Arbitrum dominates L2 TVL, but ARB’s price isn’t responding – Why?

- Arbitrum had the third-highest DEX volume at press time.

- ARB has continued to decline for the last three months.

Arbitrum [ARB] has maintained its position as a dominant decentralized exchange (DEX) platform and boasts the most significant Layer 2 (L2) Total Value Locked (TVL) in the ecosystem.

Despite the platform’s strong performance in TVL and dominance in the DeFi space, the native token, ARB, has followed a less favorable trend over the past few months.

Data indicated that almost 100% of ARB holders were holding at a loss at press time, reflecting the token’s decline in value.

Arbitrum continues downtrend

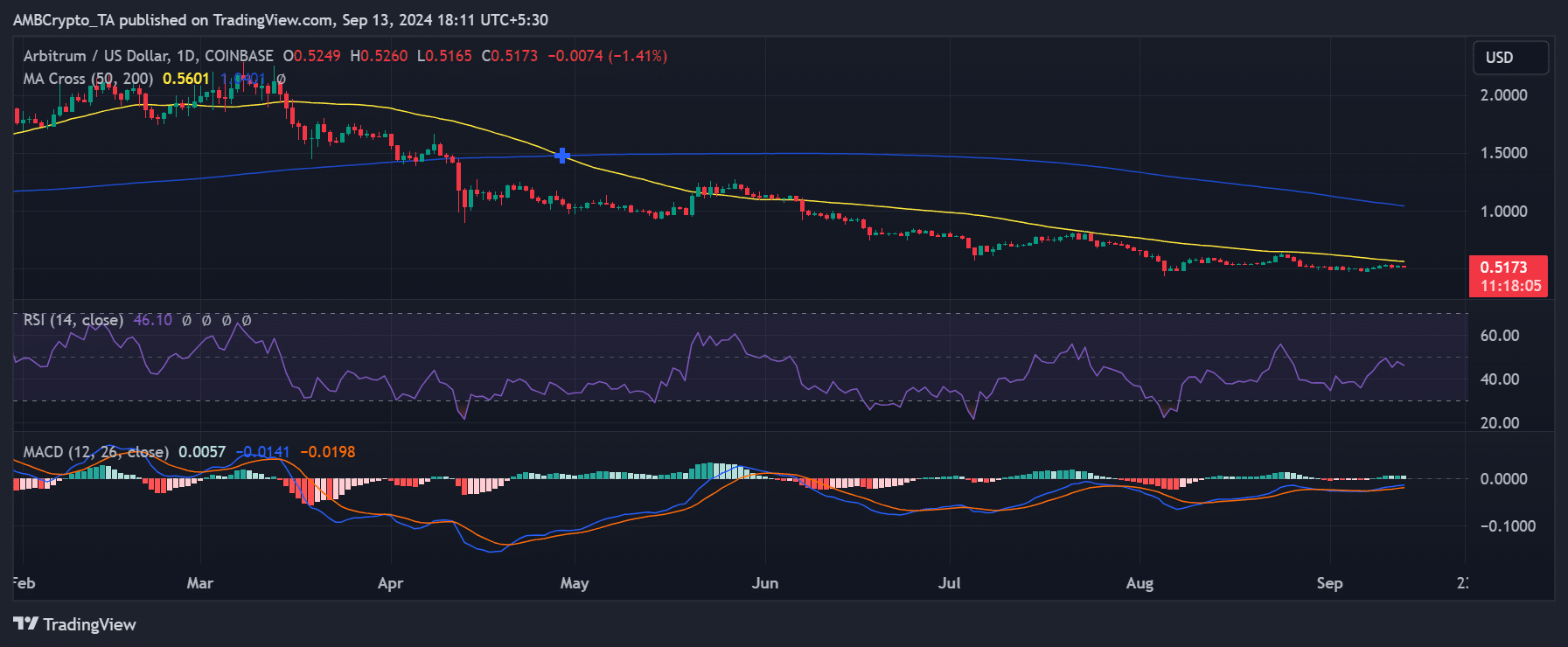

AMBCrypto’s analysis of Arbitrum on a daily chart revealed that it had experienced muted trading activity over the past few months, accompanied by a steady overall decline in its price.

The short and long-moving averages (yellow and blue lines), which also function as trend lines, indicated that ARB’s price has been on a downtrend since May.

ARB was trading at approximately $0.51 as of this writing, reflecting a decline of over 1% in the current session.

The MACD (Moving Average Convergence Divergence) further supported the bearish outlook, with the signal lines below zero.

The severity of this downtrend is underscored by the fact that almost 100% of ARB holders are now holding their positions at a loss.

More ARB holders go out of the money

The Global In/Out of the Money chart on IntoTheBlock highlighted the significant impact of Arbitrum’s price decline on its holders.

Approximately 1.19 million addresses were out of the money at press time, meaning that over 94% of ARB holders were experiencing losses.

Only about 2% of holders are profitable, marking one of the lowest profitability levels in the token’s history.

Despite this challenging price trend, Arbitrum’s network activity has remained robust.

Data from IntoTheBlock revealed that Arbitrum ranked as the third-highest decentralized exchange (DEX) platform by volume, with over 14% market share, trailing only behind Ethereum [ETH] and Solana [SOL].

The combination of a high percentage of holders at a loss and Arbitrum’s strong network fundamentals presented a unique scenario.

It suggests that, while the platform’s utility remains intact, market sentiment towards ARB may be driven more by speculative factors.

Arbitrum maintains a large share of L2

Per AMBCrypto’s look at Arbitrum’s dominance in the Layer 2 (L2) space, the platform remained commanding.

Data from L2 Beats indicated that Arbitrum controlled over 39% of the L2 Total Value Locked (TVL), with more than $13 billion locked in the ecosystem.

Is your portfolio green? Check out the ARB Profit Calculator

However, despite this impressive performance in terms of network usage and dominance in the L2 sector, ARB’s price has not mirrored these positive metrics.

The platform’s robust activity has not translated into a positive price trend for the ARB token, which continues to struggle with muted price movements and a large percentage of holders at a loss.