As MakerDAO tops in revenue, is MKR now undervalued?

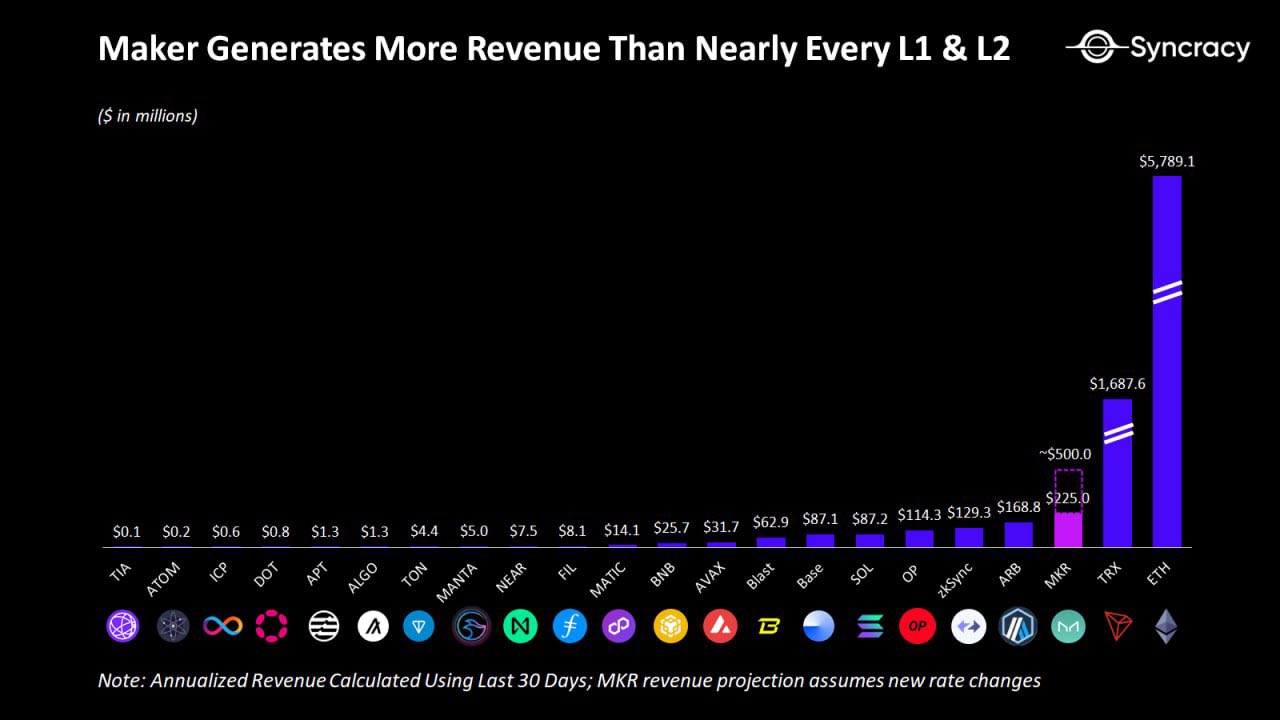

- MakerDAO generated massive amounts of revenue compared to other networks.

- The price of MKR grew, however, the velocity at which it was trading had declined.

The crypto sector’s recent rally has caught the attention of many investors who are mainly looking for blue chip cryptocurrencies and meme coins.

Underneath all the hype, it was seen that the MakerDAO [MKR] network had been successfully seeing growth for quite some time.

Revenues on the rise

According to recent data, the revenue generated by the MakerDAO network was greater than most Layer-1 and Layer-2 networks. This bodes well for MakerDAO on many fronts.

The heightened revenue indicated a growing user base and increased activity within the MakerDAO ecosystem. Moreover, it also showcased a rising interest in its decentralized finance (DeFi) offerings.

The surge in MakerDAO’s revenue can be attributed, in part, to the popularity of DAI, MakerDAO’s stablecoin.

DAI has been the stablecoin of choice for many holders who want to capitalize on the current bullish sentiment in the market.

Responding to high demand

In response to the large demand for DAI due to market conditions, an Accelerated Proposal was introduced for an Executive Vote to prepare for potential excessive demand for DAI caused by bullish sentiment.

The proposed changes in the MakerDAO protocol are aimed at ensuring that DAI, the stablecoin issued on the platform, remains stable at a value of $1.

The proposed changes include adjusting stability fees for various collateral assets, increasing SparkLend DAI Borrow Rate, making PSM adjustments, raising the Dai Savings Rate, and reducing the GSM Pause Delay.

By adjusting stability fees for different collateral assets and increasing the interest rate for borrowing DAI through SparkLend, MakerDAO intends to influence borrowing and lending behaviors within its ecosystem.

Additionally, adjustments to the Peg Stability Module (PSM) and Dai Savings Rate aim to enhance the efficiency of managing DAI’s availability and incentivize users to hold the stablecoin.

The reduction in the Governance Security Module (GSM) Pause Delay is meant to make the protocol more responsive to market conditions.

These measures are proactive steps to safeguard the Maker Protocol during temporary market fluctuations.

The changes are temporary, and once the market stabilizes, all procedures will return to their regular settings.

Another indicator of the growing interest in MakerDAO was the rising activity on the network. The activity on the MakerDAO protocol grew by 24.0% over the last month, according to AMBCrypto’s analysis of data.

How much are 1,10,100 MKRs worth today?

Taking a look at the price

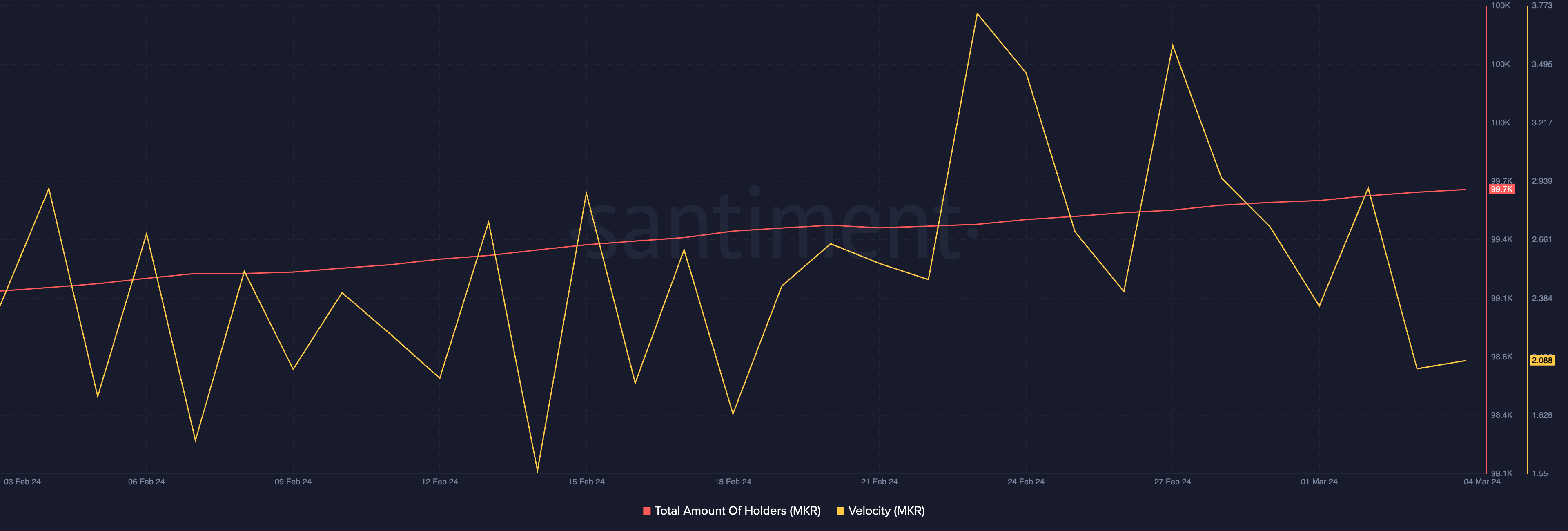

In terms of price, MKR was trading at $2,598.55. In the last 24 hours, the price of MKR had grown by 4.77%. The overall number of addresses that were holding MKR had also grown over the last few weeks.

However, the velocity at which MKR was trading had also declined during this period, indicating that the frequency at which MKR was trading had also fallen.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)