As CEXes expand into self-custody, MetaMask leads the way

- MetaMask remains the biggest self-custodial crypto wallet service provider.

- Most of the top self-custody wallets were linked to centralized exchanges.

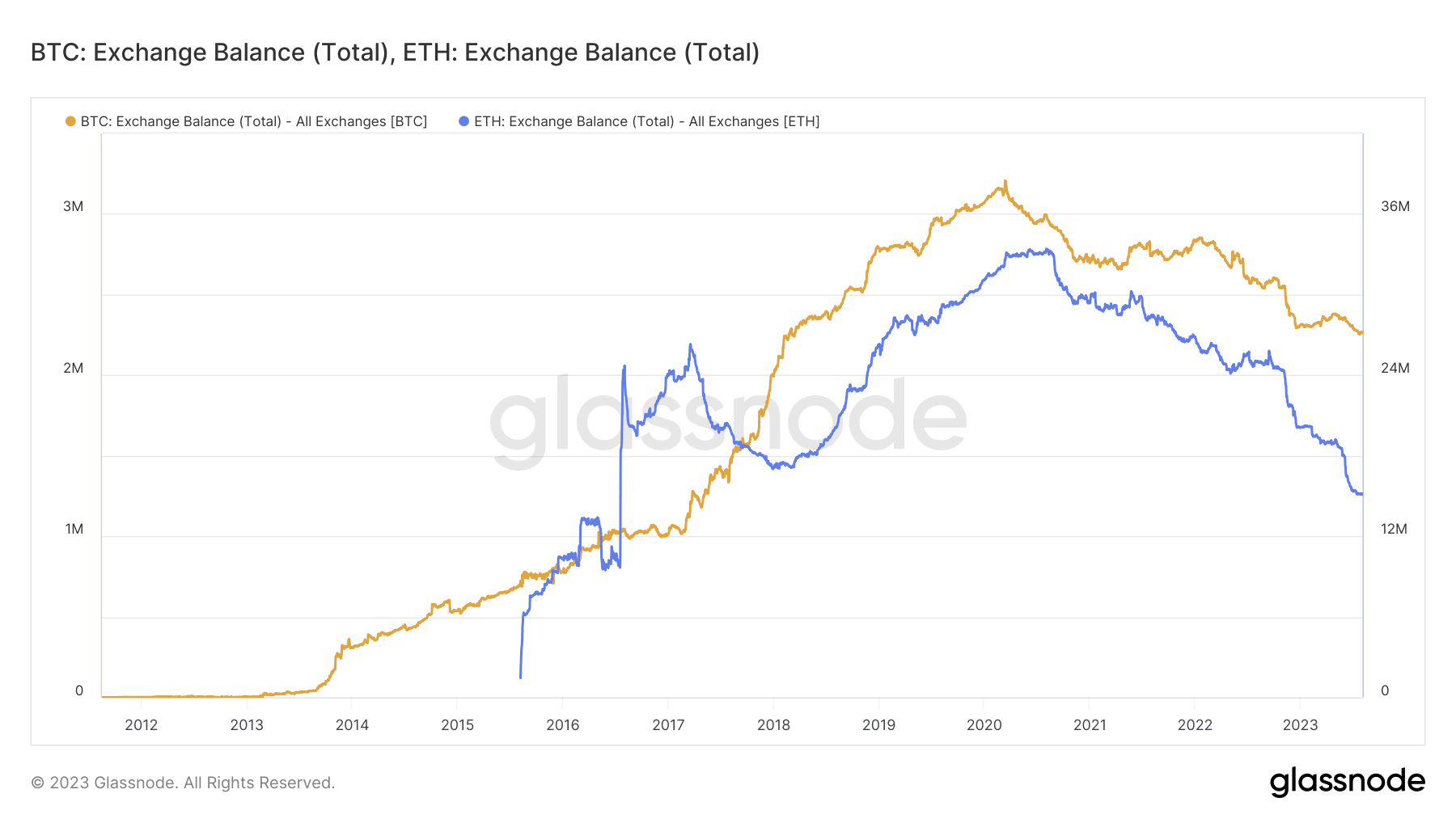

The liquid supply of top crypto assets like Bitcoin [BTC] and Ethereum [ETH] shrank to multi-year lows as evidenced by data from on-chain analytics firm Glassnode. While many experts attribute this to investors’ propensity to hoarding coins for long-term gains, diminishing trust in centralized exchanges has also played a significant role.

“Not your keys, not your coins”

The stunning collapse of FTX in November last year started a debate around the safety of third-party crypto custody. A large chunk of the users’ funds, including both institutional and individual investors, were stuck on the fallen exchange. The recovery process was still ongoing at the time of publication.

To make matters worse, regulatory actions against two of the biggest trading platforms in the realm, Binance [BNB] and Coinbase [COIN], have increased crypto holders’ skepticism.

Amidst this atmosphere of FUD, the narrative of self-custody has been steadily gathering a lot of steam. Recently, the U.S. House Financial Services Committee passed a landmark bill namely “Keep Your Coins Act of 2023″.

The legislation will protect crypto users’ right to maintain custody of their digital assets in self-hosted wallets.

It’s getting hot

Hot wallets remain the most popular way for crypto holders to store their funds. Consider it similar to any traditional digital wallet service that is internet-enabled and allows you to view your balances and transmit funds for transactions.

These wallets, however, also contain the private keys required to access and use the cryptos for the purposes mentioned above.

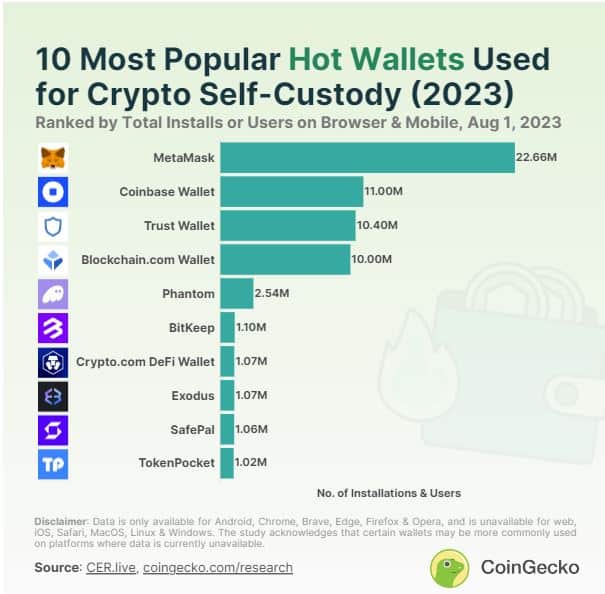

As per a recent report by crypto market tracker CoinGecko, as many as 54 crypto hot wallets were being used with total installations of 76.16 million as of 1 August. The number of wallets was expected to increase as more people took a plunge into the world of Web3, the report added.

Unsurprisingly, MetaMask remains the biggest self-custodial crypto wallet service provider, with over 22.66 million app installations. The fact that MetaMask’s user base exceeded the combined user bases of the second and third-ranked entities in the market demonstrated its dominance.

Created in 2016, MetaMask stores private keys, broadcasts transactions, and enables sending and receiving cryptos through a browser extension or a mobile app. However, it should be noted that the wallet can only support tokens that are on the Ethereum blockchain. As of this writing, the wallet doesn’t have a Bitcoin custody mechanism.

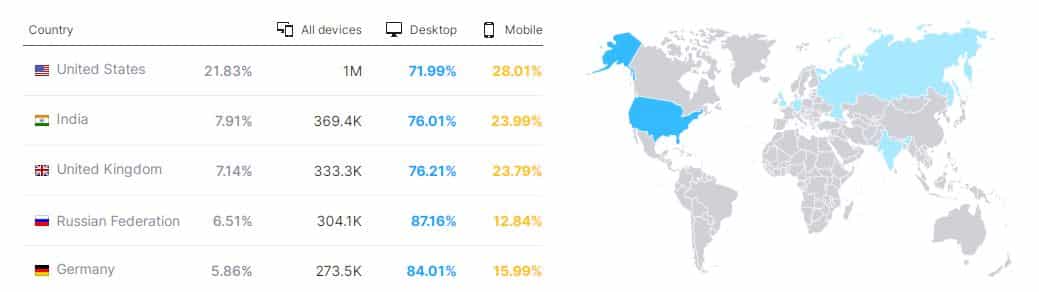

As of June 2023, the majority of visitors to the main MetaMask website came from the United States, followed by India and the United Kingdom, as per SEO analytics firm Semrush.

Exchanges tap into self-custody market

Ironic but interesting, the report revealed that five out of the 10 most popular wallets were linked to centralized exchanges. Coinbase Wallet, with about 11 million app installations and users, was the second largest self-custodial wallet. As the name suggests, the wallet was created by the parent company which is the largest crypto trading platform in the U.S.

Moreover, the third-ranked Trust wallet operated as the world’s largest exchange Binance’s official crypto wallet.

The increasing involvement implied that these centralized trading platforms have started to come to terms with the new reality. An earlier report by CoinGecko had revealed that an overwhelming 80% of crypto holders practiced self-custody. With full-fledged legislation in place, this number is bound to increase. Hence, it makes business sense for crypto exchanges to branch out into self-custody services.

Weaknesses can’t be ignored

Despite their demonstrated strengths, even hot wallets have disappointed in providing foolproof security. They are more vulnerable to security breaches and hacking attempts because they are connected to the internet.

Two weeks back, hackers drained over $31 million worth of crypto assets from hot wallets belonging to crypto payments service provider Alphapo. The stolen tokens included Bitcoin, Ethereum and TRON [TRX]. As per details, a leak of private keys led to the hacking incident.

However, as happens with most technologies, the loophole in one paves the way for another to emerge. Cold wallets, or hardware devices that store private keys offline, look to address the gap in hot wallets. However, only time will tell where they gain mainstream acceptance

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)