Arbitrum: Are whales taking advantage of the price dip

- Whale activity around Arbitrum has remained relatively high.

- Bullish sentiment around ARB surged in the last 24 hours, but metrics were bearish.

Like most cryptos, Arbitrum [ARB] has also been witnessing the bears’ wrath as its price moved southwards. In fact, the token underwent another price correction on 10 September as its value plunged by more than 3%. While ARB’s price went down, whales might have tapped the opportunity to increase their holdings. Though whales’ confidence in ARB seemed high, investors might have to wait longer to enjoy profits.

Read Arbitrum’s [ARB] Price Prediction 2023-24

Whales are buying Arbitrum

CoinMarketCap’s data revealed that ARB’s price suddenly moved southwards on 10 September, pushing its value down by more than 3% in the last 24 hours. At the time of writing, it was trading at $0.8702 with a market capitalization of over $1.1 billion.

Lookonchain’s data revealed that while Arbitrum’s price struggled to move up, a whale kept buying the token for a week. To be precise, a whale spent 2,000 ETH, worth over $3.27 million, to buy 3.64 million ARB at an average price of $0.9 since 3 September 2023.

Last month, the whale spent 800 ETH, which was $1.47 million, to buy 1.27 million ARB.

A whale is buying $ARB!

The whale spent 2,000 $ETH ($3.27M) to buy 3.64M $ARB at an average price of $0.9 since Sept 3.

The whale spent 800 $ETH($1.47M) to buy 1.27M $ARB on Aug 13 but soon dumped on #Binance at a loss of ~$36K on Aug 16.https://t.co/0uohrf6PI3 pic.twitter.com/R6Zdjbtcje

— Lookonchain (@lookonchain) September 9, 2023

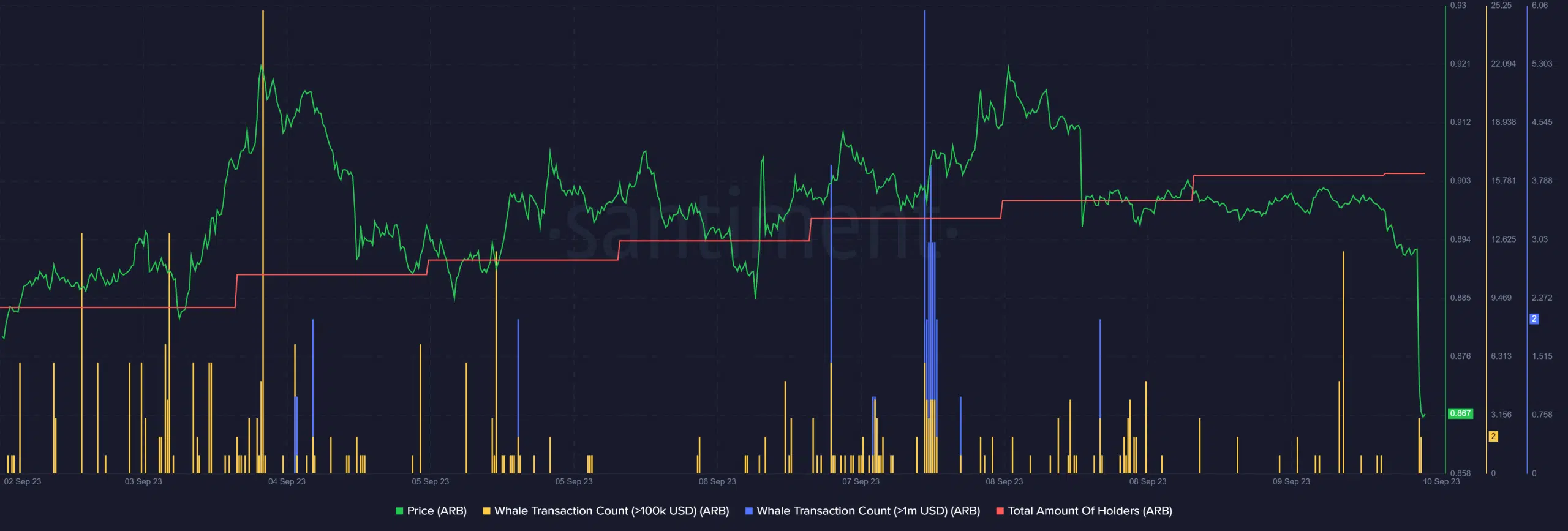

This clearly indicated that the whale had high hopes for ARB. A look at Santiment’s data revealed that not just one, but several were actually using this opportunity to accumulate more.

Whale transaction counts remained high throughout the week, signifying their accumulation trend. Not only whales but investors at large were stockpiling ARB as the token’s total amount of holders increased.

Arbitrum’s cold days to last longer

Buying pressure on ARB might take longer to show its effects on the token’s price, as a few of the metrics looked bearish. For instance, ARB’s funding rate remained green even after the price drop, meaning the derivatives investors were buying ARB at that price.

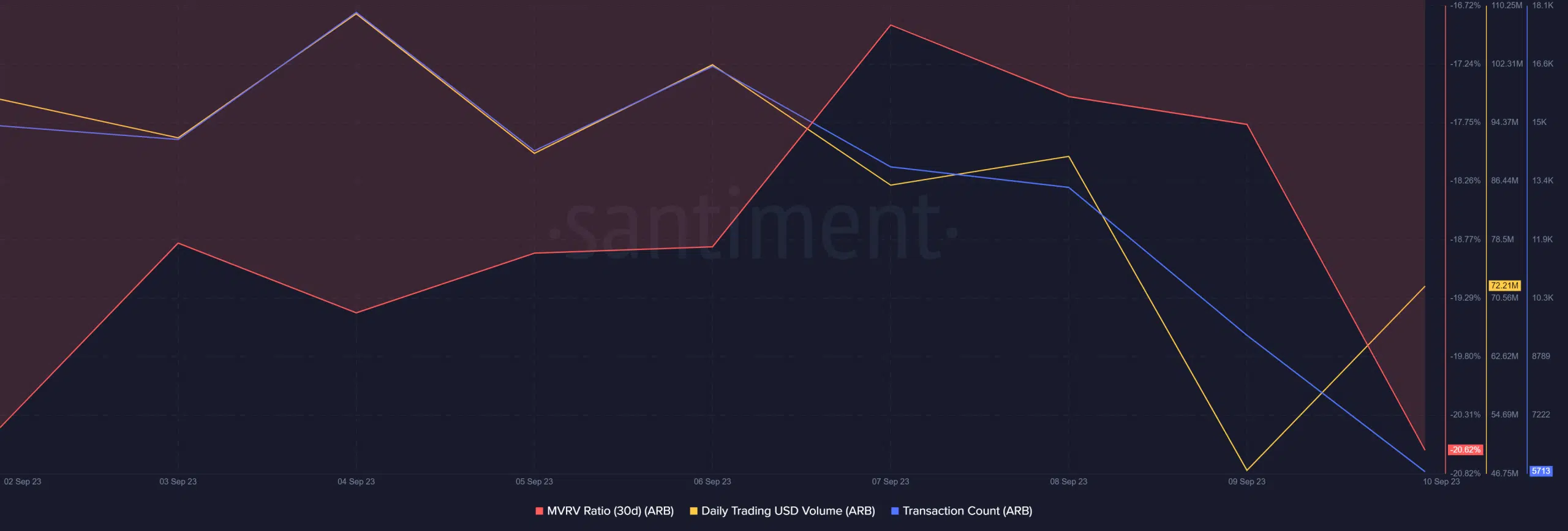

On top of that, its MVRV Ratio registered a decline, which is a bearish signal. ARB’s daily trading volume in USD and transaction counts also dropped, signaling a lower willingness of investors to trade the token.

Surprisingly, despite the price drop, LunarCrush’s data pointed out that bullish sentiment around ARB shot up by 180% in the last 24 hours.

Realistic or not, here’s ARB’s market cap in BTC terms

Like sentiment around ARB, the token’s Relative Strength Index (RSI) also gave a bullish notion. The graph was about to enter the oversold zone, which can further increase buying pressure, causing a trend reversal in the coming days.

The Chaikin Money Flow (CMF) registered an uptick and was headed towards the neutral mark. Nonetheless, Arbitrum’s Money Flow Index (MFI) remained below the neutral mark, increasing the chances of a continued downtrend.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)