Assessing if arrival of NFTs on Uniswap can initiate a 78% rally for UNI

The largest decentralized exchange is set to upgrade with NFTs as Uniswap announced that the platform will be integrating an NFT marketplace aggregator in fall 2022. The integration will allow users to discover and trade NFTs across most platforms.

Naturally, the market was bound to react positively, and it did. However, the question here is, how long can Uniswap ride on the success of this hype?

Uniswap brings NFTs

While NFTs are coming to Uniswap, they are not coming in the traditional form as they do with other chains.

Put simply, NFTs, such as Bored Ape Yacht Club (BAYC), CryptoPunks among others are available across different chains and marketplaces. However, with Uniswap, they can be accessed directly without visiting each of the NFTs individually.

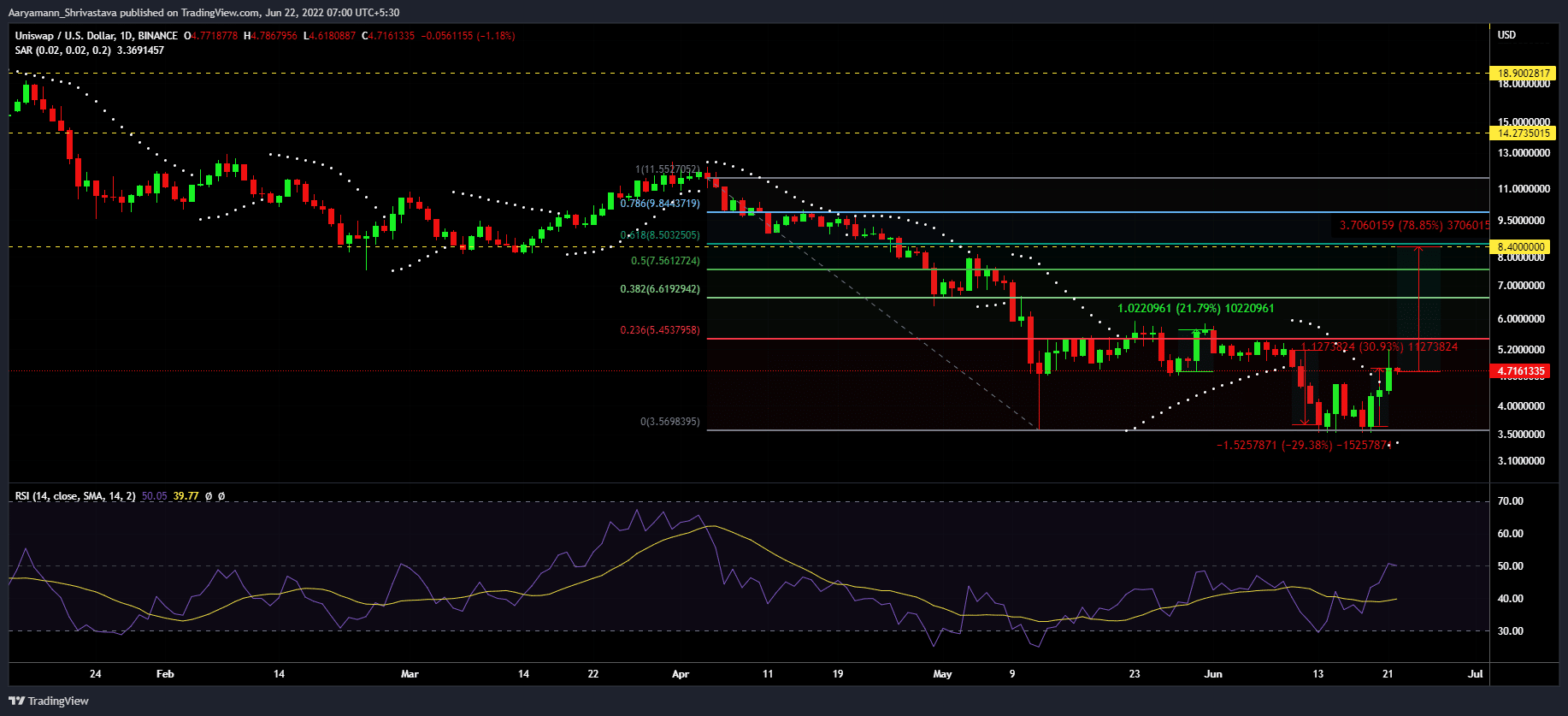

After the announcement, UNI managed to hit the lower highs and surged by almost 31% in three days. Undeniably, the broader market also had an impact on UNI.

But these lower highs are set to turn into higher lows as UNI is looking at an uptrend beginning on 22 June.

The Relative Strength Index (RSI) reached the bullish zone for the first time in more than two months, indicating an upcoming rally in the near future, even if it’s short-lived.

uniswap price action | Source: TradingView – AMBCrypto

More to the celebration

The Parabolic SAR further exhibited an uptrend following the rise. Interestingly, if UNI can manage to sustain this increase and carry on from its current position, the altcoin will have an opportunity of flipping the 23.6% Fibonacci level into support.

This would allow the DEX token to bounce and convert the $8.4 level into support. It would, thus, coincide with the 61.8% Fib level.

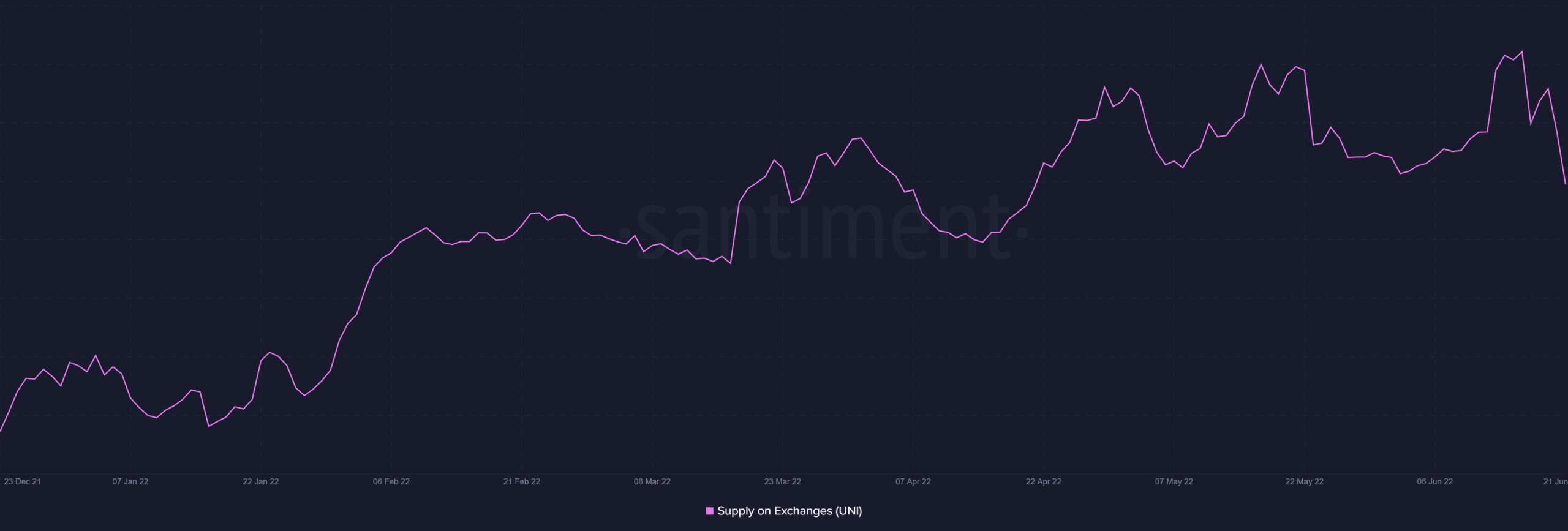

The coinciding of the Fib level would provide a further push to the coin, which is already doing pretty well among its holders. In this context, it should also be noted that $8 million worth of UNI was bought out of exchanges in the last seven days.

Uniswap investors buying | Source: Santiment – AMBCrypto

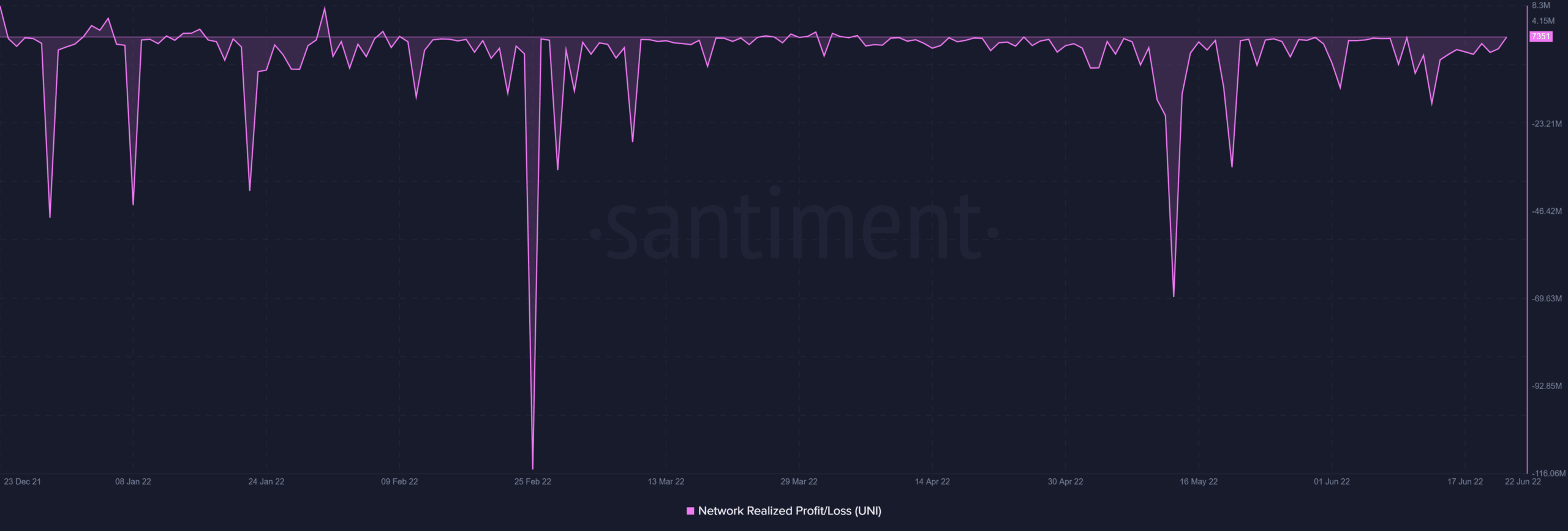

Consequently, network-wide losses have declined significantly and currently stand closer to indicating profits.

Network wide losses | Source: Santiment – AMBCrypto

NFTs have strengthened investors’ faith in UNI. Furthermore, this may also help UNI mark a 78% rally in the weeks to come.