As building on Base gets “blocked,” what’s next for the L2?

- Coinbase’s Layer-2 solution, Base, experienced a brief block production halt.

- Despite the disruption, Base has shown resilience in terms of activity and DeFi performance, while Coinbase expanded its services.

Coinbase’s [COIN] Layer-2 (L2) solution, Base, which garnered significant attention post-launch, experienced a brief interruption in block production, raising questions about its future growth.

A minor bump in the road

During this incident, Base temporarily ceased creating blocks for approximately 45 minutes, causing concerns among users. However, the Base team acted swiftly, identifying and deploying a fix, and ultimately restoring block production.

As of the latest update, network operations and RPC API have returned to their normal state.

While this disruption was resolved, it prompted discussions about the potential impact of such incidents on the protocol’s stability in the future. Maintaining seamless block production is crucial for the protocol’s reliability and user trust.

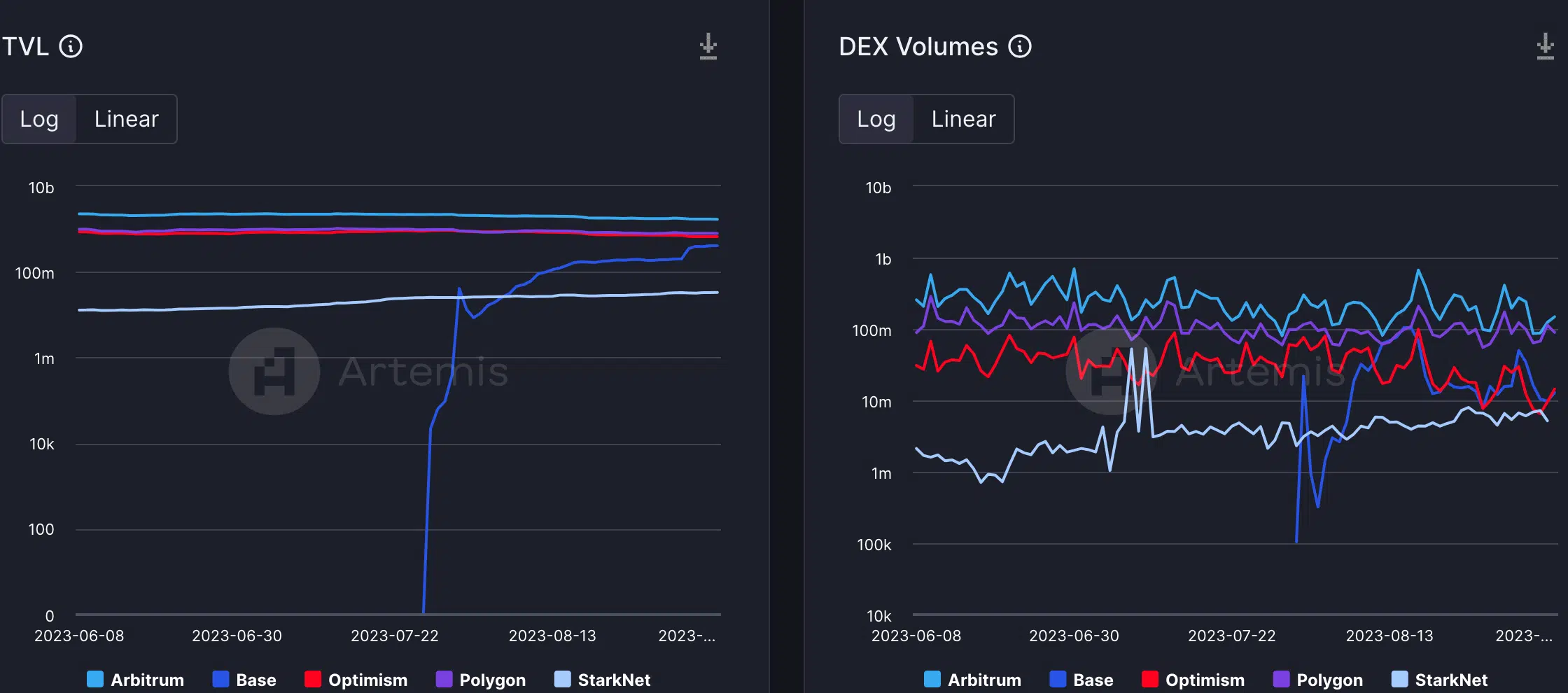

Despite the hiccup in block production, Base’s overall activity and transaction volume showed resilience in comparison to other Layer-2 solutions.

According to Artemis data, the protocol’s activity continued to exhibit steady growth over the past few months, positioning it favorably among its Layer-2 counterparts.

In the realm of decentralized finance (DeFi), Base demonstrated noteworthy performance, outpacing competing protocols in total value locked (TVL) and decentralized exchange (DEX) volumes.

In terms of TVL, Base surpassed Starknet, while also eclipsing Starknet and Optimism in DEX trading volumes.

A significant contributor to Base’s growth was the launch of friends.tech, a social platform built on its network. This platform rapidly gained traction, with TVL reaching an all-time high at the time of writing.

The addition of friends.tech has strengthened Base’s ecosystem and furthered its appeal to users seeking a versatile and engaging experience.

New TVL ATH for https://t.co/FiDOu2o2IK ($7.4m)

src: https://t.co/v5uPA9QD0n pic.twitter.com/3siPm0bIaH

— hildobby (@hildobby_) September 5, 2023

How is Coinbase doing?

Meanwhile, Coinbase, the parent company of Base, was expanding its suite of services. In the United States, Coinbase introduced a cryptocurrency lending service tailored for institutional clients, addressing a gap left by the bankruptcies of companies like Genesis and BlockFi.

This move signifies Coinbase’s commitment to providing a comprehensive financial infrastructure for both retail and institutional users.

Additionally, Coinbase was actively repurchasing its debt at considerable discounts. The co-founders were acquiring substantial positions of shares, signaling their confidence in the company’s future prospects.

This behavior indicated that Coinbase founders were optimistic about the future of the company.

Coinbase buying back debt at a steep discount and co-founders repurchasing huge positions of shares, but markets still bearish?

TradFi doesn't understand crypto. pic.twitter.com/VCQb5kdd7r

— Ryan Selkis ? (@twobitidiot) September 5, 2023