Arbitrum forms a bullish pattern, but drop still likely – Here’s why

- Arbitrum is trading within an ascending triangle pattern with strong resistance at $0.62.

- A decline in DeFi activity and whale inactivity could see prices continue rangebound trading.

Arbitrum [ARB] was tracking the performance of the broader cryptocurrency market after gaining slightly by 1.2% in the last 24 hours after the global market cap pushed higher.

ARB traded at $0.558 at press time. In the last seven days, Arbitrum has traded rangebound between $0.54 and $0.57 amid a lack of volatility.

The altcoin had formed an ascending triangle on the one-day chart, with the price facing strong resistance at $0.62 despite forming a series of higher lows.

This pattern is often bullish, showing that buyers are slowly gaining strength.

However, the momentum is weak, suggesting that ARB could face resistance at $0.62 again if buyers fail to step in.

The Relative Strength Index (RSI) line is below the signal line, indicating a bearish momentum is in play. Moreover, the RSI at 47 shows that the sellers are still in control.

The Chaikin Money Flow (CMF) is still positive, but it is tipping south. This suggests that buying activity is not strong, and if sellers take control, ARB could drop to test support at $0.48.

Besides a lack of buyers, several other factors could affect Arbitrum’s uptrend.

Whale inactivity

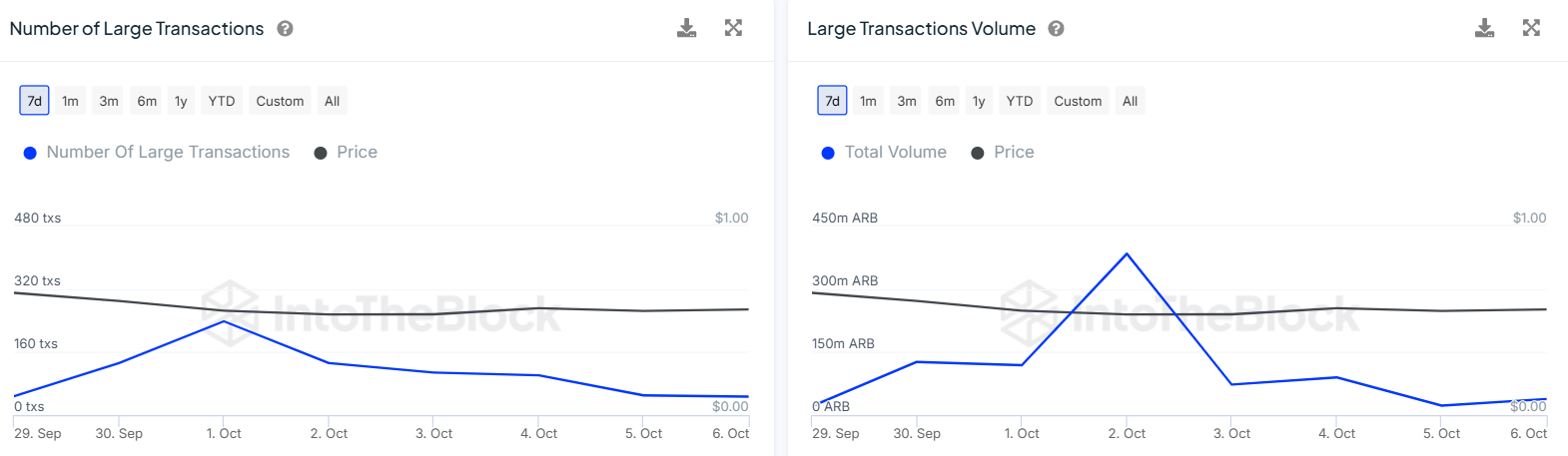

Data from IntoTheBlock showed a drastic drop in the large transactions. The number of large transactions has dropped from a weekly high of above 200 to below 50 transactions.

Large transaction volumes have also dropped from 342 million to 93 million.

Whales usually play a key role in driving prices, as large buy or sell orders can influence price movements. Therefore, when these large addresses are inactive, it can cause rangebound trading.

DeFi activity slumps

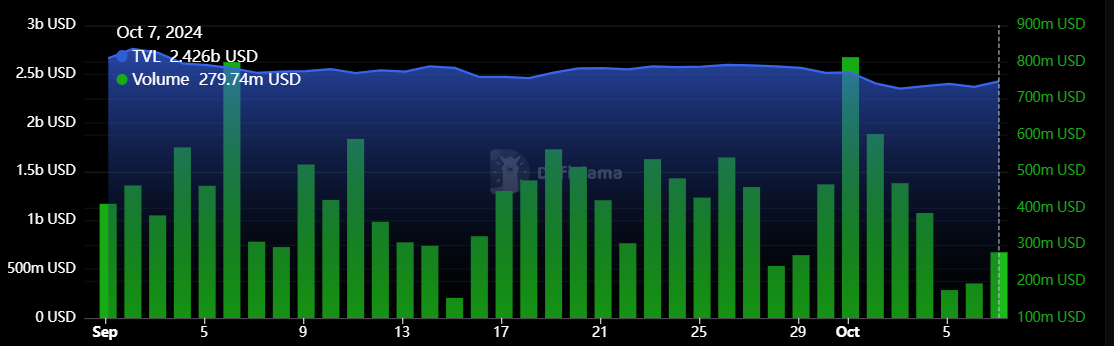

Data from DeFiLlama shows that decentralized finance (DeFi) volumes on Arbitrum have dropped significantly over the past week.

At the start of the month, DeFi volumes on Arbitrum stood at $813M, but this metric has since dropped to $279M.

DeFi inactivity points towards declining network usage. This shows weakening confidence in Arbitrum, which could cause further selloffs.

Analyzing Arbitrum’s liquidity heatmap

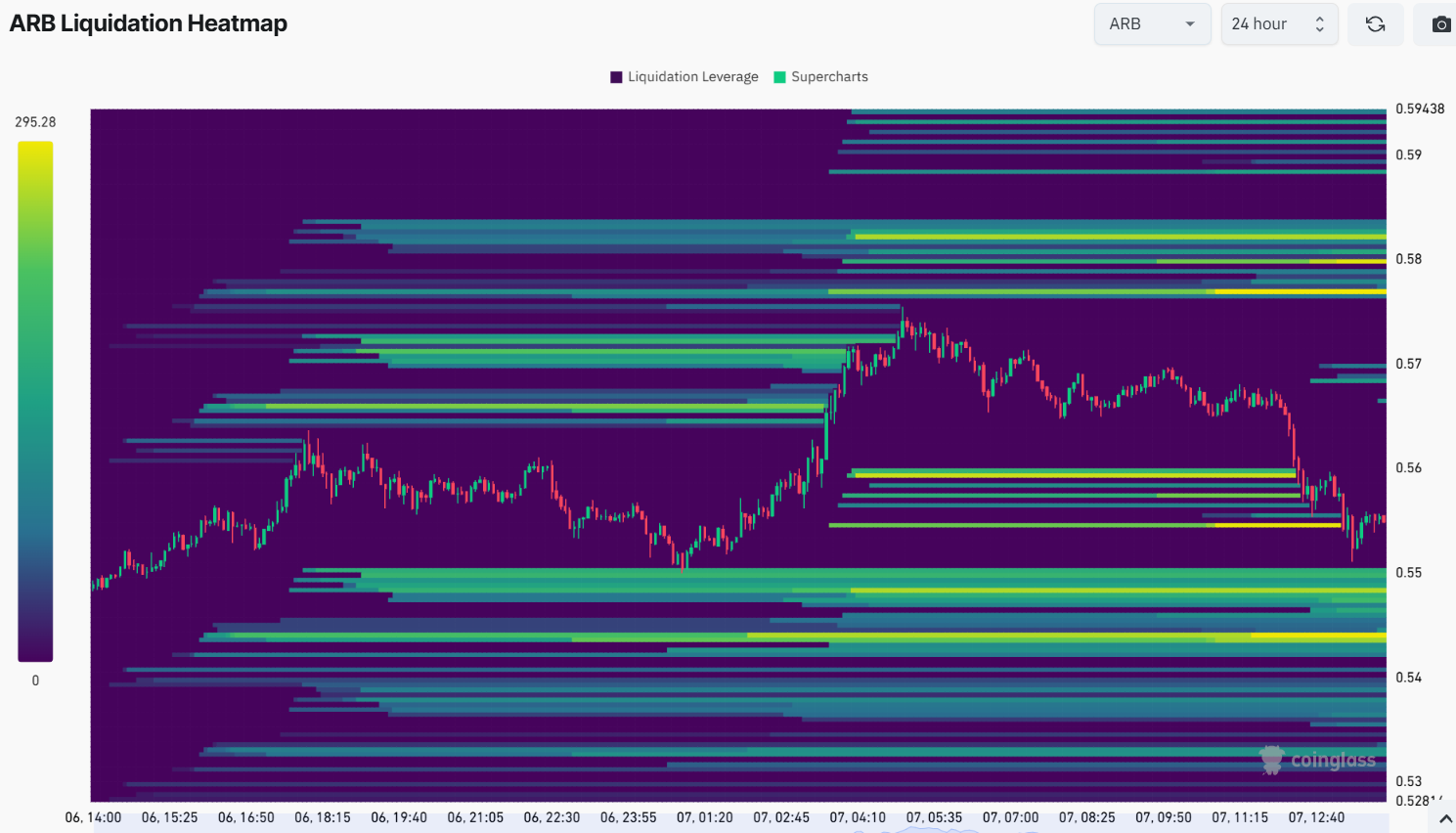

Arbitrum’s liquidity heatmap shows a cluster of liquidations below price, while the same is lacking above price. This liquidation heatmap shows a bearish sentiment where short positions are more than long positions.

A cluster of liquidation levels below the price could trigger buying pressure if short sellers are forced to close their positions if the price increases.

However, the bearish sentiment on Arbitrum remained strong, which could hinder buying activity.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

According to IntoTheBlock, the wallets that are Out of the Money (in losses) were at 91% at press time, while only 5% were in profit.

If the wallets that are in losses fail to break even for an extended period, they could choose to close their positions to minimize losses.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)