As ARB and OP see red, should you sell or buy?

- ARB and OP underwent price corrections, accompanied by declining trading volumes.

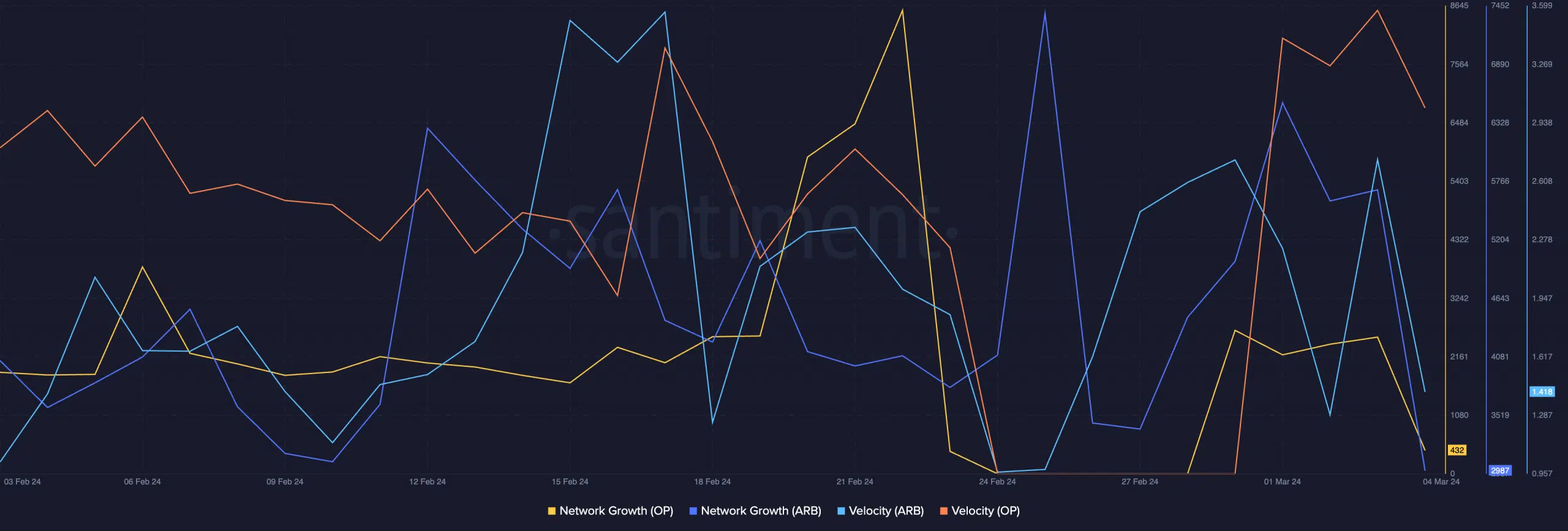

- Network Growth indicated waning interest from new users.

Arbitrum [ARB] and Optimism [OP], two of the most prominent networks in the Layer 2 sector, struggled to see similar growth in terms of price compared to the rest of the crypto sector.

Unable to see green

As ARB and OP hovered at $2.02 and $3.95, respectively, both experienced a significant decline in trading volume as well — 42% for ARB and 28% for OP.

The potential for a reduction in price movement deepens while looking at the Network Growth for these tokens, revealing a dip that signified a potential lack of interest from new users.

This decline in Network Growth can cast shadows on the short-term prospects of both ARB and OP.

Velocity, a key metric indicating the frequency of token movements, presented a divergent tale. While ARB witnessed a decline in velocity, OP saw an increase.

Activity slows down

In terms of the overall health of both these ecosystems, it appeared that both these networks were having a difficult time.

A comparison of the networks’ overall activity levels revealed a mixed bag. Both ARB and OP experienced a drop in daily active addresses and daily transactions.

However, Arbitrum managed to maintain relatively higher activity compared to Optimism.

The dwindling numbers in these fundamental metrics raised questions about the current engagement and utility of these Layer 2 networks.

The state of the networks in terms of decentralized finance (DeFi) and Total Value Locked (TVL) was both positive and negative at press time.

Despite the recent correction, both Arbitrum and Optimism witnessed a surge in TVL, showcasing continued interest from existing users.

However, the decline in daily activity and new addresses might signal caution for the sustained growth of these networks.

Realistic or not, here’s ARB’s market cap in BTC’s terms

Understanding the pivotal role that TVL and activity play in the Layer 2 sector is crucial. A decline in TVL could impact the overall health of the network and potentially lead to a loss of investor confidence.

Similarly, reduced activity may hint at challenges in attracting and retaining users, essential for the long-term success of these Layer 2 solutions.