At press time, Bitcoin was trading at $27,214.77, a 1.89% increase over the last 24 hours, according to CoinMarketCap.