Argentina’s crypto crackdown gathers pace after FATF’s pressure

- Argentina has intensified its scrutiny of the local crypto sector

- Crackdown a product of the international pressure on Argentina to curb money laundering

Argentina has recently intensified its crackdown on its local crypto sector, warning investors to declare their Bitcoin [BTC], other crypto holdings, or face penalties.

However, pressure on the country’s crypto sector can be linked to a foreign, global hand – The Financial Action Task Force (FATF).

FATF is an intergovernmental agency within the G7 whose mandate is to reign in money laundering and terrorism financing. It does so with the help of other players like the World Bank and the IMF (International Money Fund).

Argentina’s crypto woes

Argentina has a burgeoning crypto sector, with over $85 billion transacted in 2023. There is good reason behind the sector’s exponential growth though, with the same precipitated by an unprecedented inflation rate.

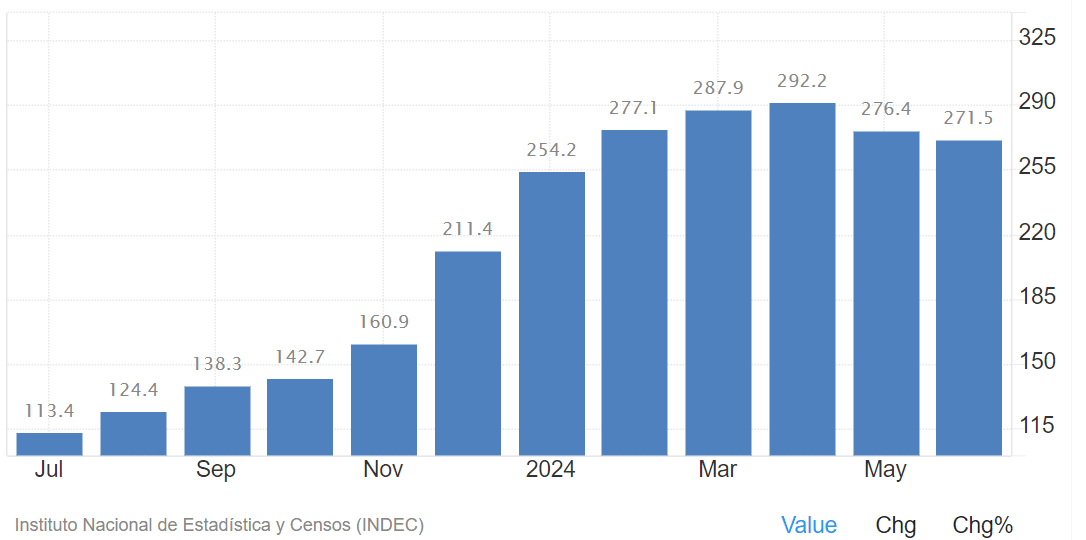

In fact, according to Trading Economics, Argentina’s inflation rate has remained in triple digits, despite it easing somewhat in recent months. The South American country’s inflation peaked at 292% in April, but dropped to 271% in June 2024.

Argentinian citizens, like those in countries like Turkey, have opted for cryptocurrencies, especially stablecoins, to hedge against inflation.

However, the sector has also been marred by allegations of tax evasion and money laundering claims. This has prompted the government to reign in the sector, demanding crypto investors to declare holdings or face penalties.

New crypto approach to avoid FATF’s greylisting

On Wednesday, the government reportedly signed a fiscal package that would extend tax relief to investors who declare $100,000, including registered crypto assets.

Reacting to the tax amnesty, Roberto Silva, President of the National Securities Commission, noted,

“The tax amnesty could ease pressure from the FATF to regulate Argentina’s crypto market.”

The FATF had reportedly threatened to grey-list Argentina if the government failed to regulate its crypto market. Such a move could reduce foreign direct investment and dent the standing of the country before global financial institutions like the IMF.

According to Silva, the government is now focused on amending everything to improve money laundering and reporting entities.

One such step is registering every cryptocurrency provider and even users at the National Securities Commission.

Only Lemon Cash, one of the largest crypto exchanges in the country, has updated its systems to help users voluntarily register assets so far. It remains to be seen whether others will follow suit.