Are Ethereum’s staker holdings undervalued? New data suggests…

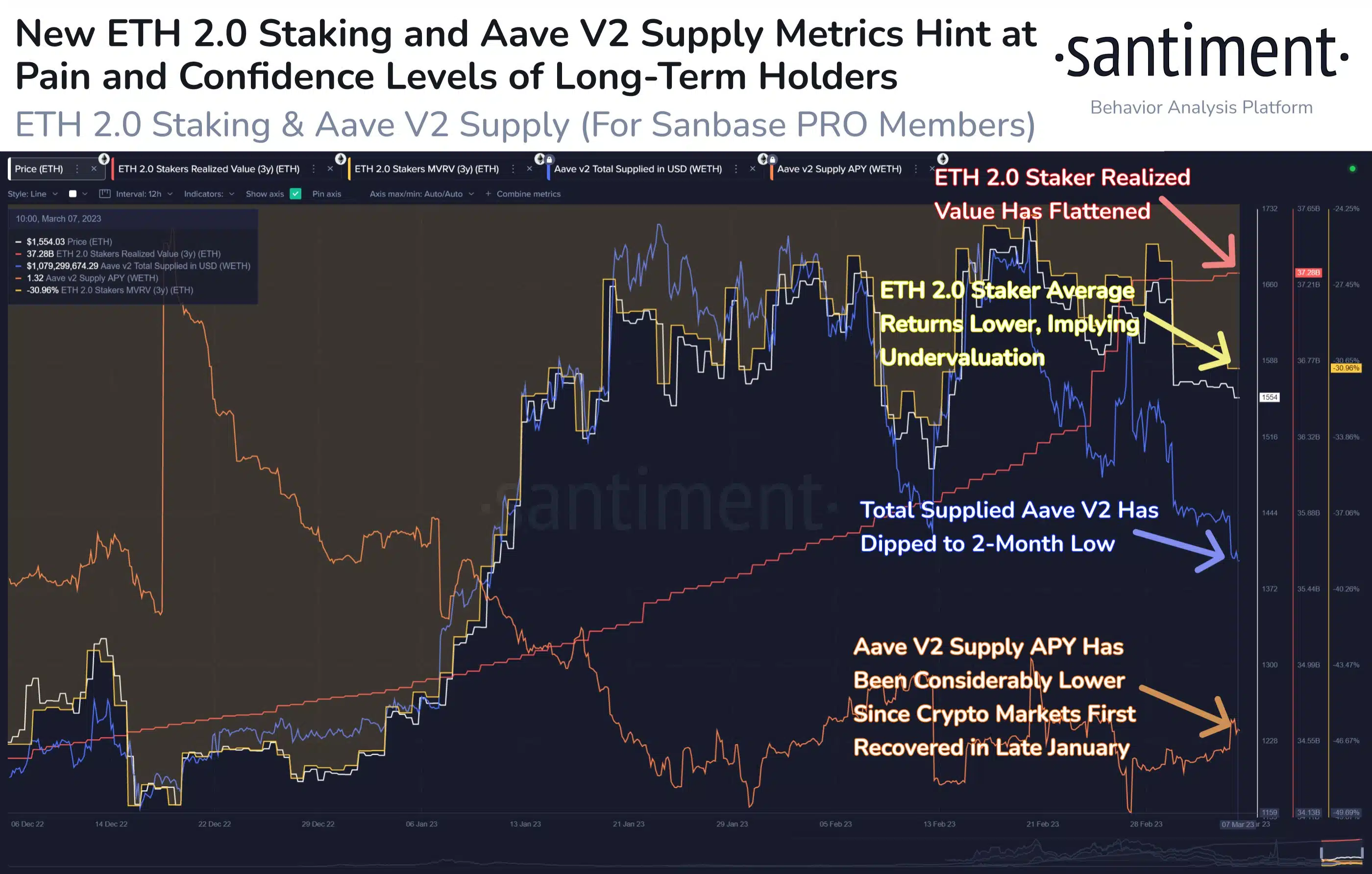

According to Santiment, holdings of Ethereum‘s long-term stakers have fallen by 31% over the last 10 weeks. In fact, the data suggests that most of the assets of these stakers are currently undervalued.

Read Ethereum’s Price Prediction 2023-2024

This can be underlined by the declining realized value of ETH 2.o stakers. Despite having low returns, stakers have continued to show interest in ETH.

Data from Staking Rewards indicated that the number of stakers on the Ethereum network have continued to rise. Over the past month, the number of stakers on the network increased by 6.14%. At press time, there were 544,248 addresses staking ETH.

Not only stakers, but retail investors also demonstrated their interest in Ethereum. According to Glassnode’s data, the number of addresses holding more than 0.01 coins rose materially over the past few months.

As staker and retail interest begins to rise and the Shanghai Upgrade inches closer, many traders are starting to place bets on Ethereum’s future. The same was evidenced by rising Open Interest in Ethereum on BitMEX, with the same hitting a 4-month high of $76,153,778.12 at the time of writing.

? #Ethereum $ETH Number of Addresses Holding 0.01+ Coins just reached a 7-month high of 23,190,382

View metric:https://t.co/XXb0u19Wkf pic.twitter.com/L666tWOSCq

— glassnode alerts (@glassnodealerts) March 7, 2023

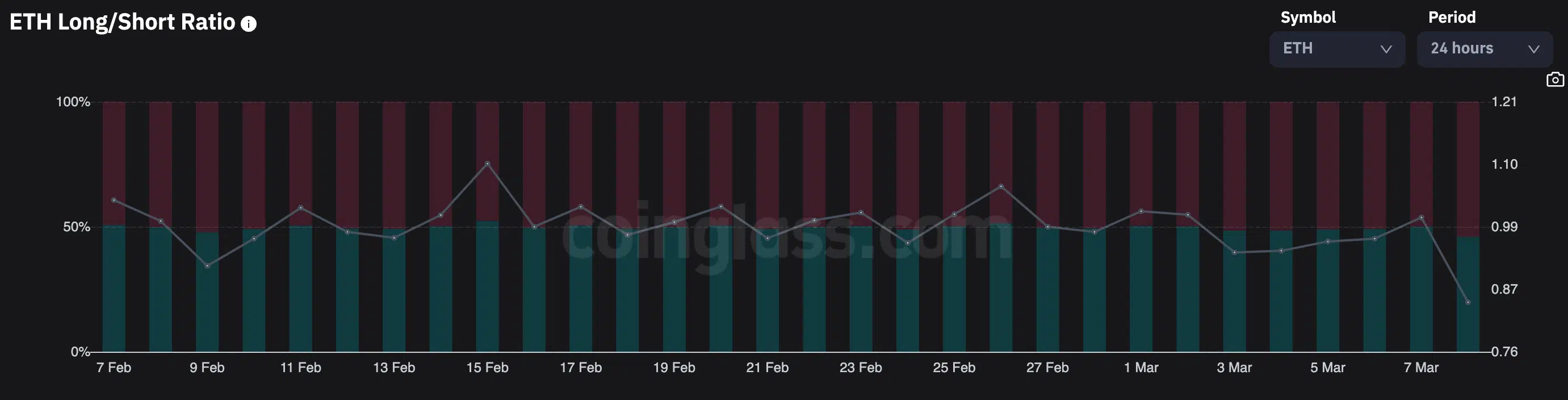

However, traders’ sentiment against Ethereum has started to turn bearish.

According to Coinglass, for instance, the number of short positions against Ethereum grew significantly over the last few weeks. At press time, 54.08% of all positions taken against Ethereum were short in nature.

Bears v. Whales

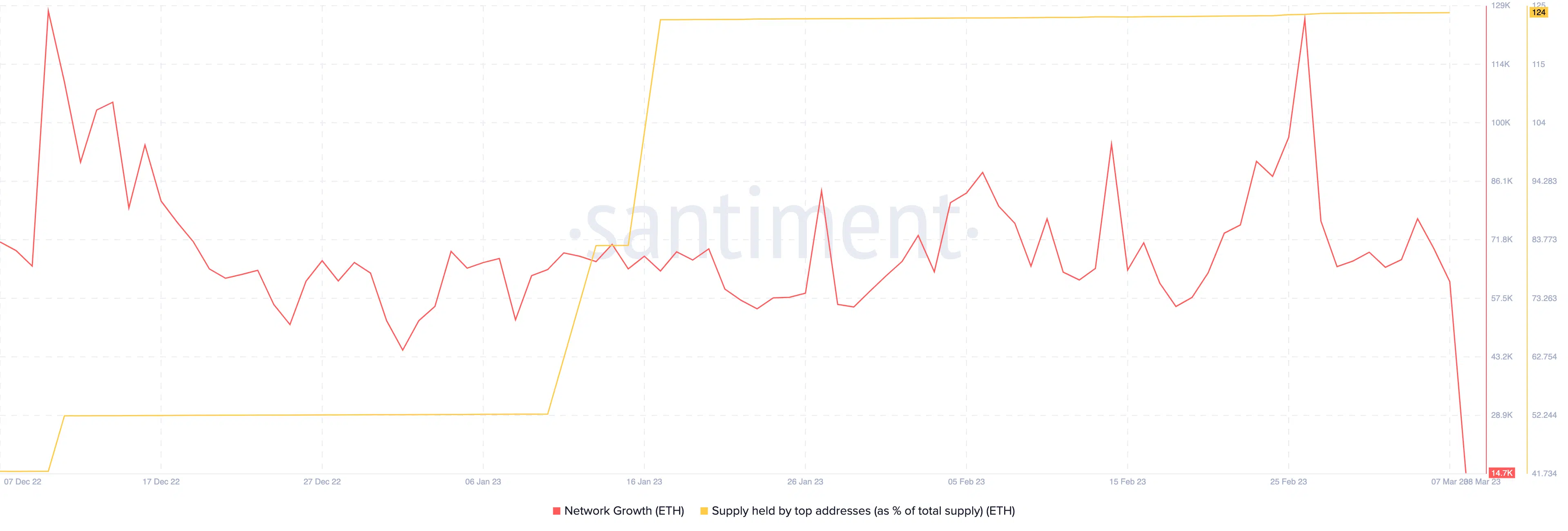

This bearish sentiment from traders, however, has not deterred whales from investing in Ethereum.

For instance, over the last 3 months, the percentage of addresses holding ETH has increased. Even though high interest from whales may benefit Ethereum holders in the short term, a sell-off by these whales could make retail investors more vulnerable to price fluctuations in the long run.

Realistic or not, here’s ETH market cap in BTC’s terms

New addresses, however, did not share the same enthusiasm as whales when it came to ETH. This was indicated by the declining network growth, which implied that the number of times new addresses were sending ETH for the first time fell.

With multiple moving factors at play, only time will tell how things play out for Ethereum in the future.