Arbitrum beats Polygon in key area: What’s next for the Ethereum L2 rivals?

- Another whale bought ARB tokens worth $6.15 million while MATIC did not attract such investment.

- New unique transactions on Arbitrum were more than those on Polygon.

If the kind of accumulation Arbitrum [ARB] has experienced within the last few months, then another Ethereum L2 like Polygon [MATIC] might need to be wary.

A few times, AMBCrypto reported how investors purchased ARB in large numbers. While the activity slowed down at some point, another accumulation resurfaced on the 17th of May.

According to Arbiscan, a whale bought 4.17 million ARB on the mentioned date. This same buyer has been purchasing the token since July 2023.

In total, the participants hold $6.15 million worth of the token despite offloading some previously.

Both tokens fall, but one has the upper hand

Purchases like this suggest conviction in the long-term performance of the token. This is something Polygon has struggled to experience.

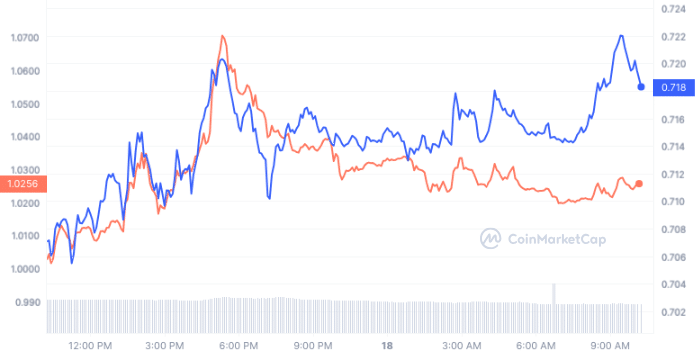

When it comes to the price, MATIC has lost 29.23% of its value on a Year-To-Date (YTD) basis. ARB was however worse off— Registering a 40.86% decrease within the same period.

However, consistency in ARB accumulation could change the state of things. If this is the case, the Polygon native token might begin to lag behind the Arbitrum governance cryptocurrency.

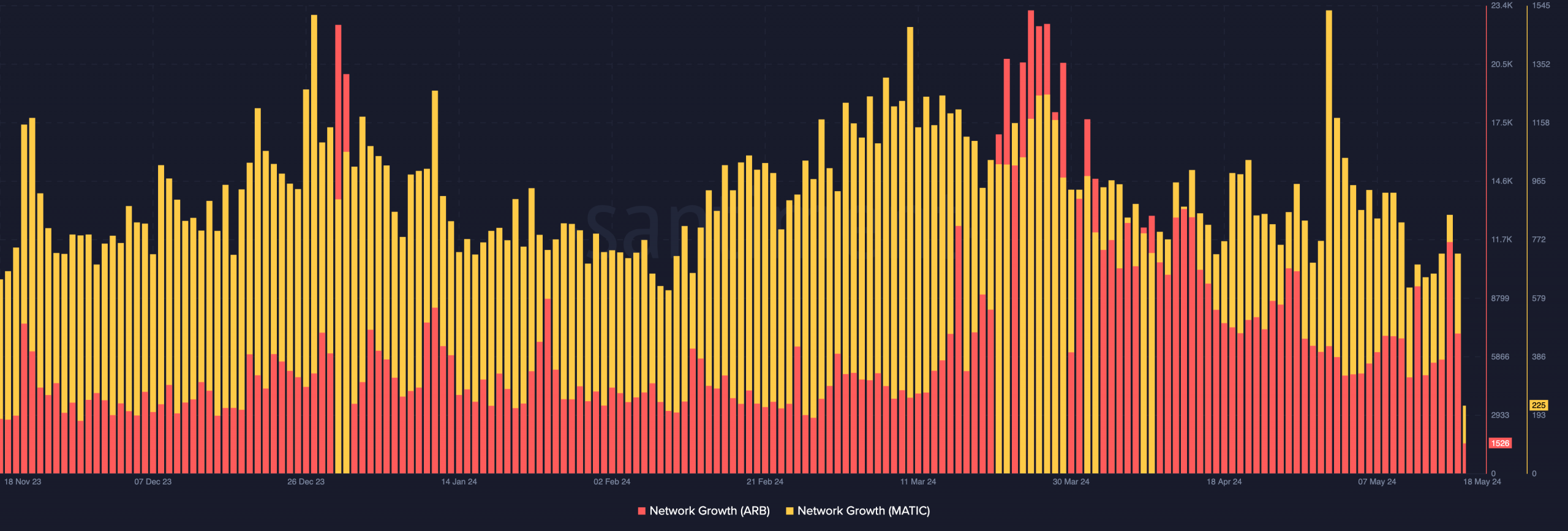

Beyond the price, other aspects of the individual ecosystems give insights into their potential future performances. First off, AMBCrypto compared the network growth.

This metric shows the number of new addresses making transactions on the network. At press time, Arbitrum’s network growth was 1526.

For Polygon, it was 225. The significant difference was proof that market participants were flocking to Arbitrum. However, Polygon has not achieved much in convincing new entrants to transact using MATIC.

If this continues, ARB’s price might experience a good level of appreciation. Furthermore, the token has been able to surpass the $1 landmark.

For many months, ARB struggled to revisit the region. By the look of things, the price of cryptocurrency might rise higher than this.

However, this does not mean that it would be easy to hit the $2.39 all-time high it reached in March.

Can Arbitrum’s market cap jump 3x?

Despite the potential Arbitrum showed, it might find it hard to flip Polygon’s market cap. As of this writing, Arbitrum’s market cap was $2.72 billion.

Polygon, on the other hand, was triple at $7.12 billion. For ARB to hit such heights, the price has to move past $3.50. But that would require MATIC to stall below $1.

Going by our analysis, Arbitrum might continue to outpace Polygon in terms of transactions. Also, this could fuel an improved performance than MATIC.

Realistic or not, here’s ARB’s market cap in MATIC terms

In the long term, the price of ARB and MATIC could depend on Ethereum since both are L2s of the blockchain.

If ETH price pumps, most likely, ARB and the Polygon native token would jump. On the other hand, a decrease in ETH’s value could trigger a plunge in the prices of the tokens.