As interest in Bitcoin Ordinals rise, how will BTC be impacted

- Interest in Bitcoin ordinals grew as BTC’s price soared.

- Open Interest rose, despite growing Implied Volatility.

The recent rise in Bitcoin’s [BTC] price has inspired optimism amidst various sectors of the crypto market. But it wasn’t just Bitcoin that people were starting to get interested in. Recently, it was seen that members of the crypto community were showing an interest in Bitcoin Ordinals as well.

Is your portfolio green? Check out the BTC Profit Calculator

Out of the ordinary

Ordinal Inscriptions are digital assets on the smallest Bitcoin unit, a satoshi, much like NFTs.

They are named after Bitcoin’s creator, Satoshi Nakamoto.

These inscriptions hold unique and valuable information, and like NFTs, they’re gaining attention in the digital world.

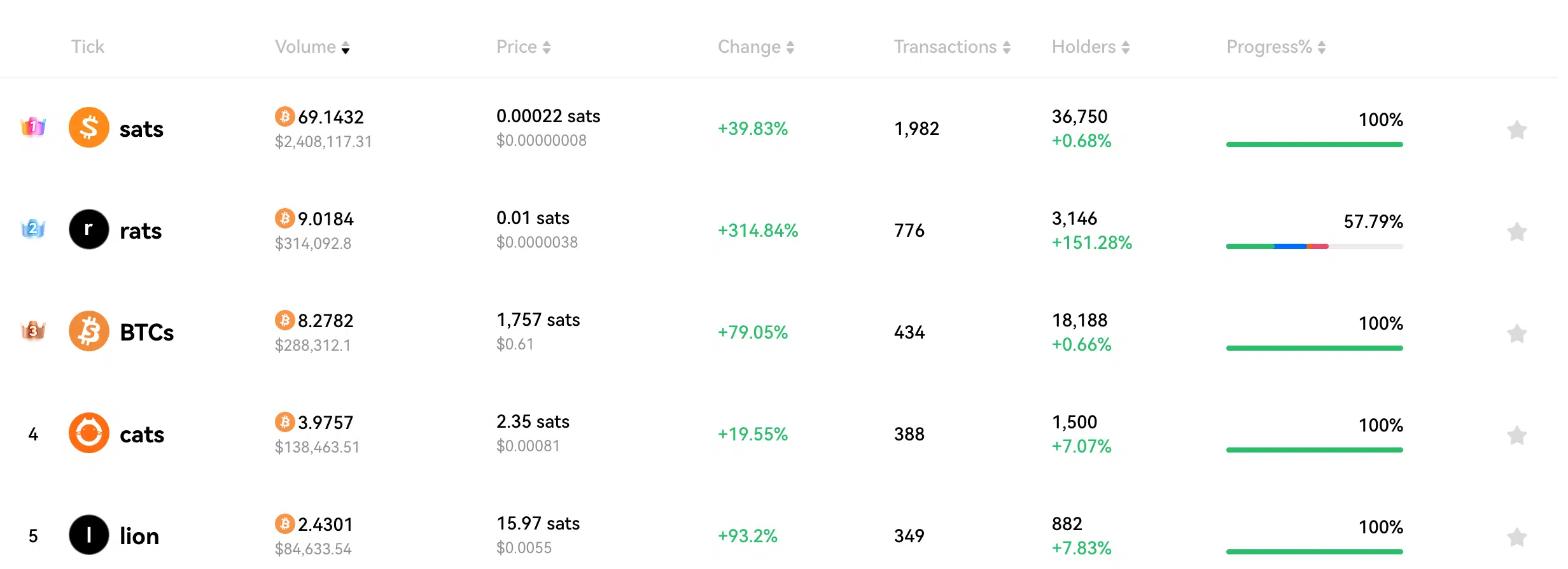

According to recent data, the Bitcoin Ordinals BRC-20 transactions were on the rise.

In the last week, sats collection went up by 124%, the “BTCs” collection surged by 30%, and “honk” grew by 300%, and “ordi” by 13%. Among them, “sats” held the top spot with a market cap of about $166 million, surpassing “ordi” with approximately $130 million.

A surge in interest in Bitcoin ordinals can benefit the Bitcoin network in terms of price in several ways. First, it adds more value to each satoshi, the smallest Bitcoin unit, which could lead to an overall increase in Bitcoin’s price.

How are traders doing?

As people see the potential value in these ordinals, they may become more interested in owning Bitcoin and engaging with its network, driving demand.

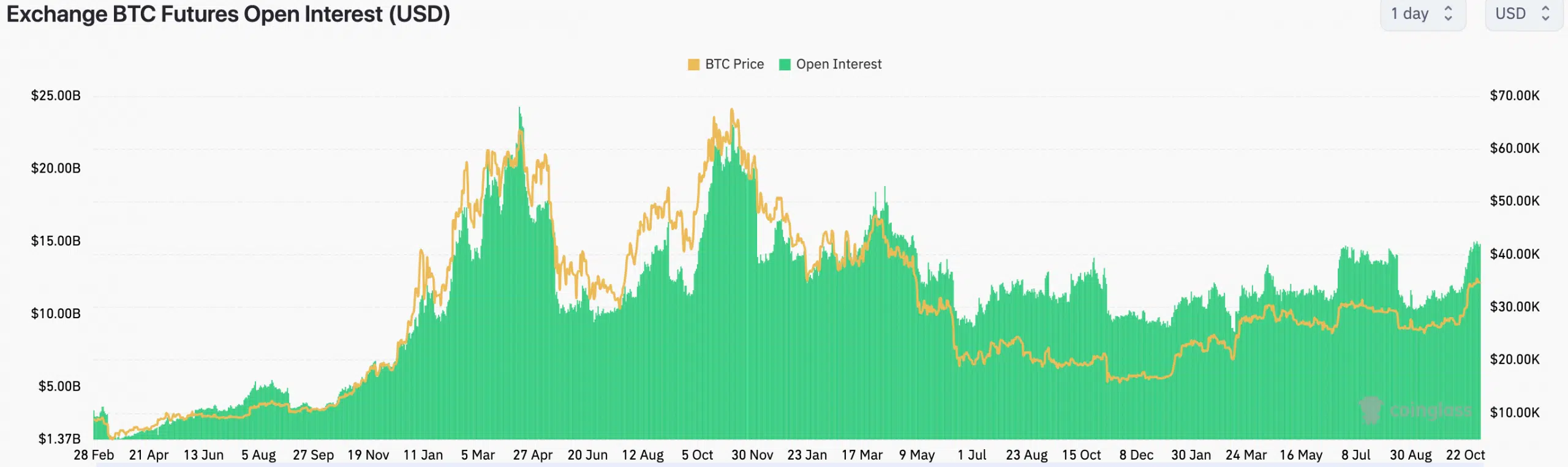

Apart from NFT enthusiasts, traders were also showing interest in BTC as well. According to Coinglass’ data, the open interest in Bitcoin surged significantly over the last few days.

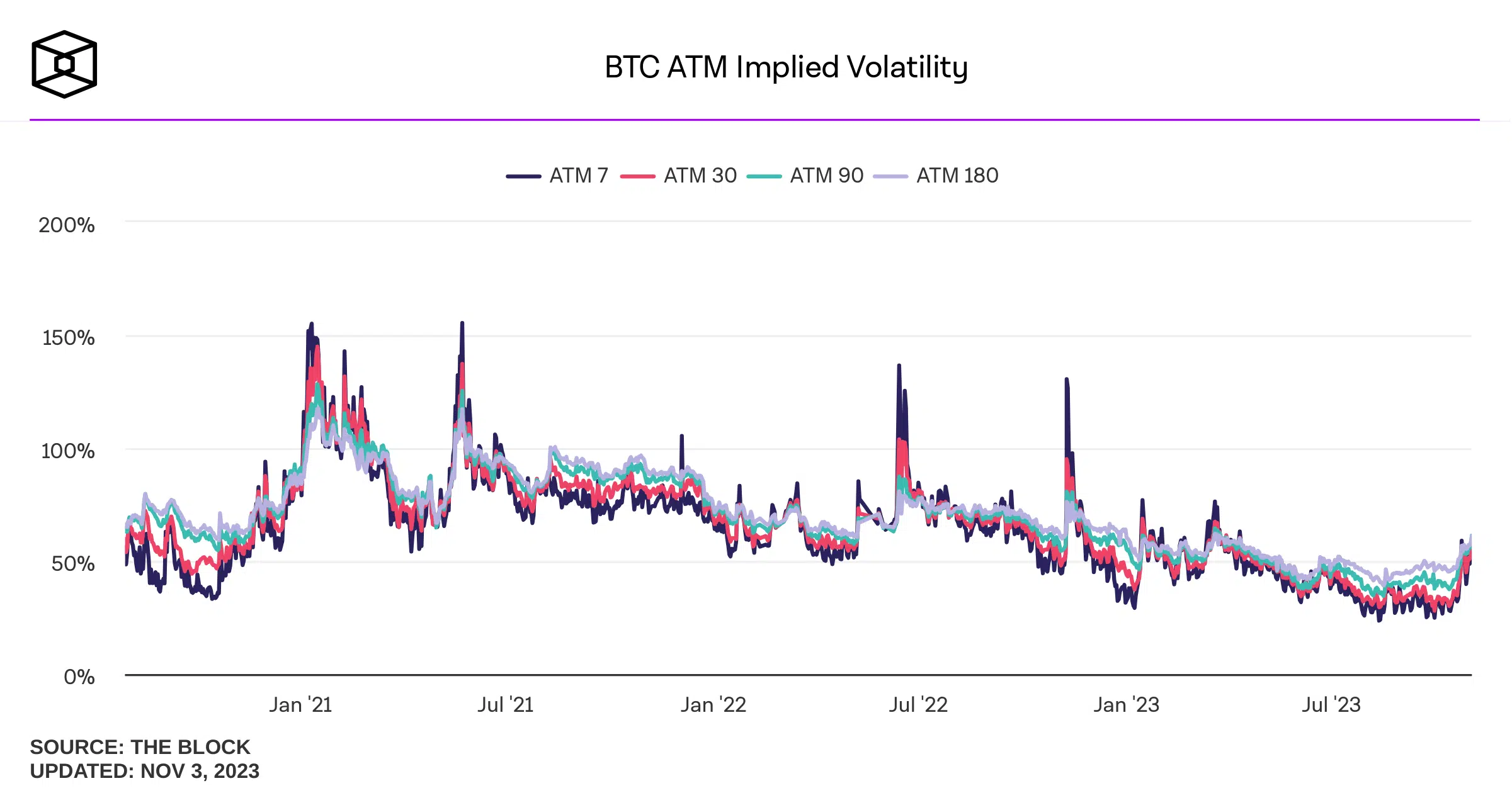

However, Implied Volatility (IV) around BTC also started to rise during this period.

When Implied Volatility (IV) increases, it affects how traders behave in several ways. Traders tend to become more risk-averse, as a higher IV indicates greater price uncertainty.

They might reduce their positions or avoid trading to protect their investments.

Some traders embrace volatility, while others use hedging strategies to mitigate risk. The overall market sentiment becomes less predictable, potentially leading to panic selling or buying.

In such times, traders closely follow market news to make informed decisions based on the changing dynamics. At press time BTC was trading at $34,237.54 and had grown by 1.45% in the last 24 hours.