Are Bitcoin’s long-term hodlers entering the seller’s market?

Bitcoin has been on an impressive bull run since the end of 2020 and with the coin being able to register new all-time highs almost on a weekly basis, Bitcoin hasn’t really acknowledged the presence of a ceiling for its price. However, will Bitcoin have to deal with yet another spell of sideways movement after having set a new ATH, or is price discovery still an option for a coin that has grown by a whopping 450 percent in the past 6 months.

Bitcoin’s market is extremely profitable at the moment and the latest bullish boost came on the back of Tesla’s investment in Bitcoin a few weeks ago. Since then, not only has the price surged but more importantly, Bitcoin has demonstrated its resilience against an immediate pullback. However, things may not be as rosy as they currently seem to be. Data provided by Glassnode highlighted that traditional hodlers may now be tempted to sell off some of their BTC stashes and that they appear to have taken advantage of the market strength to move their coins and sell some of them.

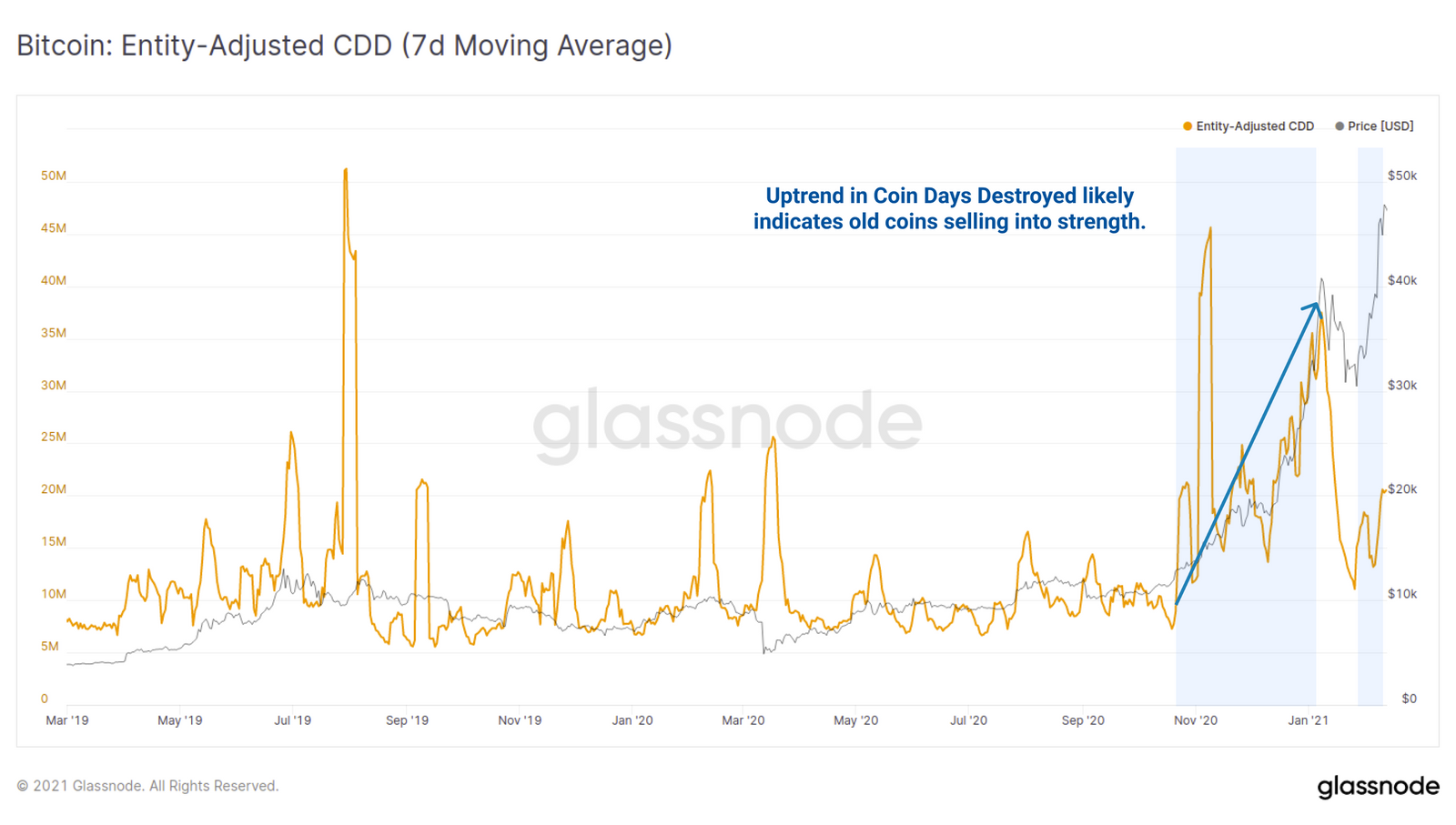

Source: Glassnode

Glassnode’s Coin Days Destroyed (CDD) metric illustrates a similar phenomenon taking place. The metric tracks when old coins are on the move and the data shows that such has been the case even before the December 2020 price rally. There has been increased movement right from when Bitcoin was valued at around $12,000 in November 2020 and according to Glassnode’s data, this slowed down a bit in January as the price went into a consolidation phase, and with the price regaining the bullish momentum and setting a new ATH, the CDD has once gain increased indicating that old coins are once again being sold.

For Bitcoin’s price, the hodler faction is extremely important as they serve as a kind of wall that protects Bitcoin from large sell-offs that can reduce much of its gains. In such a scenario two demographics are very crucial for Bitcoin – the miners and the long-term hodlers. Now coming to the miners, a recent report highlighted that,

“After a period of increased miner distribution during the rally and subsequent consolidation throughout January, miners have actually eased off their sell pressure this week.”

This is a welcome sign for Bitcoin and also explains why the coin has been able to go past the $56k price point. The Average Spent Output Lifespan indicator (ASOL) highlighted that after Elon Musk’s entry into Bitcoin the average age of coins spent has risen from 30-days to 58-days – implying the entry of older BTC into the seller’s market.

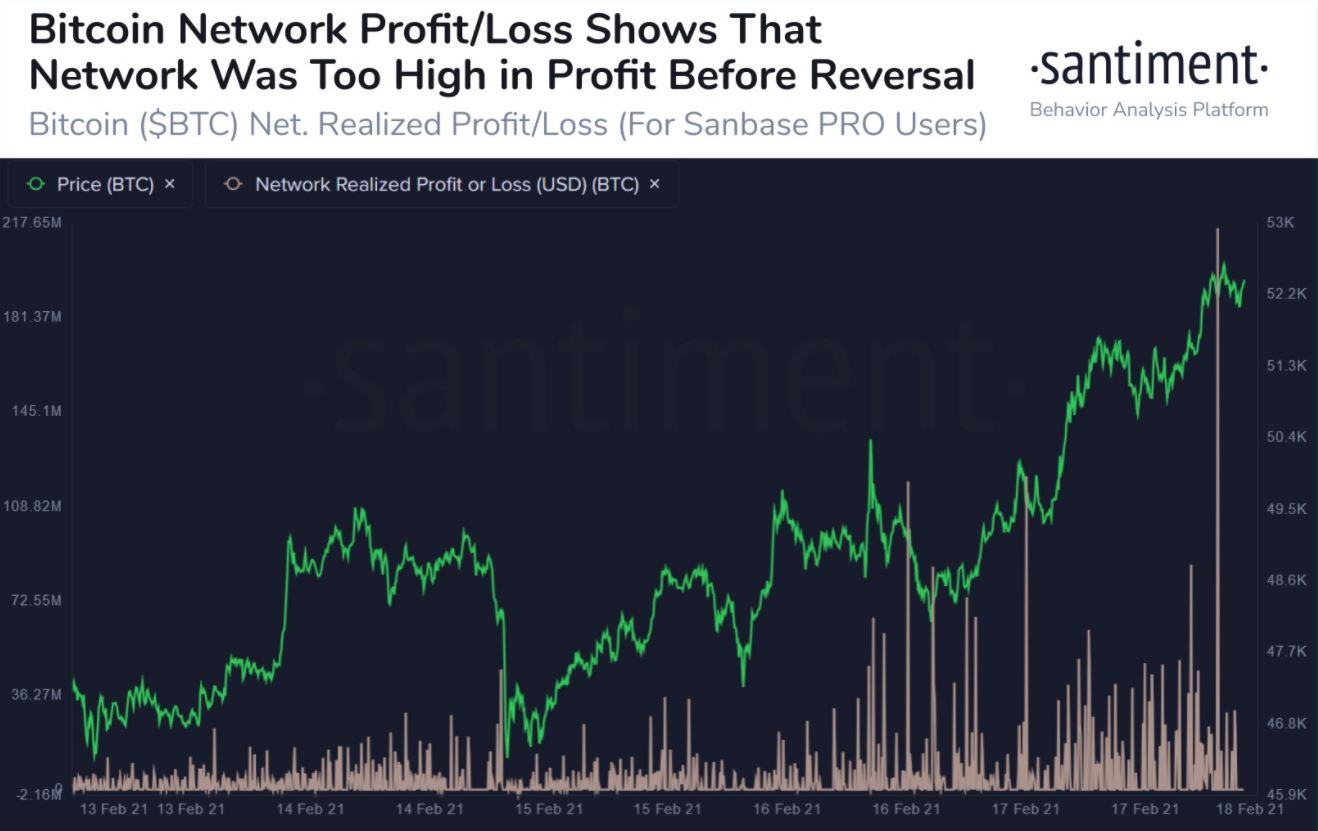

Source: Santiment

In addition to this one can argue that as the market enters a very high profitability margin chances of a price correction and a sell-off also go up. This was illustrated by the data provided by Santiment which showed that as Bitcoin’s network was too high in profit, it ultimately culminated in a price correction.

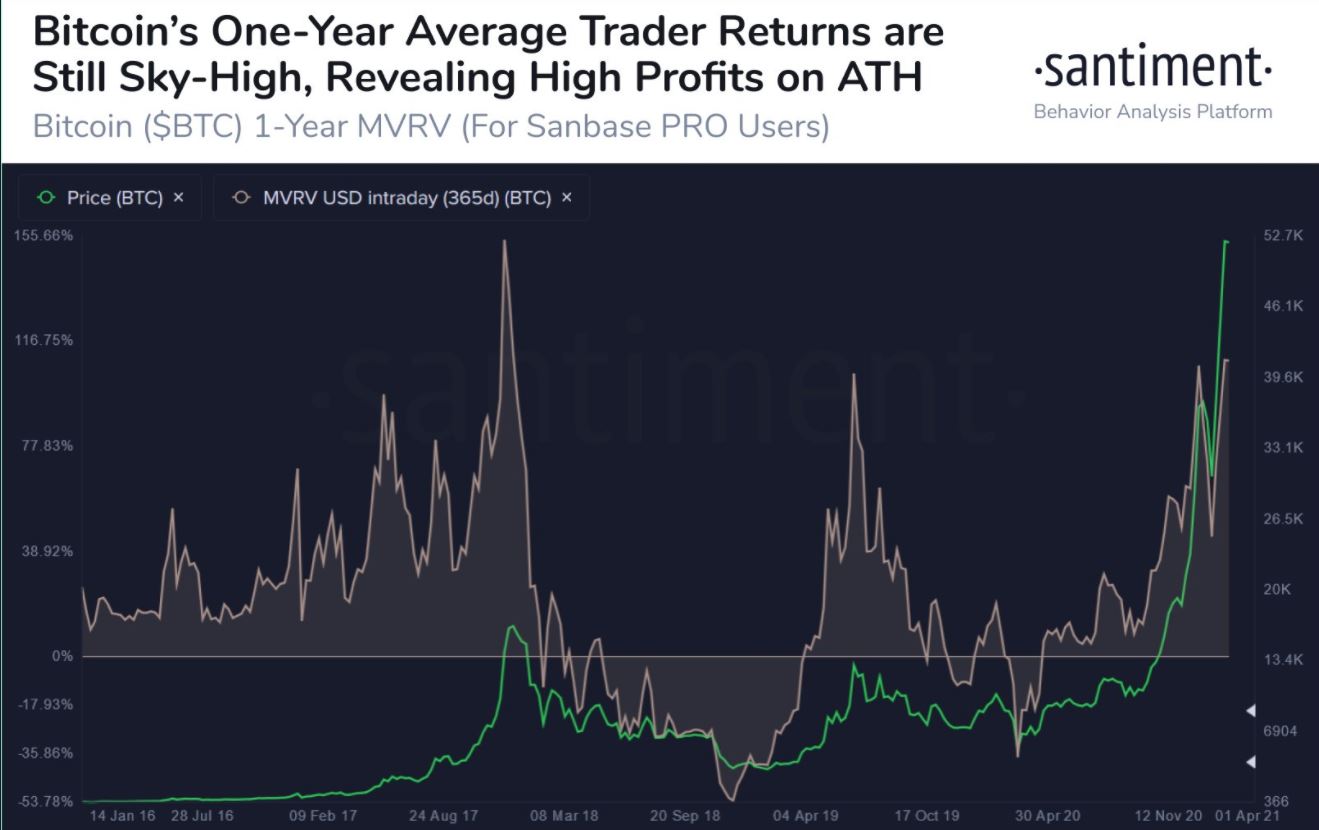

Source: Santiment

While these factors illustrate some of the challenges Bitcoin may face it has been able to sustain the bullish momentum and set yet another all-time high with trader and investor returns continuing to surge by substantial margins. However, as seen in the past, just like how Bitcoin has the ability to sustain uptrends, the inverse is also true and the coin may also be able to delay price corrections if the market dominance continues to reside with buyers.