Aptos ramps up its DeFi foundation to benefit from CEX’s tribulations

- Aptos Network aims to improve its DeFi foundation.

- It must contend with inherent challenges in the DeFi ecosystem.

Aptos [APT] is racing to update its DeFi foundation in partnership with Econia Labs to attract more next-gen DeFi products to its platform.

Although the move aims to benefit from sustained turbulences on CEXs (central exchanges), Aptos must deal with cut-throat competition and other challenges in the DeFi space.

Read Aptos [APT] Price Prediction 2023-2024

Aiming to thrive in CEX’s chaos

DEXs saw increased trading volume during the Silicon Valley Bank (SVB) crisis in mid-March 2023. A similar trend is always seen whenever CEXs face challenges like transparency issues. Aptos is eyeing to benefit from CEX’s tribulations by ramping up its DeFi foundation.

Econia Labs, a startup building decentralized order book infrastructure on the Aptos network, is streamlining integrations to attract more DeFi developers. It recently received $6.5 million in seed funding to improve the Aptos DeFi foundation.

We're excited to join @EconiaLabs' $6.5M seed round!

Econia Labs is pioneering a decentralized on-chain order book protocol for the @Aptos_Network, paving the way for a more efficient & transparent trading ecosystem.

Congrats Alex, Kiki & the team! ?https://t.co/UooDYCLOja

— Wintermute (@wintermute_t) March 29, 2023

Well, Econia already has a design in place, through its Econia protocol, that enables a wide array of applications on the Aptos blockchain, from spot trading to leveraged perpetual futures. Also, dApp integrators have begun utilizing the system, and DeFi developers will soon be onboarded to streamline their integrations.

Aptos seems keen on more diversification. It recently branched into NFT and music space too. Expanding to DeFi systems could be beneficial, especially for long-term sustainability.

Cut-throat competition exists in DeFi, as some protocols opt for multi-chain strategies. For example, PancakeSwap [CAKE] is currently deployed on BSC, Ethereum, and Aptos networks to attract more revenue and users. As such, Aptos must deal with stiff rival competition besides attracting more users to DeFi applications on its network.

APT’s price reaction to the DeFi ramp-up

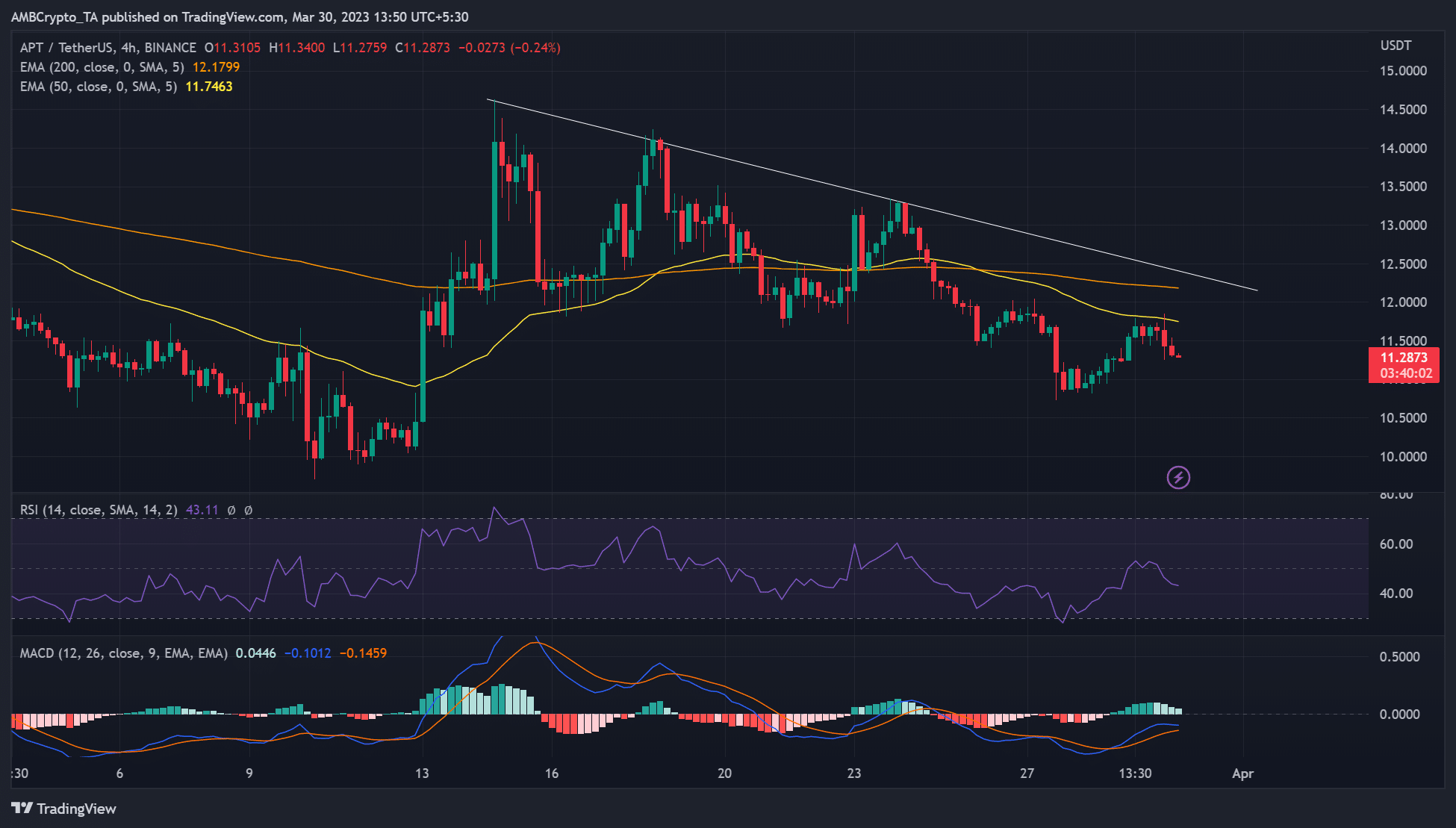

APT’s value increased slightly after the news, rising from $11.23 but saw rejection at the 50 EMA (exponential moving average) of $11.8.

Overall, the price action still toiled below the 50 EMA, 200 EMA, and the descending trendline on the 4-hour chart, at the time of writing. It shows APT was trading below its mid and long-term trend, and bears had slight leverage despite the new development.

Is your portfolio green? Check out the APT Profit Calculator

Nevertheless, the total value locked (TVL) increased from $36M on 29 March to about $42M on 30 March – a 15.8% increase in the past 24 hours.

Similarly, the open interest rate increased from $160.9M to $162.4M before dropping to $154M at press time after BTC faced rejection at the $29K zone.

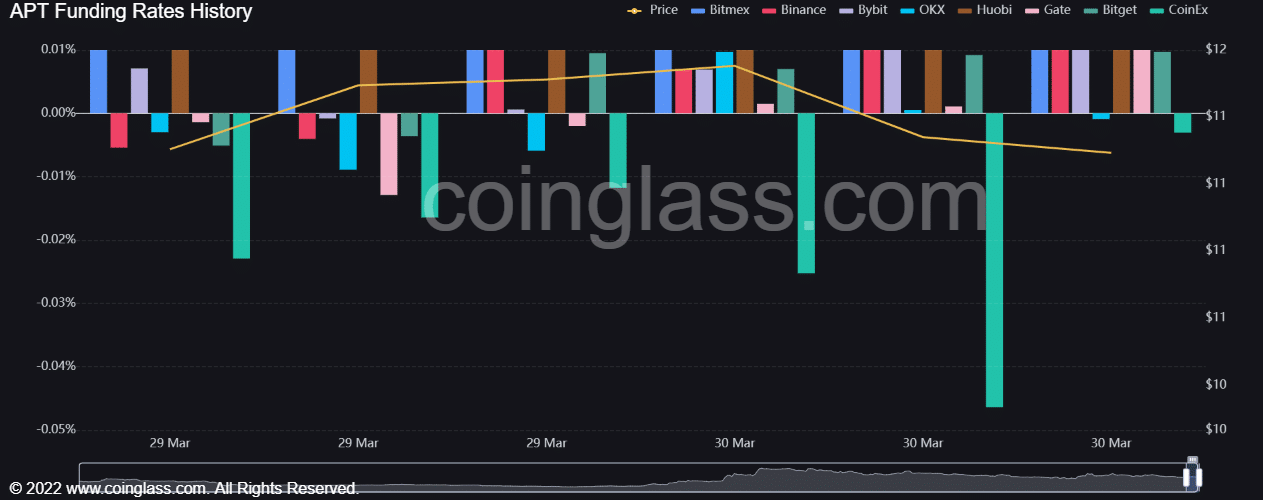

According to Coinglass, APT saw a fairly positive funding rate between 29 and 30 March. However, the DeFi ramp-up announcement may have been overshadowed by the BTC’s price movement.

The move to ramp up Aptos network’s DeFi system could poise it to attract more players and enhance sustainability in the long term.

However, BTC’s price action has overshadowed the APT’s new development. Besides, the Aptos network must deal with cut-throat competition from Ethereum, BSC, and other blockchain networks in the DeFi space.