As MakerDAO grows, will MKR’s price finally cross $3K?

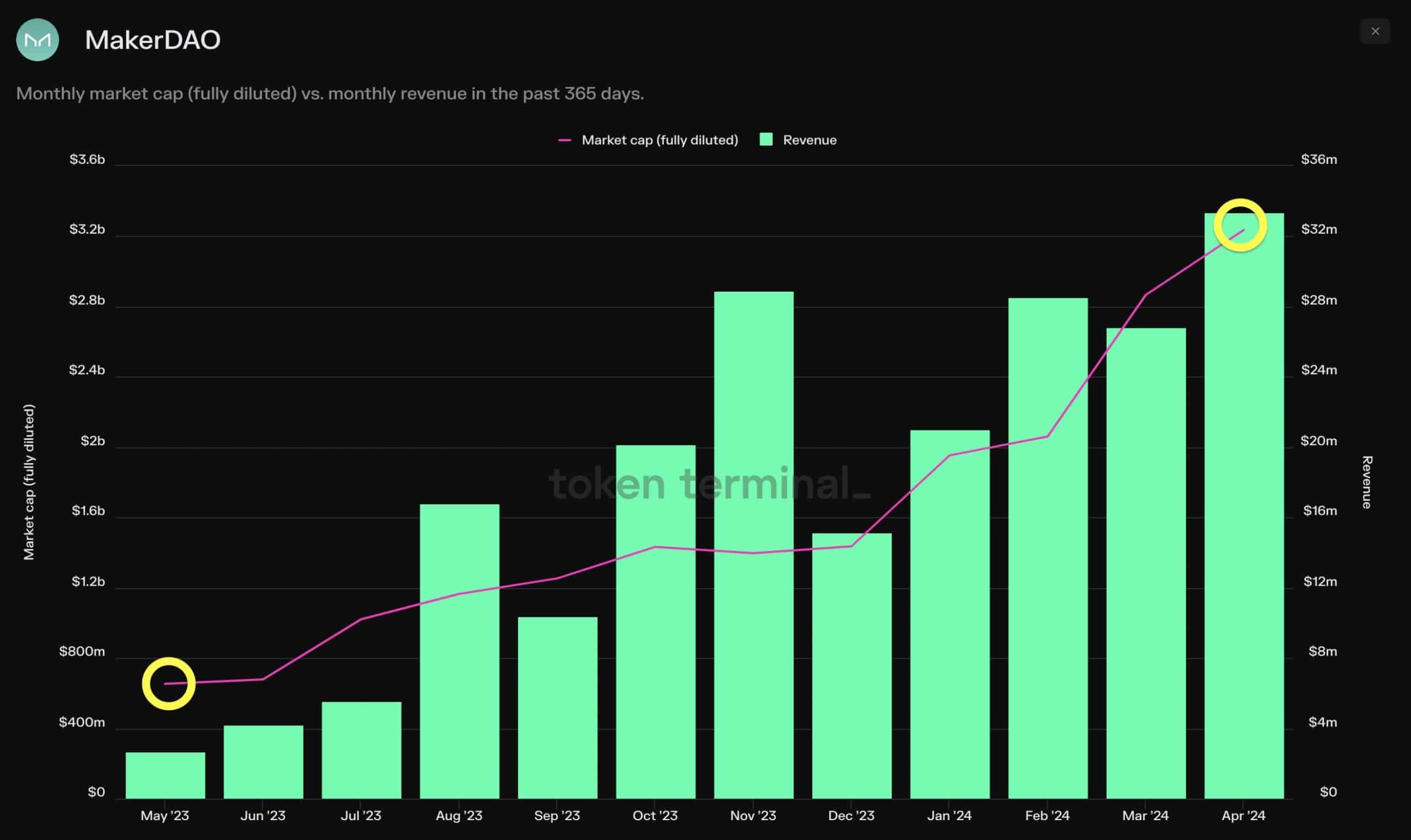

- MakerDAO’s market cap and revenue grew significantly over the past year.

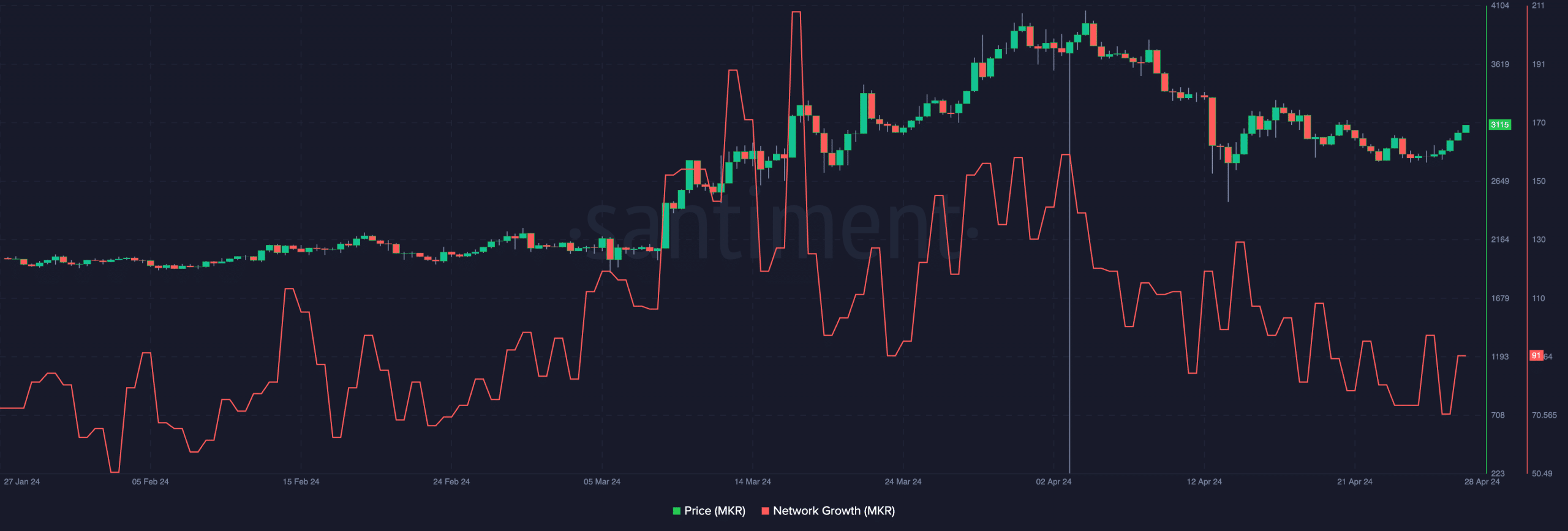

- Price of MKR surged, despite declining network growth.

Despite the uncertainty the crypto markets have faced over the last few months, MakerDAO [MKR] has been consistently performing well.

MakerDAO expands

According to recent data, MKR’s market cap is up five times in terms of year-on-year growth, while monthly revenues are up 10 times in terms of year-on-year growth.

MakerDAO’s dominance in the DeFi sector is a significant factor contributing to this trend. Maker, currently, accounts for nearly 40% of all DeFi profits on Ethereum [ETH].

Its strength lies in its stablecoin DAI, which boasts widespread adoption, deep liquidity, extensive integrations, and a proven track record.

In fact, Maker’s financial prowess is so substantial that it generates more fees than many Layer 1 and Layer 2 solutions.

Staking season

Historically, Maker has been criticized for its conservative approach. However, its ongoing Endgame rollout aims to change this perception by transforming Maker into a more scalable ecosystem of modular protocols.

In this cycle, Maker is poised to play a crucial role in the staking, restaking, and tokenized basis trading economies by offering on-chain financing options for users.

This presents a multi-billion dollar fee opportunity, positioning Maker to capture a significant portion of DeFi profits.

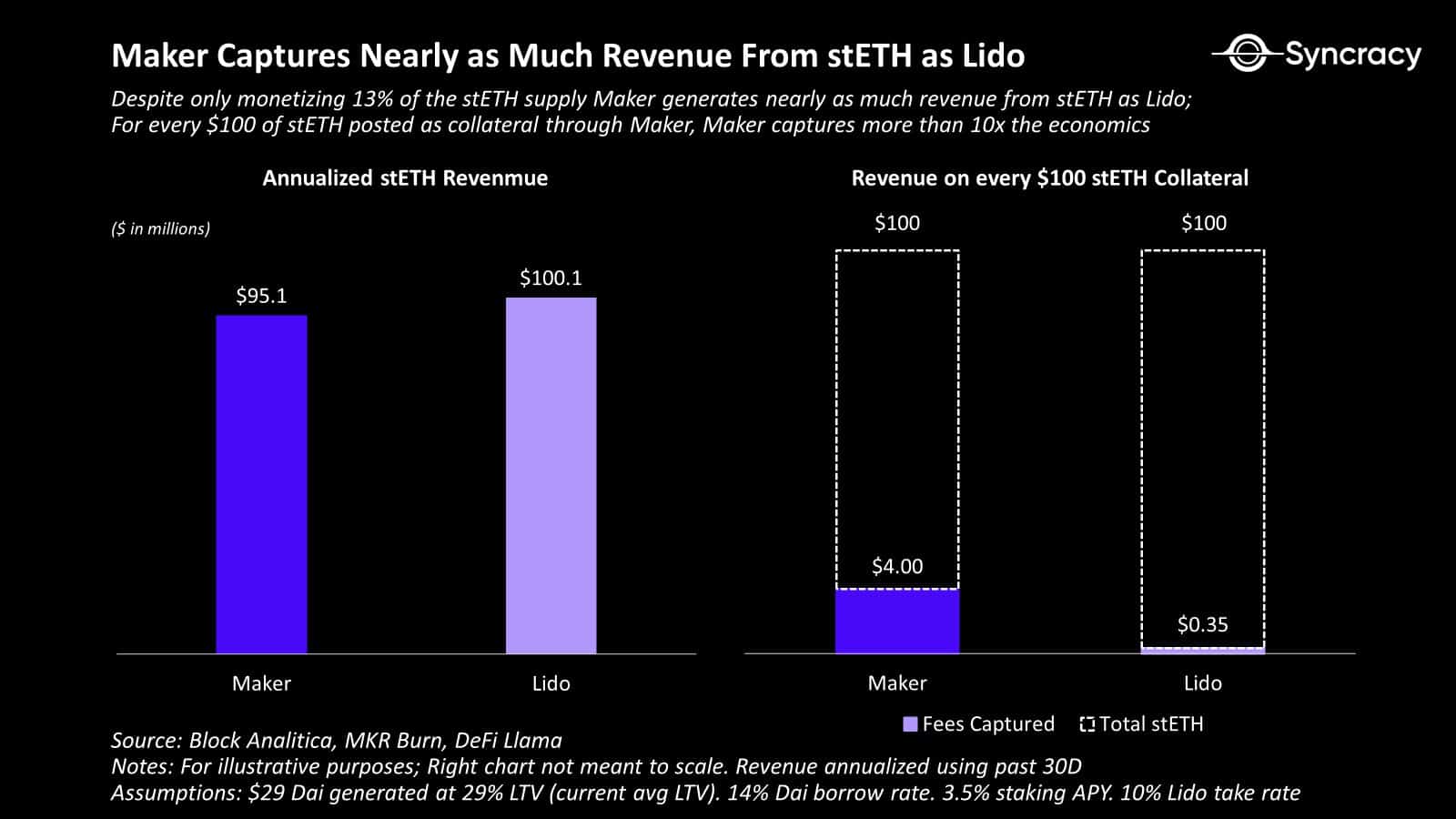

Already, Maker generates substantial revenue from lending against a fraction of the stETH supply, rivaling the income generated by Lido across the entire stETH supply.

The anticipated use cases for liquid restaking tokens and tokenized basis trading positions are expected to yield similar outcomes, further bolstering Maker’s financial position.

Realistic or not, here’s MKR’s market cap in BTC’s terms

At press time, MKR was trading at $2,706.20 and its price had grown by 4.28% in the last 24 hours. The volume at which it was trading at had surged by 20.16%.

In terms of network growth, there was a decline seen on the broader chart, indicating waning interest from new addresses.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)