ASI merger begins: So why are AI tokens FET, AGIX, OCEAN plummeting today?

- The Artificial Superintelligence Alliance has announced the merger of FET, OCEAN and AGIX.

- The merger has resulted to market uncertainty and unpredictability, causes places to plummet.

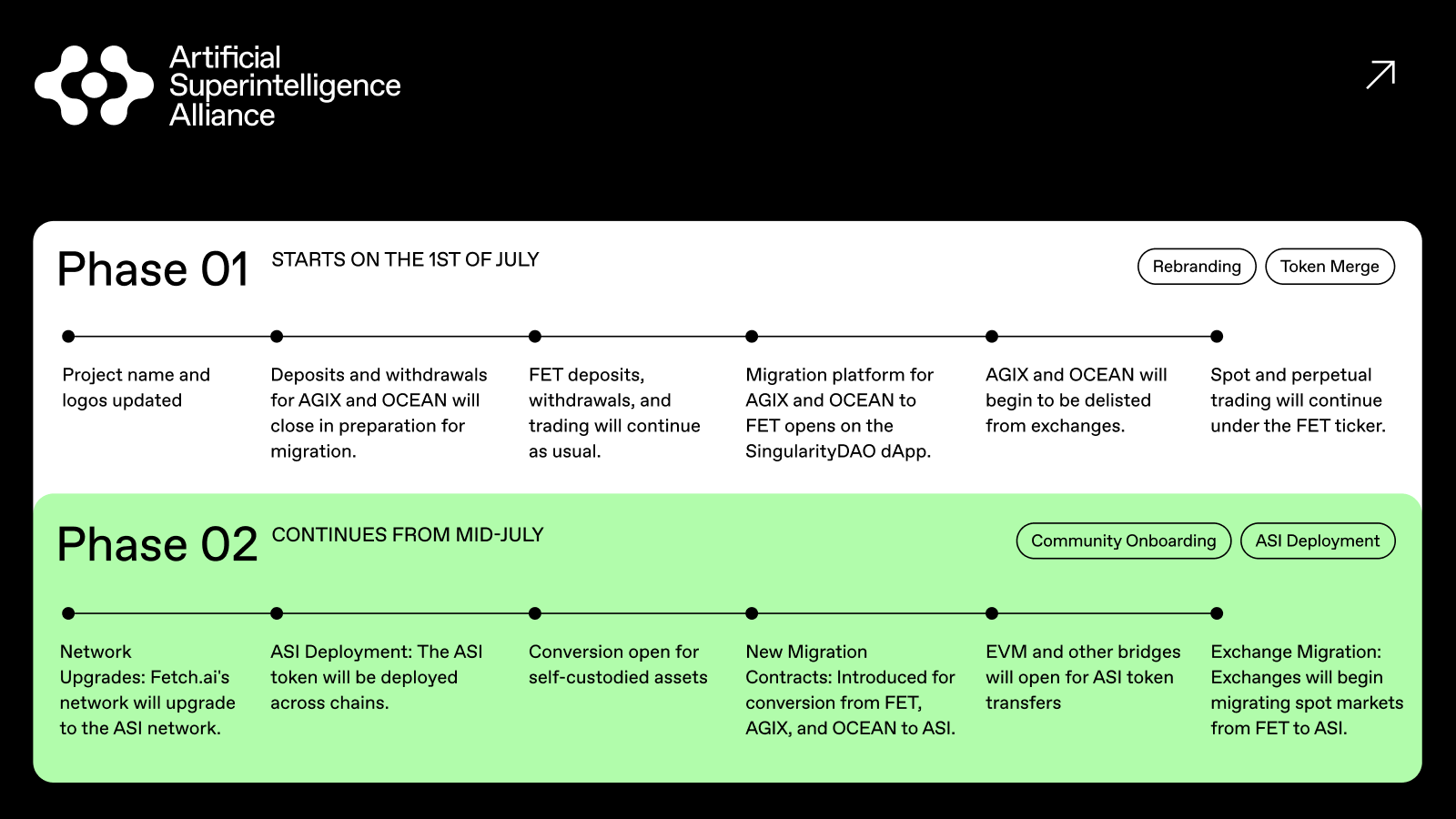

After three months of speculations, the Artificial Superintelligence Alliance (ASA) has announced the first phase of its two-phase token merger via its official press release.

Fetch.ai [FET], SingularityNET [AGIX], and Ocean Protocol [OCEAN] will merge together to build an ASI coin.

In their official X (formerly Twitter) page, SingularityNET announced the start of the merger, stating,

“We are pleased to announce the initiation of Phase 1 of the ASI token merger involving SingularityNET (AGIX), @Fetch_ai(FET) and @oceanprotocol (OCEAN).”

The first phase involves the merger of AGIX and OCEAN into FET. While the merger continues, the FET team announced that the trading will go uninterrupted.

Equally, SingularityNET explained that the migration platform was open on Singularity dApps to ensure smooth conversion of AGIX and OCEAN to FET tokens.

After the first phase, the second phase will involve the transition from FET to ASI.

Major crypto exchange platforms also intended to adopt the changes and continually support ASI. Such platforms include KuCoin, Binance [BNB], Bitget, and Bitfinex.

Fear amidst migration

Despite these developments and progress, there are various concerns from the wider crypto community. One major concern is Coinbase’s refusal to support the ASI merger.

According to the report, Coinbase will not participate in the Artificial Superintelligence Alliance’s $7.5 billion token migration (ASI).

Various stakeholders have expressed their concerns following the merger.

@EricDM101 expressed such a concern, saying,

“There is a lot of fear about this new open source decentralized superpower within #AI.”

Impact of the ASI merger on AI tokens

The ASI merger could be transformative and huge for the AI crypto sector. Therefore, if ASI takes good shape, it will boost other AI-centered cryptos, making their prices and market caps soar.

The merger will create the market potential for faster, more impactful, and transformative AI developments. Such development within the crypto market mostly translates into bullish market sentiment.

Consequently, the merger may result in various risks, such as issues during the transition, price, and market volatility for the ASI, which may affect long-term holders of FET, OCEAN, and AGIX.

The market buzz around the merger could also attract the attention of the authorities, especially over regulations and rules.

How did prices react?

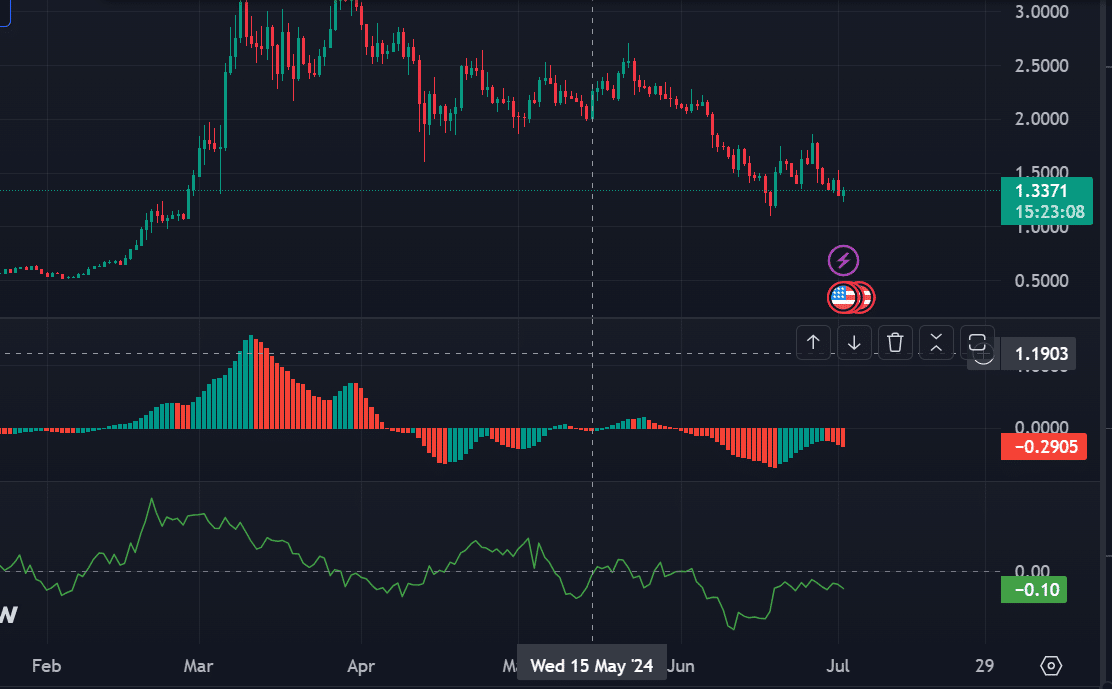

At press time, the market remained uncertain and unpredictable despite the heightened crowd buzz following the merger. FET traded at $1.34 after a 9.54% decline in 24 hrs and a 20.7% decline in seven days.

Also, AGIX was trading at $0.6136 following a 13.55% decline in seven days. At the same time, OCEAN was trading at $0.6127 following a 13.40% decline in seven days.

Broadly, at the time of writing, FET reported a negative CMF at -0.10, OCEAN-0.07, indicating increased selling pressure and lower prices.

Also, FET’s AO (awesome oscillator) was negative at -2905, OCEAN-1239 and AGIX -0.11022, which indicated that short-term momentum was declining, resulting in more price declines.

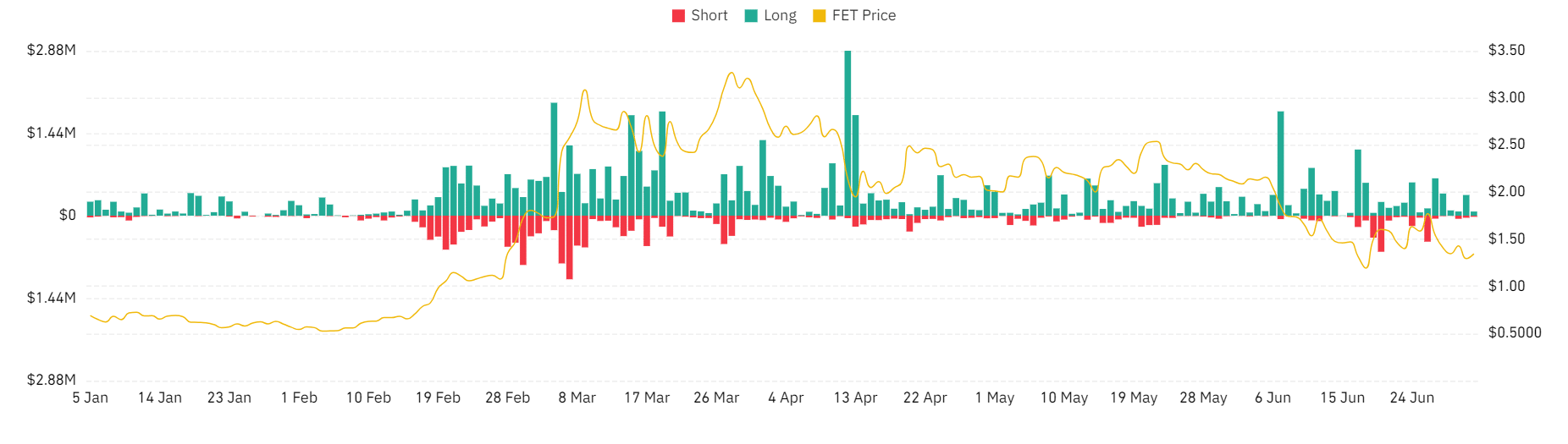

Thus, AMBcrypto’s analysis indicated the merger has resulted in negative market sentiment. According to Coinglass, FET has experienced substantial liquidation for long positions.

Read Artificial Superintelligence Alliance’s [ASA] Price Prediction 2024-25

This meant that long positions were closing, resulting in higher selling pressure, which pushed prices down.

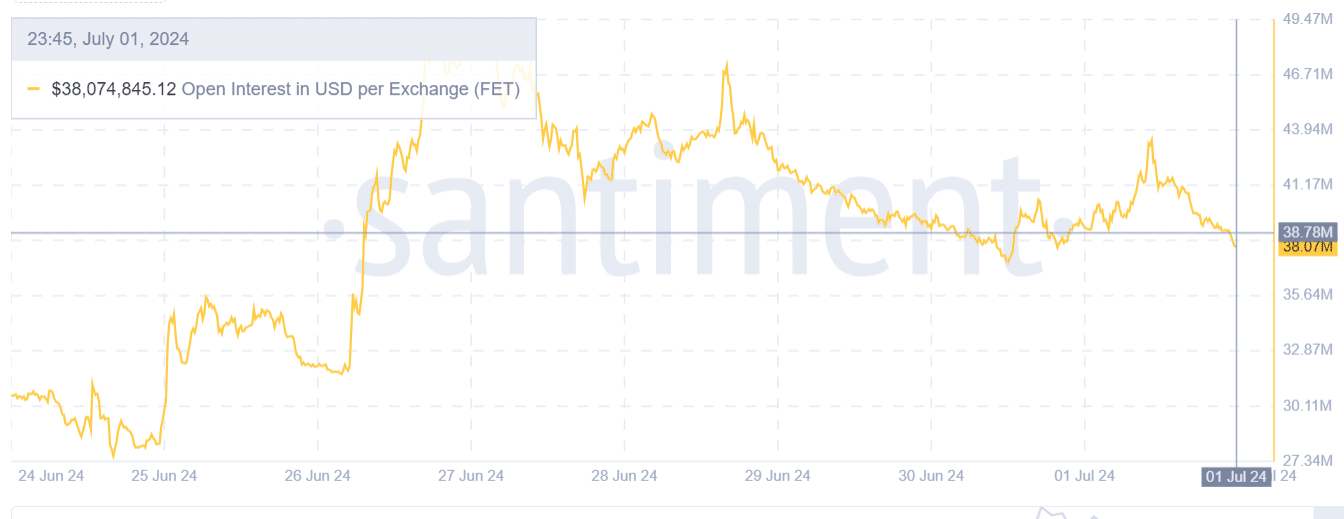

Finally, FET’s Open Interest has declined in the last 24 hours from $43M to $38M. The decline showed that holders were closing their positions without opening new ones, which is a bearish sign.