As Bitcoin [BTC] emerges victorious amidst banking crisis, will it reclaim $30k

![As Bitcoin [BTC] emerges victorious amidst banking crisis, will it reclaim $30k](https://ambcrypto.com/wp-content/uploads/2023/04/Bitcoin.jpg.webp)

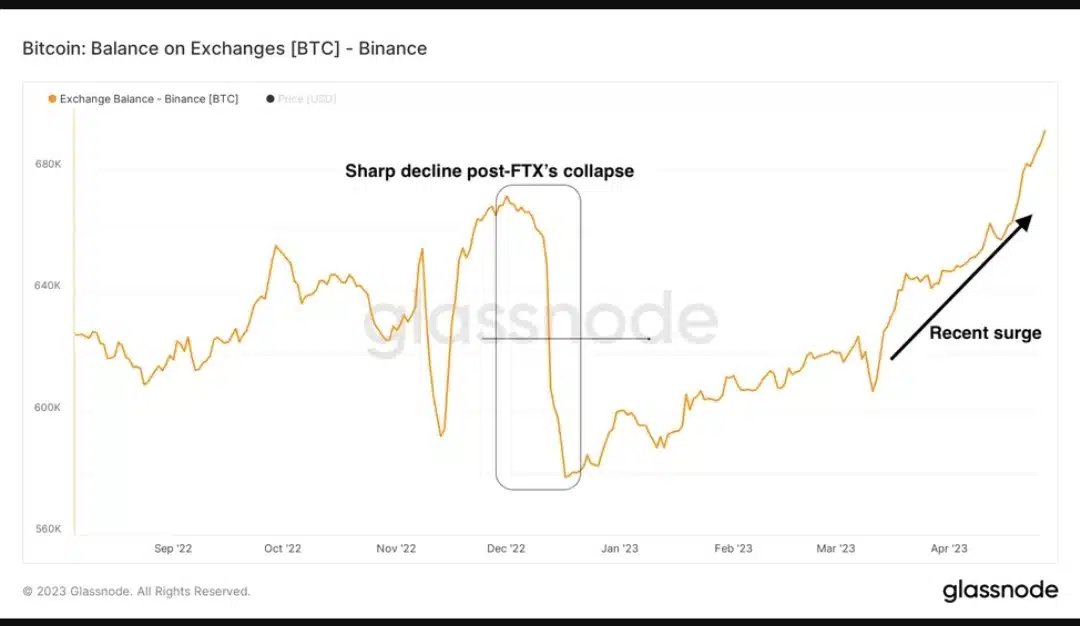

- There was a sharp uptick in BTC’s balance on Binance exchange.

- Over the last week, the king coin recorded gains of 7.34% although it struggled to break through $30,000.

Bitcoin [BTC]’s network activity exploded since the start of 2o23 as it recovered from the depths of 2022 bear market. As per a research analyst, the number of daily transactions on the network was poised to reach its highest level since the bull market of December 2017. A big factor fueling this exponential growth was the growing activity around BTC Ordinals.

The number of daily Bitcoin transactions is on track to reach its highest level since December 2017

Daily $BTC transactions have nearly doubled since the launch of Bitcoin Ordinals in January 2023 pic.twitter.com/FBZIrhdnQR

— Lucas (@LucasOutumuro) April 28, 2023

At the time of writing, BTC exchanged hands at $29,342, with a marginal 24-hour drop of 0.28% per CoinMarketCap. Over the last week, the king coin recorded gains of 7.34%, although it struggled to break through $30,000.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Growing interest in the crypto market

Blockchain analytics firm Glassnode revealed a sharp uptick in BTC’s balance on Binance exchange over the previous month. Of many things, this behavior implied a growing appetite for risk-based assets in the market.

The spate of banking collapses in March led investors to put their funds in the crypto market and see BTC as a hedge against traditional finance. The king coin soared 21% during March, hitting the $28,000 mark for the first time since June 2022.

As another high-profile banking entity, First Republic Bank, stares at a downfall, the crypto market in general and BTC in particular would be hoping to attract disgruntled investors from traditional markets.

BTC’s exchange supply

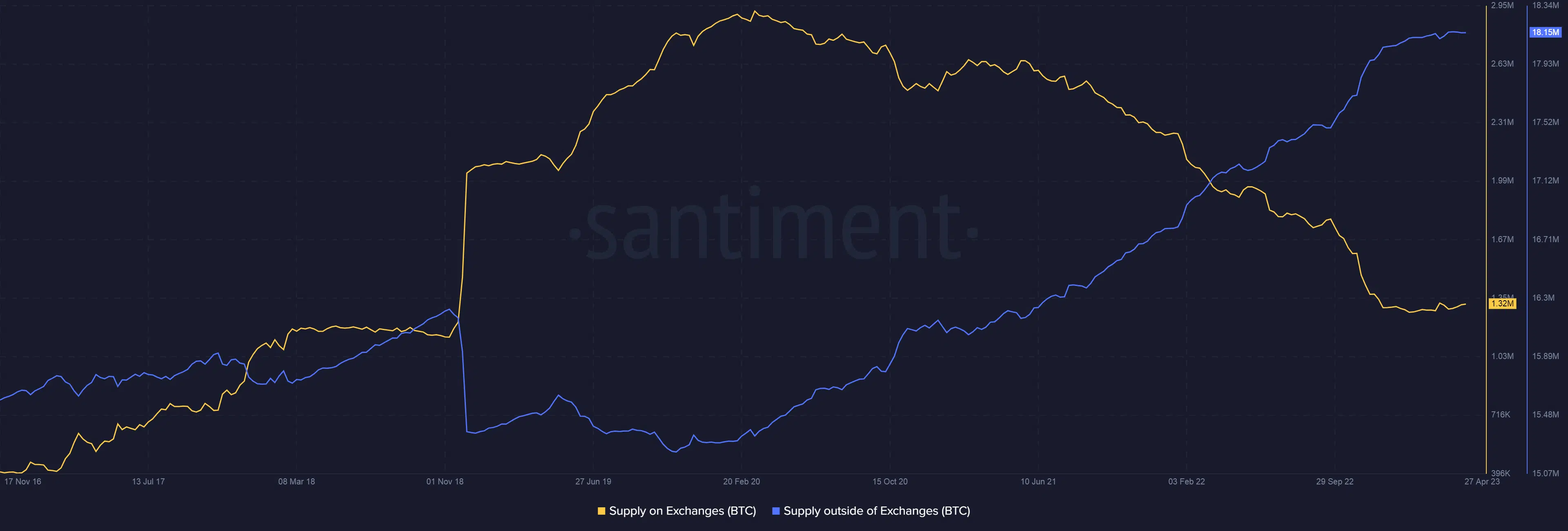

The spike in balance held on Binance was not a worrying sign yet as there was a noticeable divergence between BTC’s supply on exchanges and outside of it. This indicated that investors preferred hodling their coins instead of dumping it.

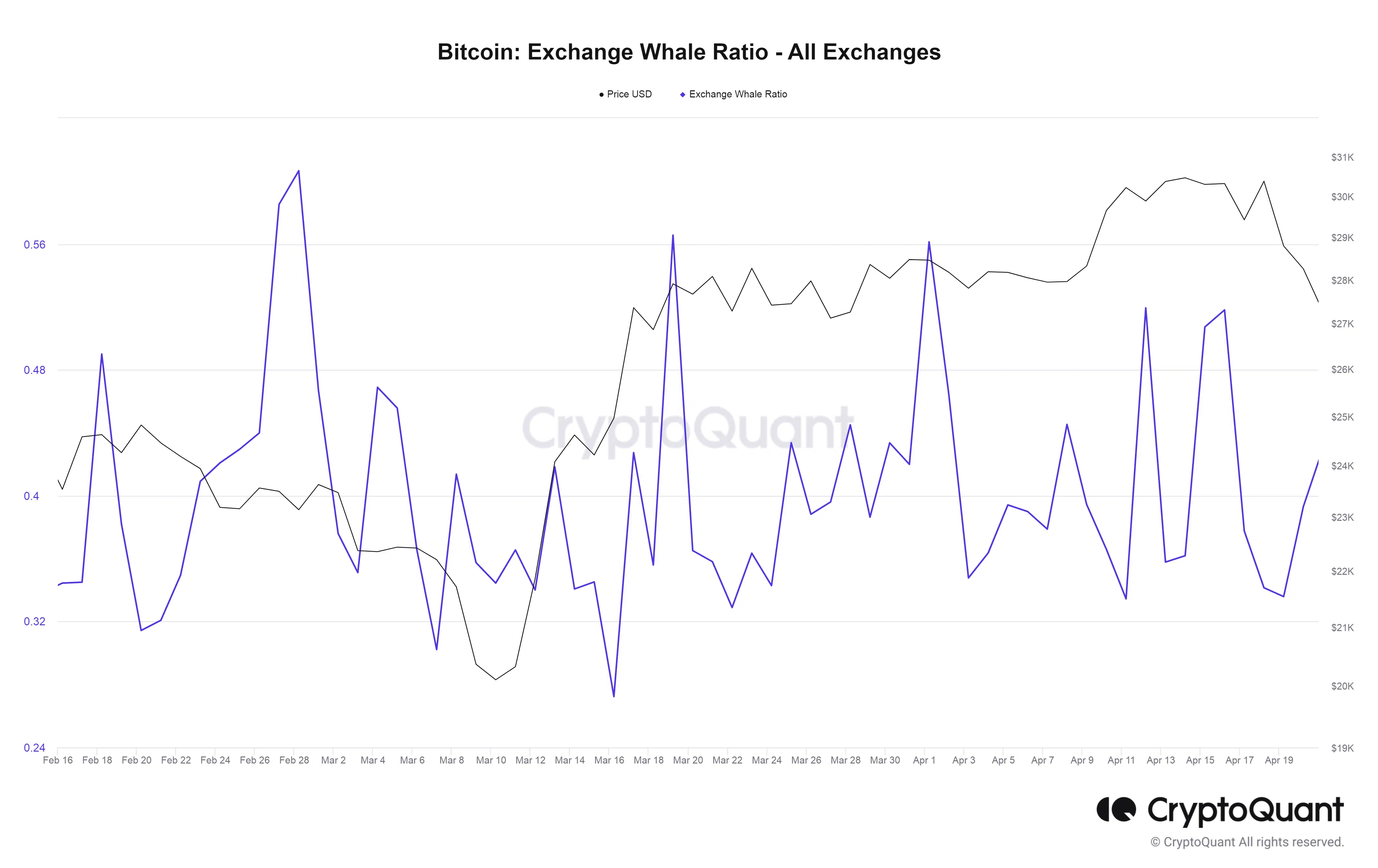

The exchange Whale Ratio is the relative size of the top 10 inflow transactions to total inflows, according to CryptoQuant. During the bull market, it typically keeps below 85%.

At the time of writing, 39% of the total inflows came from large addresses, reflecting a bullish sentiment for BTC.

How much are 1,10,100 BTCs worth today?

BTC in derivatives market

Speculative interest for BTC increased as the Open Interest (OI) for BTC futures increased 8% to $11.81 billion over the last two days.

However, funding rates across some exchanges turned negative, implying growing dominance for bearish leveraged traders.