Altcoin

Assessing AAVE’s price prediction as token gains 20% in 7 days

Given that AAVE has more than doubled in price since August, are there telltale signs of overheating?

- A significant increase in the number of new wallets fuelled AAVE’s recent price surge.

- Despite the rally facing rejection at $180, more bullish signs are still in play.

AAVE [AAVE] has been among the top performers in the cryptocurrency market, with its 7-day gains standing at 20% at press time.

As a result of this rally, AAVE’s market capitalization has increased nearly two-fold within three months to more than $2.5 billion.

AAVE’s gains in Q3 2024 happened when the broader market saw choppy price movements. As a result of this, a significant number of new AAVE wallets sprouted up as traders sought to book profits.

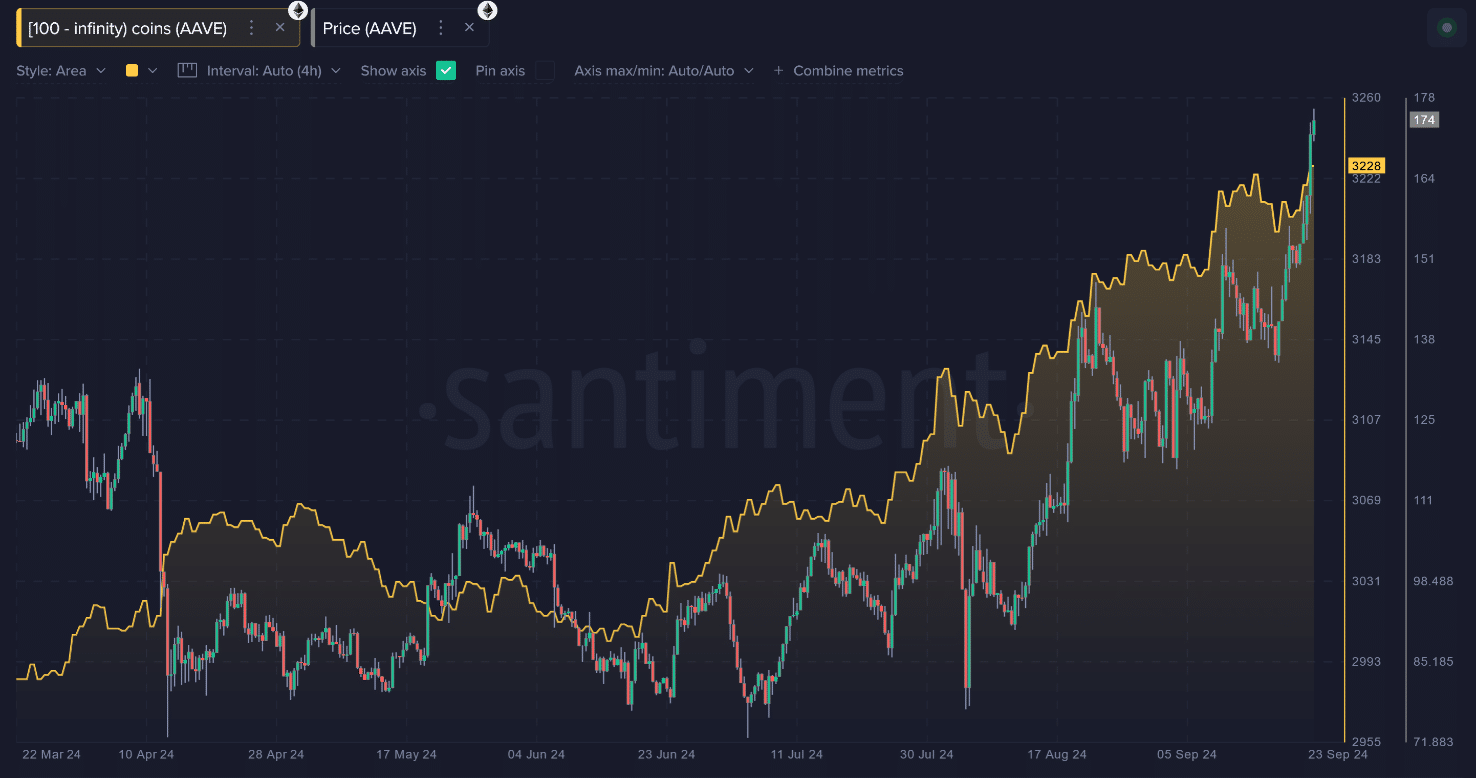

Per Santiment, the wallets holding at least 100 AAVE tokens have increased by more than 7% since mid-June to around 3,229 wallets. This increase is behind the buying momentum that has pushed AAVE higher.

Buyers remain in control of AAVE’s price action, as seen in the Chaikin Money Flow (CMF). This indicator has maintained a positive value since August.

Furthermore, the Relative Strength Index (RSI) at 69 showed that bullish momentum was still in play.

However, given that AAVE has more than doubled in price since August, are there telltale signs that the token may be getting overheated?

AAVE price prediction

AAVE traded at $168 at press time and continued to trend within an ascending channel on the one-day chart.

A breakout from this channel failed after the altcoin encountered resistance at $180, causing a swift correction.

AAVE’s uptrend was rejected at this price after it hit overbought conditions as seen in the Williams %R indicator. This metric has since dropped to -24 suggesting that the rally has cooled.

Despite the drop, AAVE was still trading above the midline of this channel, with support lying at the 0.786 Fibonacci level ($158).

A continuing trend in this zone could see AAVE attempt another breakout if buying momentum remains strong.

Conversely, if AAVE fails to sustain levels above another crucial support at $148, the price could drop below the lower trendline of this channel, igniting a bearish reversal.

Traders who bought into the rally could also start selling if this support fails, to minimize their losses.

Read Aave’s [AAVE] Price Prediction 2024–2025

At the same time, more than 456,000 AAVE tokens were bought at the $161-$182 price levels.

Therefore, AAVE might experience some volatility within these price levels as these traders seek to mitigate their losses or maximize profits.