Arbitrum’s downward spiral: Whale exodus and liquidation surges unveiled

- Seven ARB whales have sold over 20 million tokens exceeding $16 million.

- ARB has plunged into the oversold zone and has remained there despite a 1% rise in price.

Arbitrum’s [ARB] recent price performance has been unfavorable over the past few days. In addition to the declining prices, there has been a notable negative shift in whale activity, with a significant sell-off occurring within the last 30 hours.

Read Arbitrum (ARB) Price Prediction 2023-2024

Arbitrum whales sell-off at a loss

According to an 11 September post by Lookonchain, an Arbitrum whale with a substantial long position in Aave decided to withdraw their holdings and transfer them to Binance. The data indicated that this whale withdrew 5 million ARB tokens, equivalent to approximately $3.85 million, within 5 hours.

Subsequently, the same whale deposited 3.85 million ARB tokens, valued at nearly $3 million, onto Binance. Notably, the data also revealed that this whale still possessed approximately 8 million ARB tokens valued at over $6 million.

In addition to this individual’s actions, Lookonchain’s post highlighted that in the preceding 30 hours, seven different whales have executed ARB token sell-offs, incurring losses. These collective whales offloaded 20.41 million ARB tokens, with a combined value exceeding $16 million.

Consequently, these ARB whales collectively realized losses exceeding $8 million, representing a substantial decline of approximately 34%.

In the past 30 hours, 7 whales dumped $ARB at a loss!

They dumped a total of 20.41M $ARB ($16.05M), with a loss of $8.15M(-33.67%). pic.twitter.com/o7RDAYkqEv

— Lookonchain (@lookonchain) September 12, 2023

ARB goes deep into the oversold zone

The recent price trend of Arbitrum has been negative, as evidenced by its daily timeframe chart. The chart clearly illustrated that ARB has been on a downward trajectory for the past four days, with a significant drop occurring on 11 September.

ARB experienced a substantial decline of 9.7% on that day by the close of trading. This downturn marked the most significant drop the token has seen in over two months, as evident from the chart.

As a result of this sharp decline, the Relative Strength Index (RSI) line plummeted into the oversold zone. However, as of this writing, ARB had regained a modest 1% increase in value, trading at approximately $0.7.

Nonetheless, this slight uptick in price was insufficient to pull it out of the oversold zone it currently finds itself in.

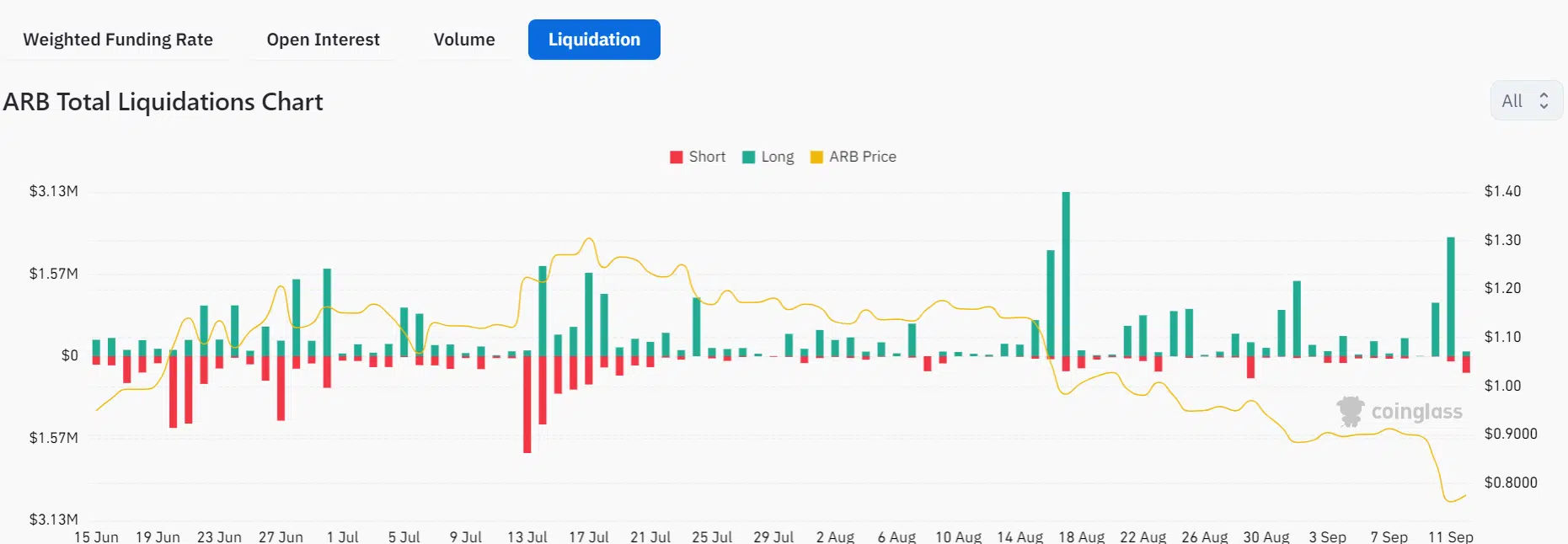

Arbitrum long positions see significant liquidations

Data from Coinglass revealed that the recent price decline in Arbitrum has led to a notable dominance of long-position liquidations. The liquidation chart displayed that on 11 September, the volume of long liquidations reached its second-highest point in over three months.

The liquidations totaled $2.27 million, in contrast to the short position liquidations, which were approximately $98,000.

Furthermore, the liquidation chart illustrated that long positions have experienced more liquidations in the past two months. However, it’s worth noting that as of this writing, short-position liquidations have taken the lead.

Is your portfolio green? Check out the Arbitrum Profit Calculator

Despite the prevalence of long liquidations in recent months, a positive funding rate has persisted. According to the observed funding rate chart, Arbitrum’s funding rate has remained positive despite its price decline.

On 11 September, the funding rate briefly dipped into negative territory, but as of this writing, it has swung back into positive territory. This indicated that traders believe ARB will ultimately experience a price increase in the long term.