Are bearish corrections finally behind for Bitcoin

After dropping below $34,000 on 7th July, Bitcoin was positioning itself near the aforementioned price range yet again. Although stronger bullish sentiments would possibly be confirmed after it closes a price position above $36,000, Bitcoin’s on-chain fundamentals have looked extremely positive over the past week. Network value has definitely increased BTC’s intrinsic interest in 2021 and at press time, a sharp signal has been observed from one of its significant indicators.

Bitcoin NVT Ratio and Signal: Market cycle trigger?

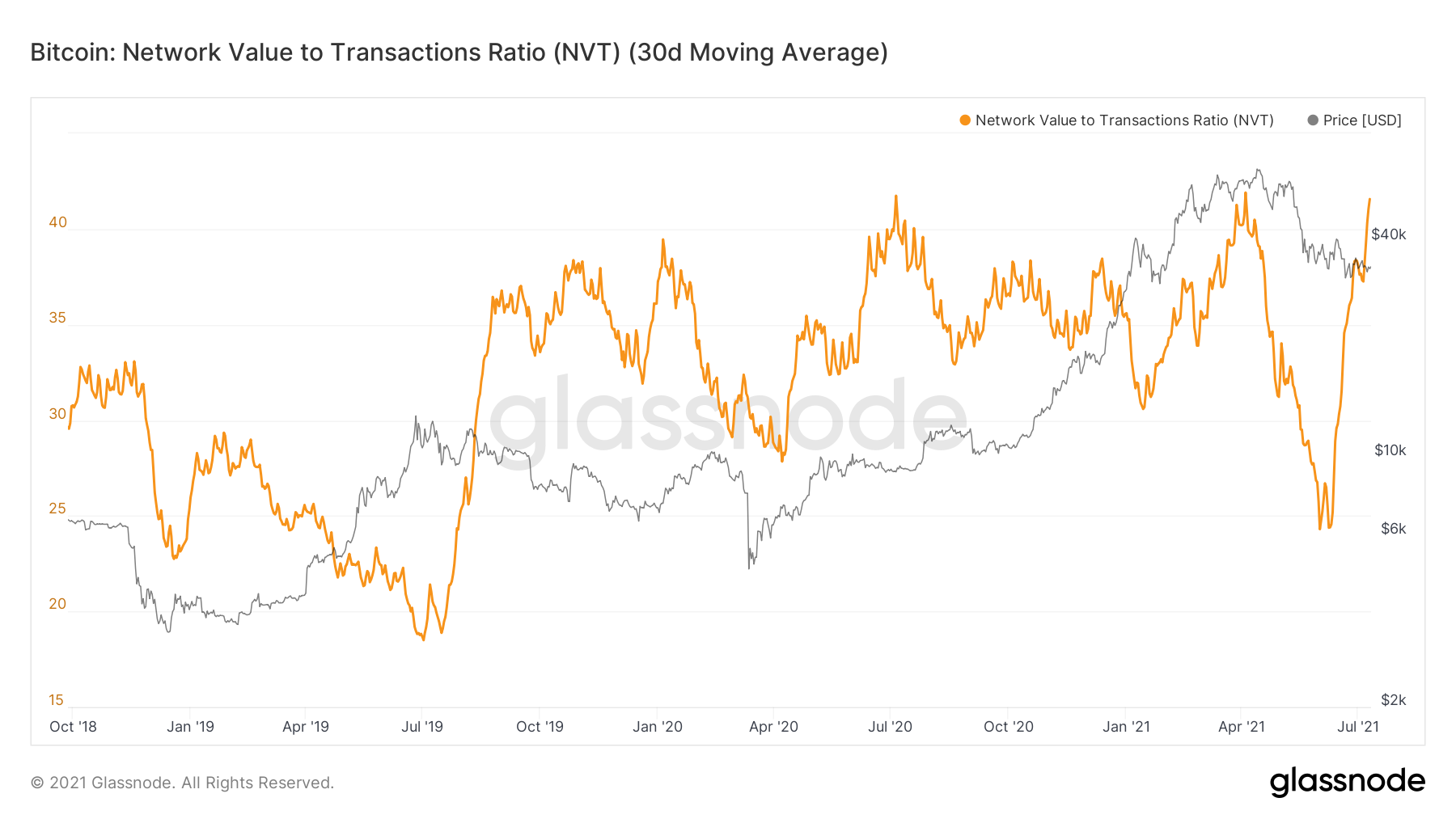

Speaking about Bitcoin’s Network Value to Transactions or NVT Ratio, it is computed by diving the market cap of Bitcoin by on-chain volume measured in USD. It describes BTC’s network utilization, and over time, it has been extremely reactive whenever Bitcoin has been under immense buying/selling pressure.

At press time, the above chart represented an uptick for the NVT ratio since the beginning of June 2021. After reaching a yearly low of 24, it is currently recording a high of 41.01 suggesting that the network value is outpacing the value being transferred on the network.

Keeping it in mind, the NVT signal presents a strong reversal indicator.

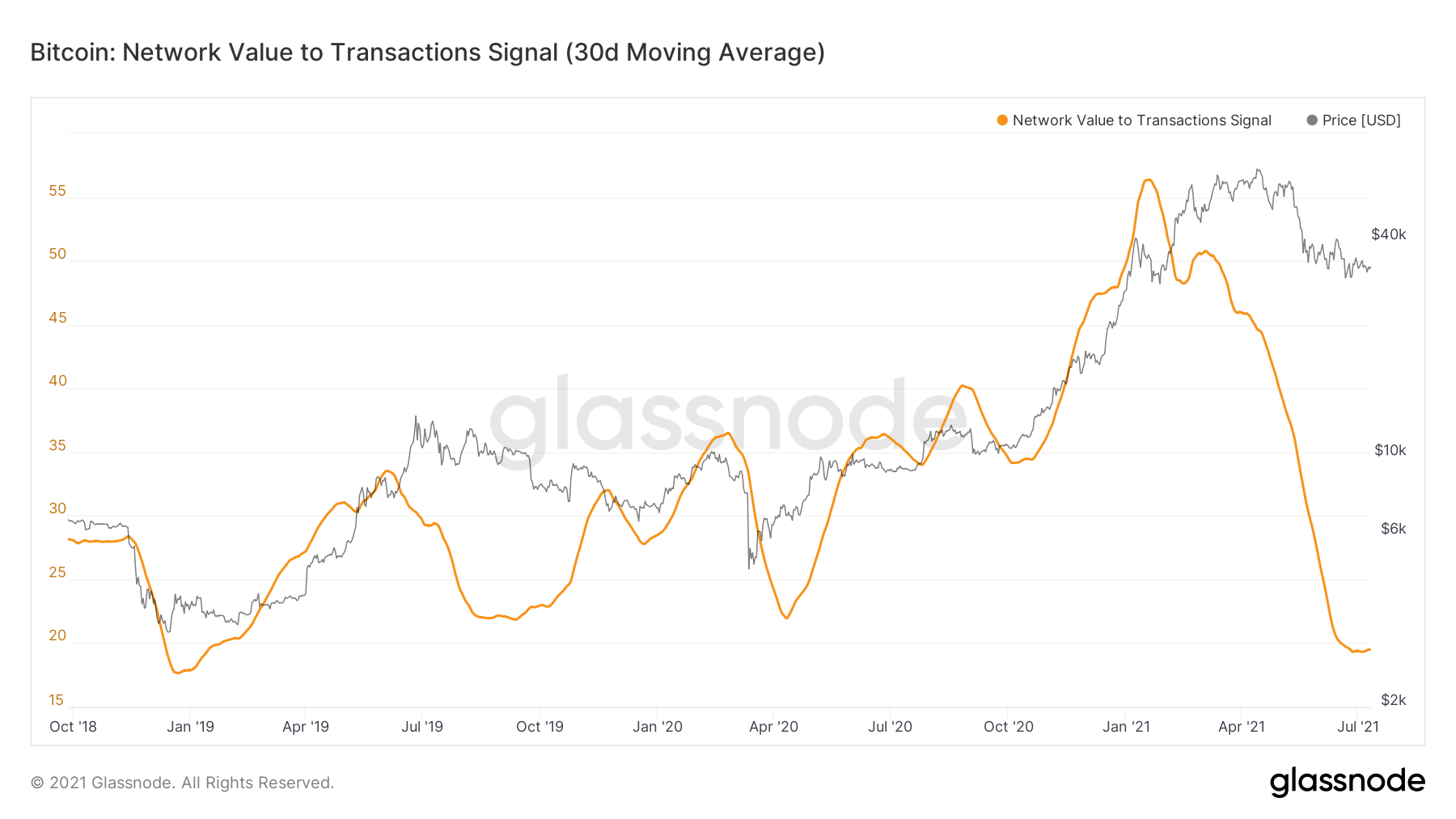

The NVT signal is an aggregated representation of the NVT Ratio, which uses a 90-moving average of the daily transaction volume. The present NVT signal displays an interesting position.

According to the chart above, the NVT signal has reached a low range last witnessed during January 2019, and it is currently facilitating a rising curve. Based on the historical charts, lower NVT signals have helped Bitcoin exhibit strong recoveries in the market, and a similar situation may unfold again for the largest digital asset.

Lets’ not put all the chips in yet

While on-chain metrics may turn relatively bullish, the presence of retail is still essential for Bitcoin to retain bullish momentum in the charts. According to CryptoCompare’s recent report,

“Top spot exchanges witnessed a strong drop in spot volumes over the past month, as Binance faced a 56% drop, Huobi Global reflected a 40.2% decline and OKEx spot trading dropped by 41.6%.”

Such a significant drop in spot trading suggested that retail traders have remained extremely cautious since the drop in May, and they haven’t turned a bullish page with the digital asset yet.

Therefore, keeping an eye on retail activity remains vital in order to catch the bullish wave when it predominantly unfolds in the market.