Arbitrum’s [ARB] inception is posing a threat to investors’ interest in GMX?

![Arbitrum's [ARB] inception is posing a threat to investors’ interest in GMX?](https://ambcrypto.com/wp-content/uploads/2023/03/GMX.png)

- GMX’s daily active users (DAUs) declined slightly, but the DAUs of ARB increased.

- On-chain performance suggested lowered investor interest, and indicators looked bearish.

Lookonchain’s data revealed a transaction on 25 March, which seemed concerning for GMX. As per the tweet, a whale exchanged all of its GMX for Arbitrum [ARB]. The whale had earlier bought more than 12,000 GMX with 300 Ethereum [ETH] and then exchanged those for 6,65,947 ARB.

We noticed a whale exchanged all $GMX positions for $ARB.

The whale bought 12,445 $GMX(($927K currently) with 300 $ETH($498K) at a price of $40.

Then bought 665,947 $ARB with the 12,445 $GMX, and the buying price is $1.39.https://t.co/QsNQVOMfeB pic.twitter.com/13ZzGAzOLx

— Lookonchain (@lookonchain) March 25, 2023

Is ARB’s inception posing a threat to GMX’s popularity among whales and, by extension, among investors?

Read GMX’s Price Prediction 2023-24

A deep dive into the scenario

A look at GMX’s key metrics gave reasons for concern. For instance, Token Terminal’s data pointed out that the network’s daily active addresses registered a decline, suggesting decreased usage.

This was further proven by taking a look at the blockchain’s decline in revenue since 10 March. Surprisingly, while GMX’s active users declined, the opposite happened with ARB, which witnessed a surge in both new and active users lately.

It was interesting to note that though the network’s TVL remained high, its growth seemed to have stopped as the chart moved sideways for quite some time.

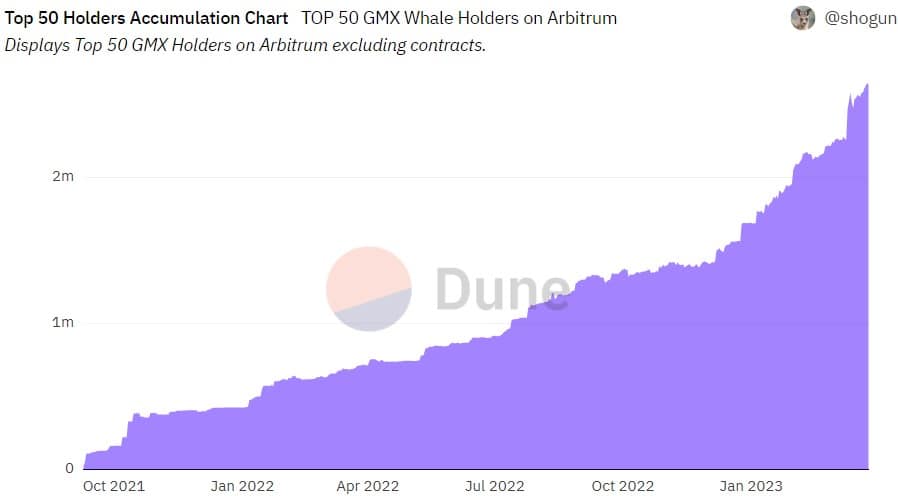

Nonetheless, the good news was that the GMX top 50 holders’ accumulation chart continued to grow, showing whales’ interest was unaffected.

The market sentiment around GMX

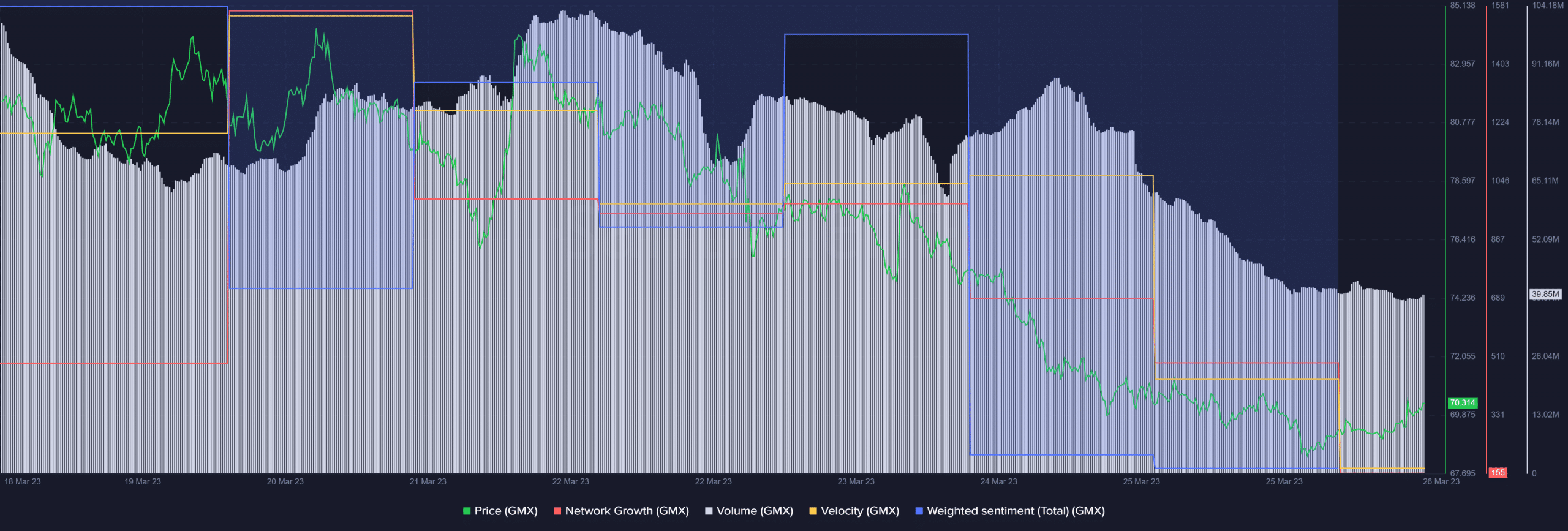

A look at the blockchain’s on-chain metrics helps to better understand the ground reality. The network growth declined sharply over the last few days, suggesting fewer new addresses were used to transfer the token.

The same remained true with velocity, which also went down. Overall sentiments around GMX remained on the negative side, as the weighted sentiment metric fell considerably. Moreover, the volume also tumbled, reflecting less interest from investors in trading GMX.

Realistic or not, here’s GMX market cap in BTC terms

A look at GMX’s state

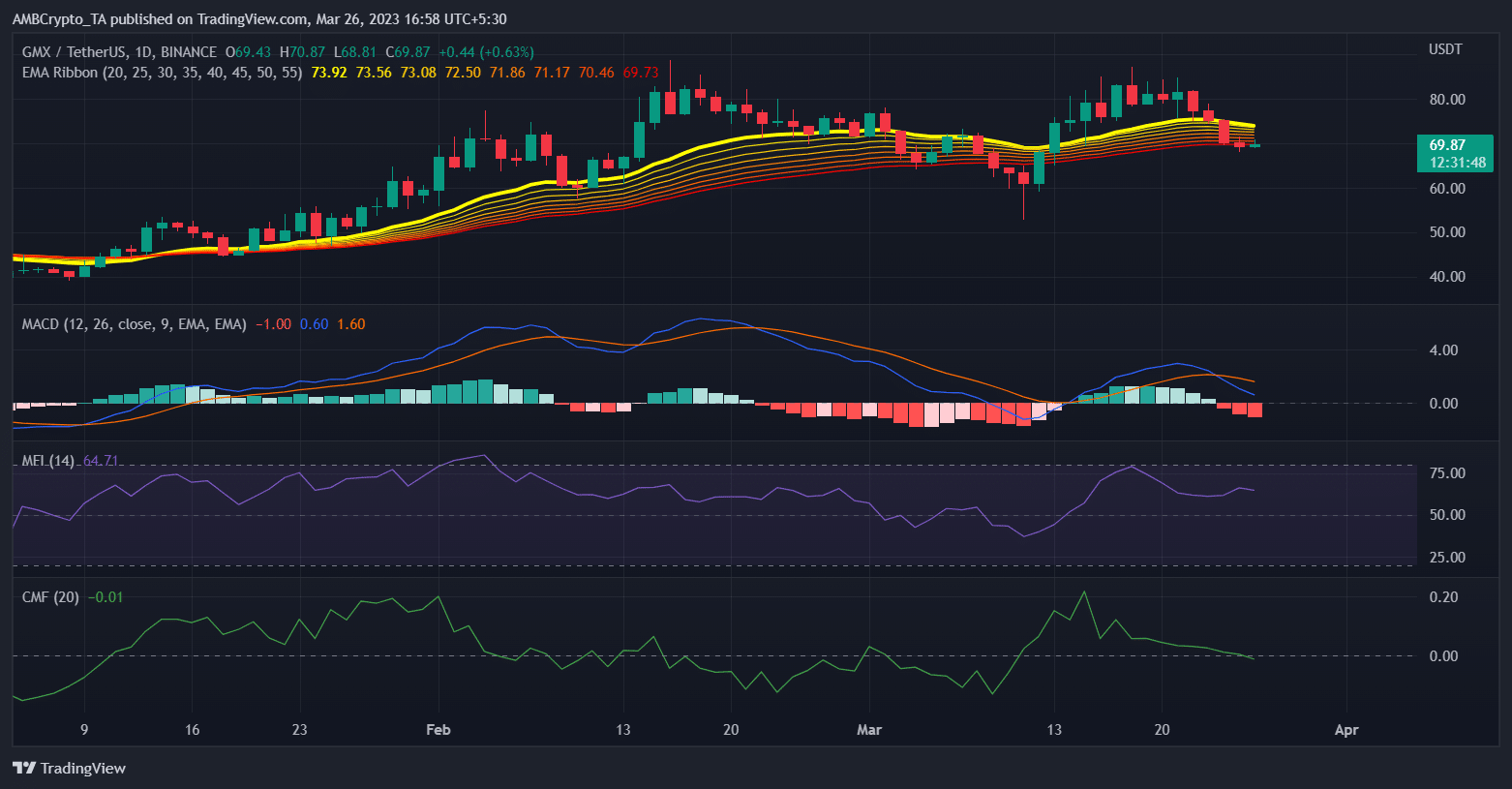

While the network’s on-chain performance was dwindling, the token also failed to make investors happy on the technical front. As per CoinMarketCap, the token’s price declined by more than 12% over the last seven days.

At the time of writing, it was trading at $70.17 with a market capitalization of over $601 million. The token’s daily chart also majorly supported the bears.

For instance, the Chaikin Money Flow (CMF) went below zero, which signified weakness in the market. GMX’s Money Flow Index (MFI) registered a downtick. And the MACD displayed a bearish crossover, which was a development to the sellers’ advantage.

Though the Exponential Moving Average (EMA) Ribbon revealed that the bulls were leading, the bears might soon take over as the distance between the 20-day and 55-day EMA was decreasing, at press time.