Asia accounts for over 43% of global crypto activity according to report

Markets were once again in the red today, with Bitcoin and Ethereum losing over 5% and 7% in the past 24-hours. It seems to be a trend for traders in Asia to sell off their positions before or after the BTC daily candle close.

As traders in the U.S wake up to slightly lower prices every day, it is now unclear whether Asia is responsible for the sell-off or if traders in the U.S are selling in anticipation of Asia doing so.

What time will Asia dump tonight??? Thinking about throwing in a 100x short.

— JChains ? (@CryptoJChains) January 20, 2021

Regardless, accounting for over 43% of the global crypto market, Asia is a dominant force with the power to influence the direction of price.

A report from Messari revealed that East Asia (mostly China) is dominated by larger trades with 90% of all volumes above $10,000.

Source: Messari

In fact, East Asia engages in more short-term trades over a wider variety of assets, compared to North America where the focus is more on long-term holdings of Bitcoin.

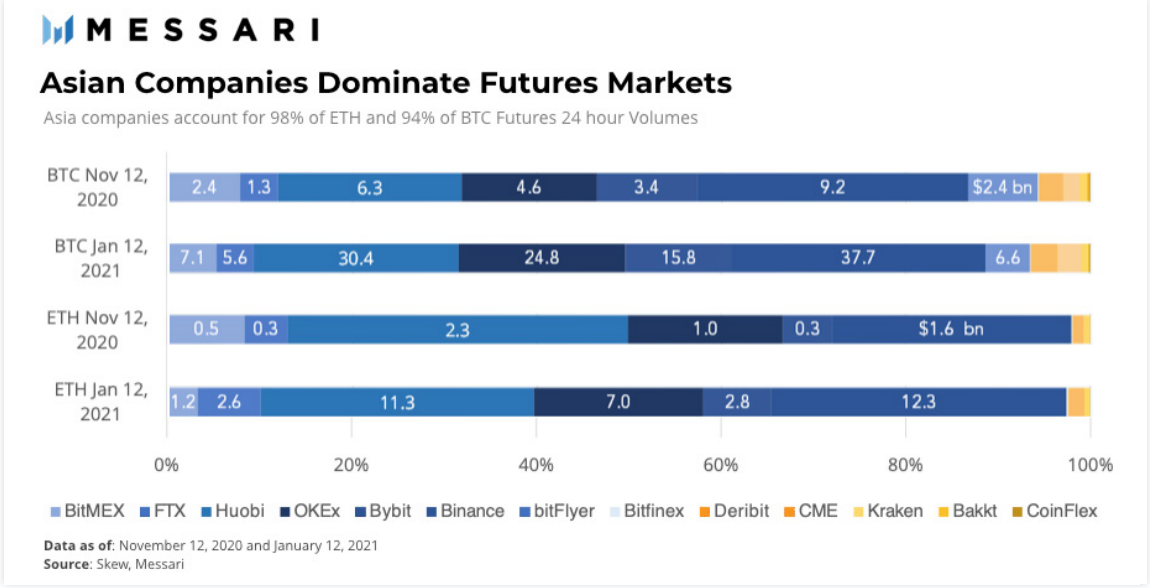

Asia’s dominance may also come down to the fact that Asian enterprises were quick to introduce new products and dominate the crypto futures market, accounting for 98% of ETH and 94% of BTC futures volumes.

With a stiff regulatory stance on crypto from the Chinese government, exchange operators in China are actually prohibited in the region. The ones that do operate in China are meant to only facilitate the buying and selling on centralized platforms for P2P services, without matching orders or taking custody of fiat and crypto.

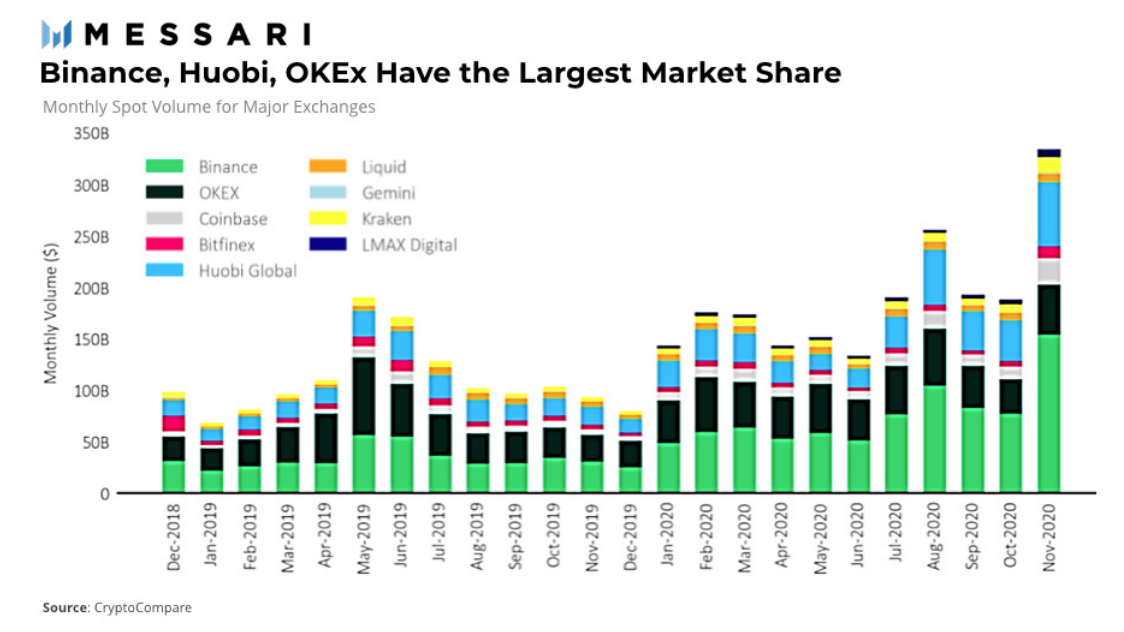

Nevertheless, that has not stopped Chinese-based exchanges from having among the largest market share in the world. While the exchanges technically have their place of incorporation elsewhere, OKEx and Huobi are physically based in China and account for the largest crypto volumes globally.

“There’s a difference between official policies and actual enforcement”, notes Mira Christanto, the research analyst who compiled the report, adding, “This means a nascent industry can still operate cautiously.”

While Asia remains the dominant force in the space for the moment, it is worth noting that developers in the West actually account for the majority of DeFi development, so as the industry matures, this trend may just be reversed.