Arbitrum vs Optimism: Who will top the L2 war

- Revenue made by sequencers on Optimism and Arbitrum has grown significantly in the last year.

- Optimism’s Bedrock Upgrade has resulted in an uptick in daily network transactions.

Layer 2 (L2) networks Optimism [OP] and Arbitrum [ARB] have seen a surge in cumulative sequencer revenue in the last year, on-chain data platform Delphi Digital noted in a recent tweet.

Sequencers are entities or individuals responsible for creating and submitting compressed summaries of transactions to the Ethereum mainnet. As more users and projects adopt Optimistic Rollups and migrate their transactions to Arbitrum and Optimism, the demand for sequencer services increases. This increased demand translates into higher revenue for these sequencers.

All credits belong to the users

On-chain assessment of the network activity on Optimism and Arbitrum revealed that sequencer revenue growth had accelerated recently. This was due to the rising adoption of layer-two solutions.

Holding a much larger share of the L2 market, the cumulative count of distinct addresses on Arbitrum recently crossed the 9-million mark, per data from ArbiScan. As of 8 July, 9.70 million unique addresses were housed within the network.

Optimism, however, trailed with a total unique address count of 6.26 million, according to data from Etherscan.

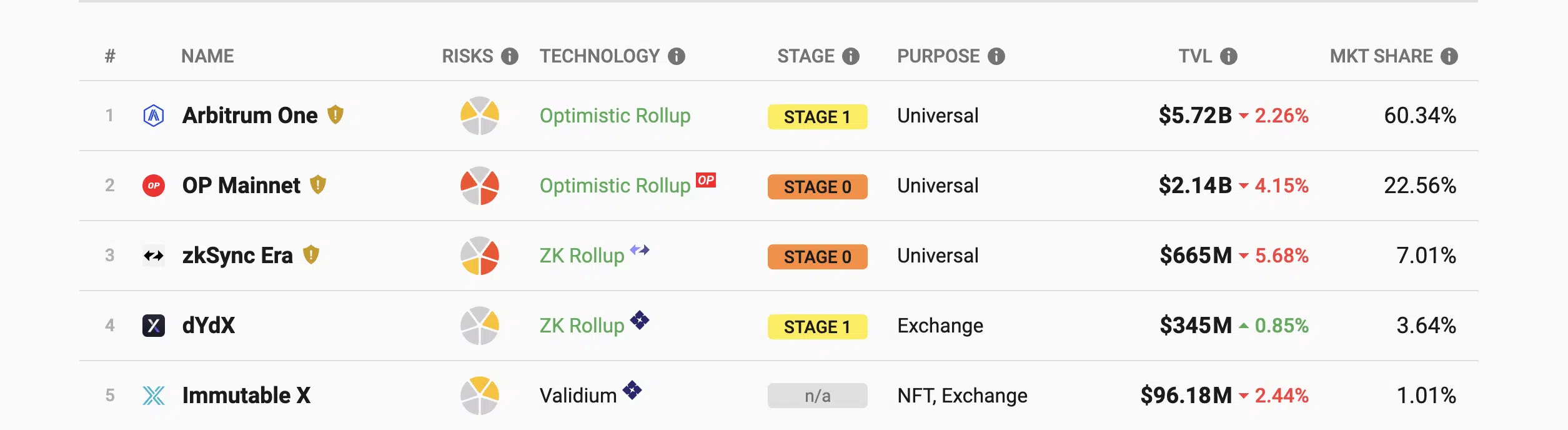

The divergence in the cumulative count of addresses on both networks is also reflected in the difference in the total value of assets locked (TVL) on each. With a TVL of $6 billion, Arbitrum controls a 60.34% market share of the $9.49 billion held as cumulative TVL in the entire L2 market.

Optimism’s TVL, at press time, was $2.14 billion, holding a 23% marketshare, according to data from L2Beat.

Who has the upper hand?

Interestingly, a consideration of day-to-day network activity on both protocols revealed that daily transactions on Optimism outpaced Arbitrum. Data from Nansen revealed that Arbitrum experienced a significant surge in daily active addresses during its AirDrop event in March. However, there has since been a steady decline in daily wallet activity.

In contrast, the number of daily active addresses on the Optimism network showed an upward trend in June. And that position that has been maintained so far in Q3.

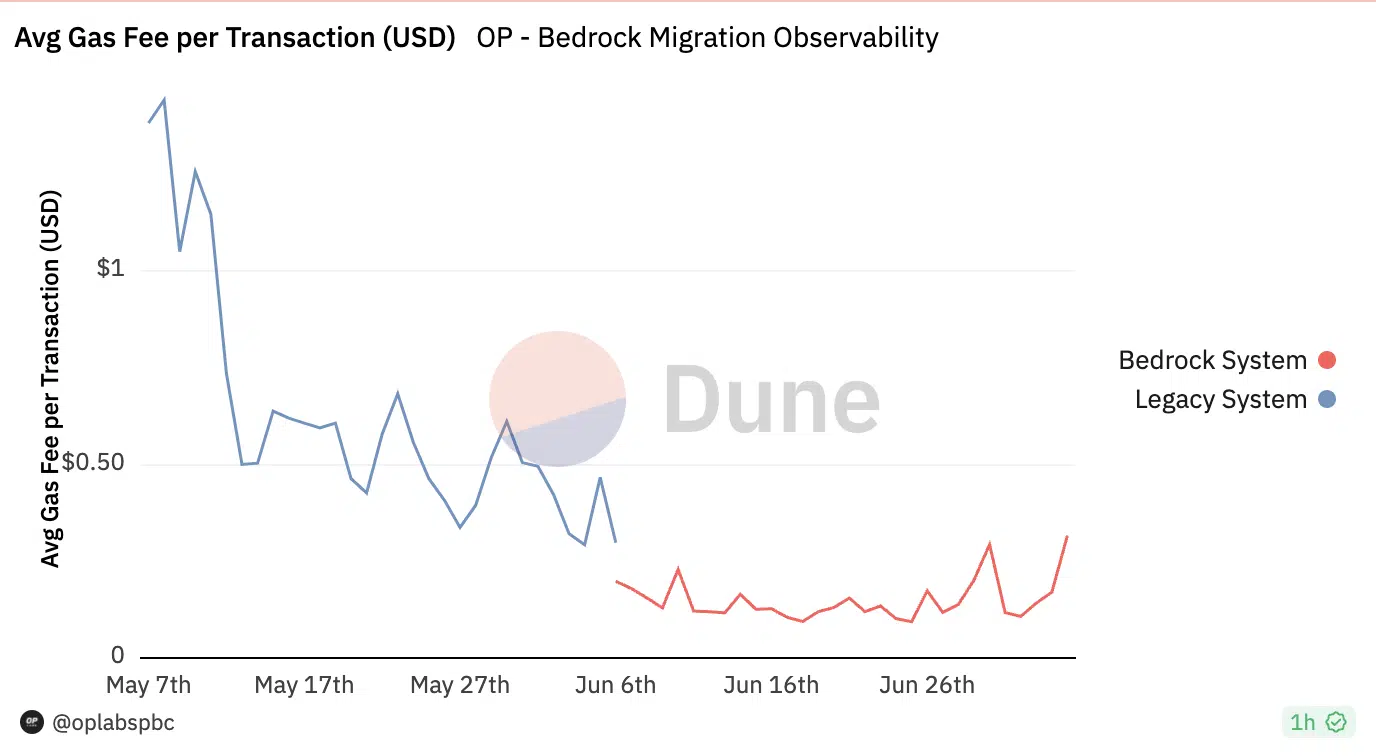

Further, regarding the number of transactions completed on both networks, Arbitrum saw relatively stable transactional activity throughout June, with no significant changes. However, Optimism experienced a sharp increase in transaction volume during the same period. The surge in transactions on Optimism in the last month has been due mainly to the introduction of “Bedrock.”

At the beginning of June, Optimism announced the launch of its Bedrock Upgrade. According to data from Dune Analytics, the upgrade has facilitated savings of nearly 75% on each transaction, drawing in more users.