Are memecoins behind Ethereum’s [ETH] increased network activity? The data suggests…

![Are memecoins behind Ethereum's [ETH] increased network activity? The data suggests...](https://ambcrypto.com/wp-content/uploads/2023/05/Ethereum-1-1.jpg.webp)

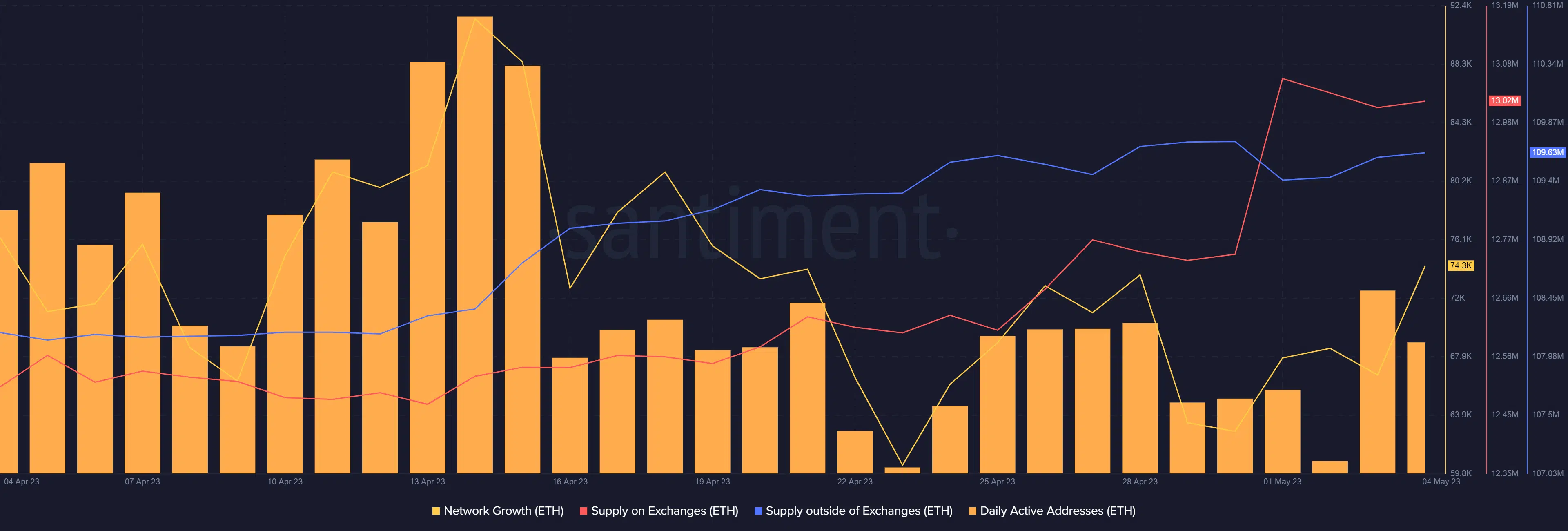

- The daily active addresses on Ethereum hit a 2-week high on 3 May.

- Since the start of May, trades worth $4.77 billion have been settled on Ethereum-based DEXs

The Ethereum [ETH] network started May on a powerful note by registering a sharp increase in its network activity. According to a Dune Analytics researcher, the median transaction fees on the largest proof-of-stake (PoS) blockchain surged to its highest point since May 2022, a reflection of growing demand for Ethereum’s ecosystem.

Is your portfolio green? Check out the Ethereum Profit Calculator

However, the researcher pointed out that most of the demand was coming from the recent memecoin frenzy which saw newbie Pepe [PEPE] being traded extensively on the chain.

Last time Ethereum median gas was this high was in May 2022 ⛽️

source: https://t.co/bjIOV2m4Cd pic.twitter.com/H2sqHAtvaZ

— hildobby (@hildobby_) May 4, 2023

PEPE drives on-chain activity

PEPE, which made its debut in April 2023, has taken the memecoin space by storm in a short span. For context, the frog-themed token exploded more than 600% in value over the last week, data from CoinMarketCap revealed.

Over the last 24 hours, the coin’s transaction volume has more than tripled. Around 36% of the total transactions were settled on decentralized exchanges (DEXs), out of which the ones on the Ethereum chain have taken the cake.

Since the start of May, trades worth $4.77 billion were settled on large Ethereum-based DEXs including Uniswap [UNI], per data from DeFiLlama.

Moreover, the memecoin craze has considerably boosted network traffic on the Ethereum network. As per data from Santiment, the daily active addresses hit a 2-week high on 3 May.

A large chunk of these were new addresses. This was evidenced by the impressive network growth exhibited over the last few days.

ETH in demand?

At the time of writing, ETH exchanged hands at $1,897.69, recording a 24-hour drop of 0.18%, per CoinMarketCap data.

Since the beginning of May, ETH supply on exchanges started to decline while that outside of exchange wallets started to increase. This signaled that investors started to position themselves bullishly.

Realistic or not, here’s ETH’s market cap in BTC’s terms

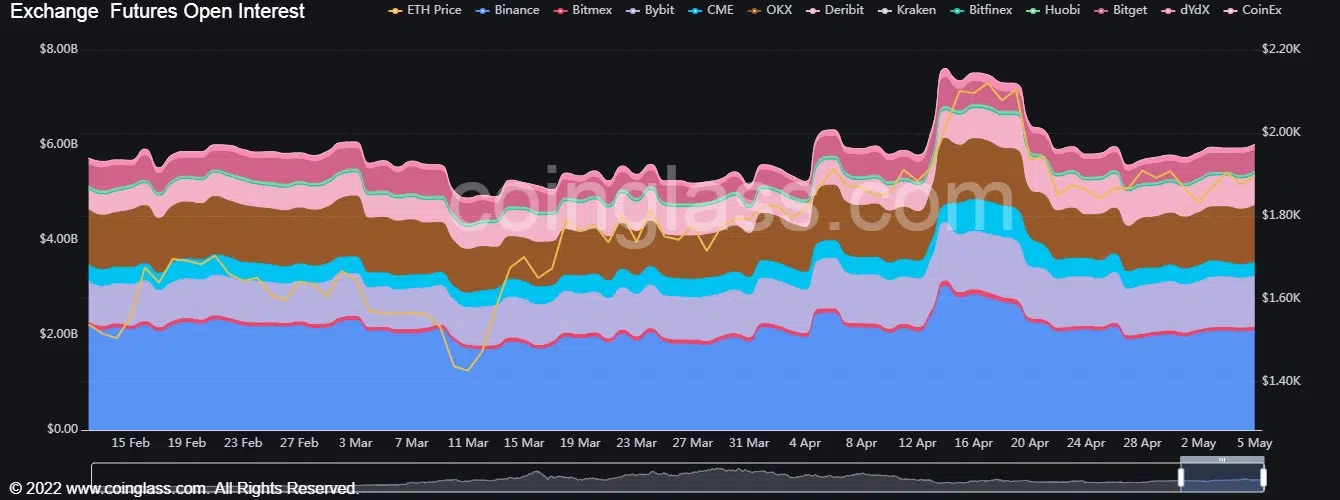

On the futures market, ETH witnessed renewed demand as the Open Interest (OI) rose by nearly 4% since the beginning of May. ETH’s OI went past $6 billion at press time, data from Coinglass showed.

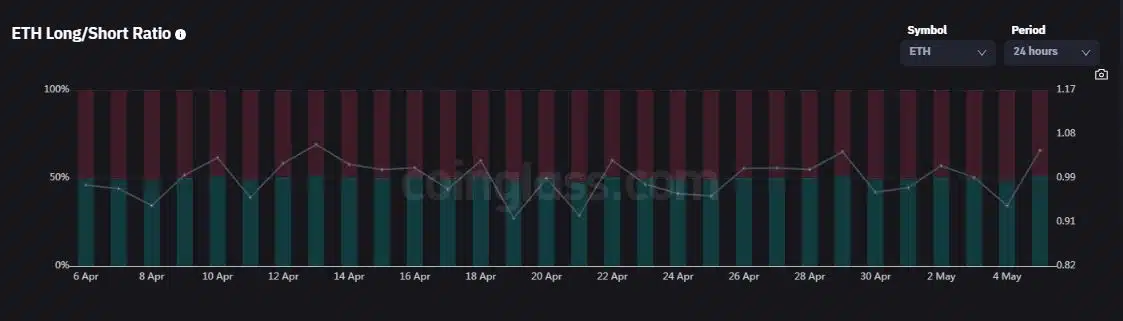

Most of the new trading positions for ETH were positioned for price gains as evidenced by a sharp increase in the Longs/Shorts Ratio over the last 24 hours.