Assessing Chainlink’s Q1 performance and its impact on LINK

- Chainlink saw growth in many sectors in Q1, as price feeds and other products helped generate revenue.

- LINK remained unaffected as prices declined and selling pressure rose.

Despite the volatility in the crypto market, Chainlink has continued to offer its services to various sectors in the crypto space. Over the last few months, the protocol has collaborated with a huge number of players in the crypto space.

Realistic or not, here’s LINK’s market cap in BTC’s terms

Seeing some improvements

According to Eric Wallach, an analyst at Platoon Digital, Chainlink’s Key Performance Indicators (KPIs) have grown incrementally over the last month.

Chainlink Network Financials & Valuation [1Q23 Update]

• Key Performance Indicators (KPIs)

• Chainlink Network Financials

• LINK 2.0 Discounted Cash Flow (DCF) Valuation Model

• Guide to resources (spreadsheets and Dune queries/dashboards)Tldr; Lots of promise! pic.twitter.com/oTPAlXp0pe

— Eric Wallach (@ejwallach) April 6, 2023

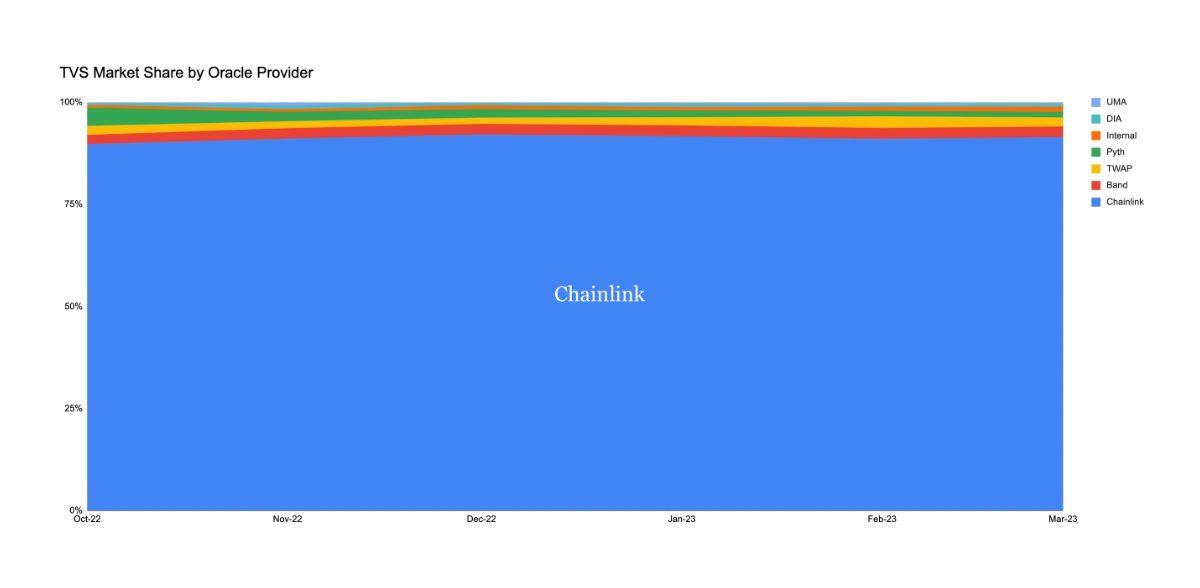

For instance, the protocol’s Total Value Secured (TVS), increased by 26% over the last quarter and reached an amount of $12 billion. Chainlink’s position as the dominant player in this sector was strengthened due to this, as it held a market share of over 75% in this domain.

The high TVS collected by Chainlink could be attributed to the performance of its Price Feeds product. According to Eric, the Price Feeds transactions surged by 8% over the last quarter.

Chainlink KPIs improved big time

• Transaction Value Secured (TVS) up 26% Q/Q to $12B.

• Lead over #2 in TVS up from 33x to 35x.

• Lead over #2 in # of Protocols Secured up from 2.6x to 3.4x.

• Price Feed TXs up 8% Q/Q despite total TXs across relevant networks down 16% Q/Q. pic.twitter.com/pDvJuBmfAB— Eric Wallach (@ejwallach) April 6, 2023

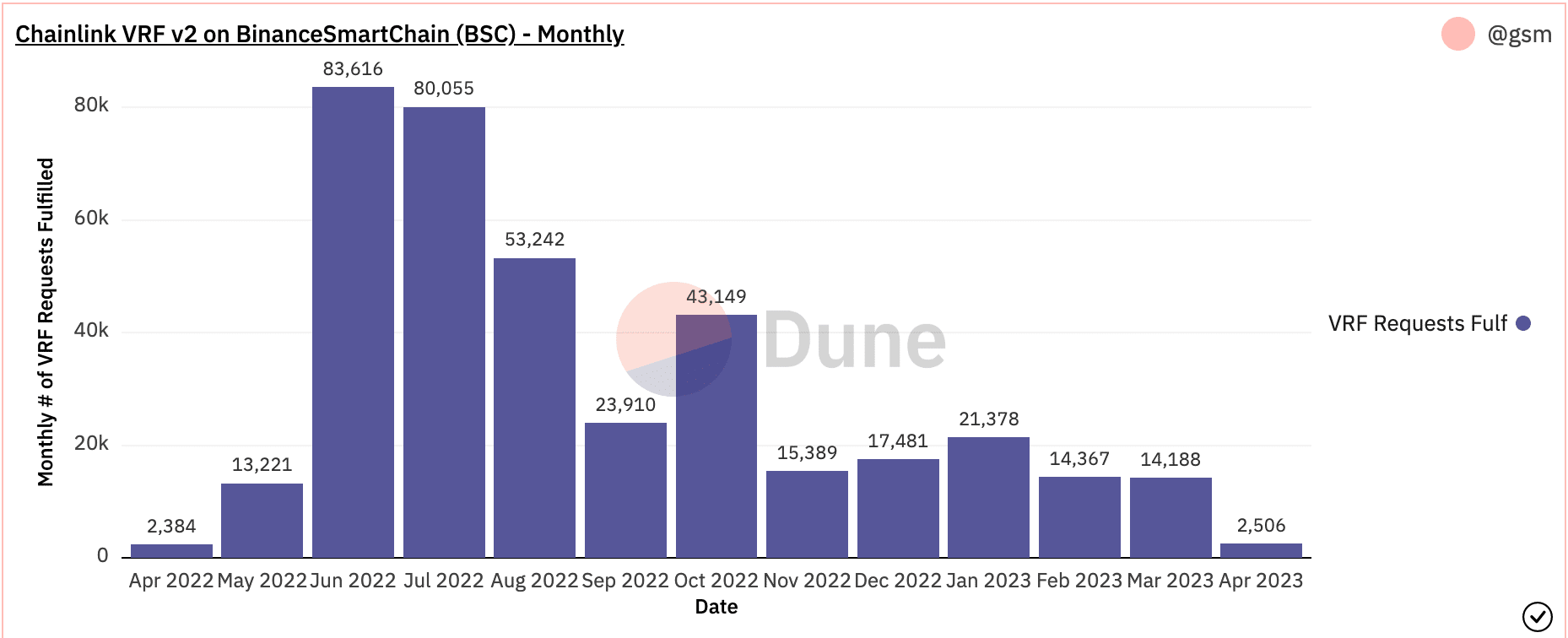

However, the same could not be said about Chainlink’s other products, such as VRFs (Verifiable Random Function). Based on Dune Analytics’ data, it could be seen that the VRF requests on prominent networks such as Binance declined in the last few months.

However, Chainlink could improve the demand for its products by improving its technology. Token terminal’s data indicated that the daily active addresses of the network have increased materially over the last few months. Along with that, the number of code commits being made on the network also surged during this period.

Active developments on the network could result in more users being attracted to Chainlink as its products saw improvements.

Read Chainlink’s [LINK] Price Prediction 2023-2024

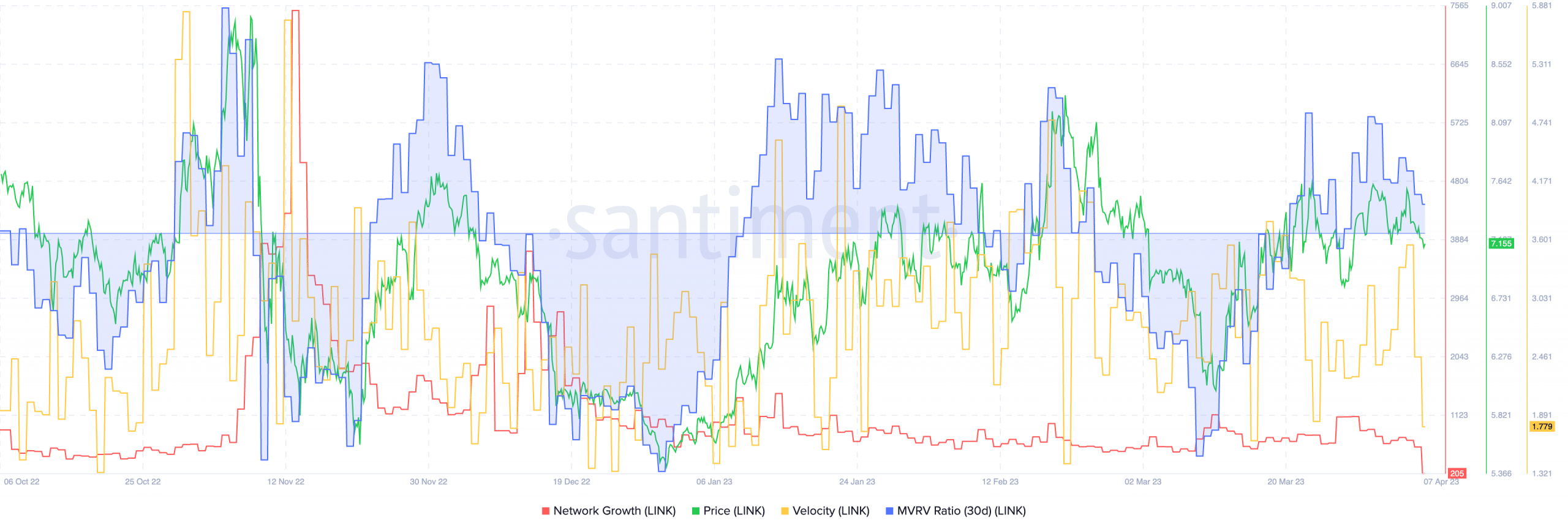

Even though the protocol saw growth in various areas, LINK wasn’t able to see improvements in its prices.

Over the last three months, the price of LINK has declined, along with its network growth. Suggesting that new addresses have lost interest in buying the LINK token. The high MVRV ratio of the token also suggested that there may still be some selling pressure on the LINK token.