Assessing if Bitcoin investors are stacking sats amid bearish conundrum

With Bitcoin trading at $38,487.33 at press time, you’d think that investors would be sick of the king coin’s seeming refusal to climb above the $40k mark – and stay there. However, a look at the data suggests this might not be the case. In fact, investors are keeping their heads down and possibly stacking sats for the future.

Bitcoin, Bitcoin everywhere, but not a sat to drink?

A new report from Arcane Research noted that the share of Bitcoin supply that hasn’t moved in a year – or more – is at a high of 64%. This suggests that more than using Bitcoin to pay for Mcdonald’s meals or Starbucks coffee, investors are perhaps accumulating the asset.

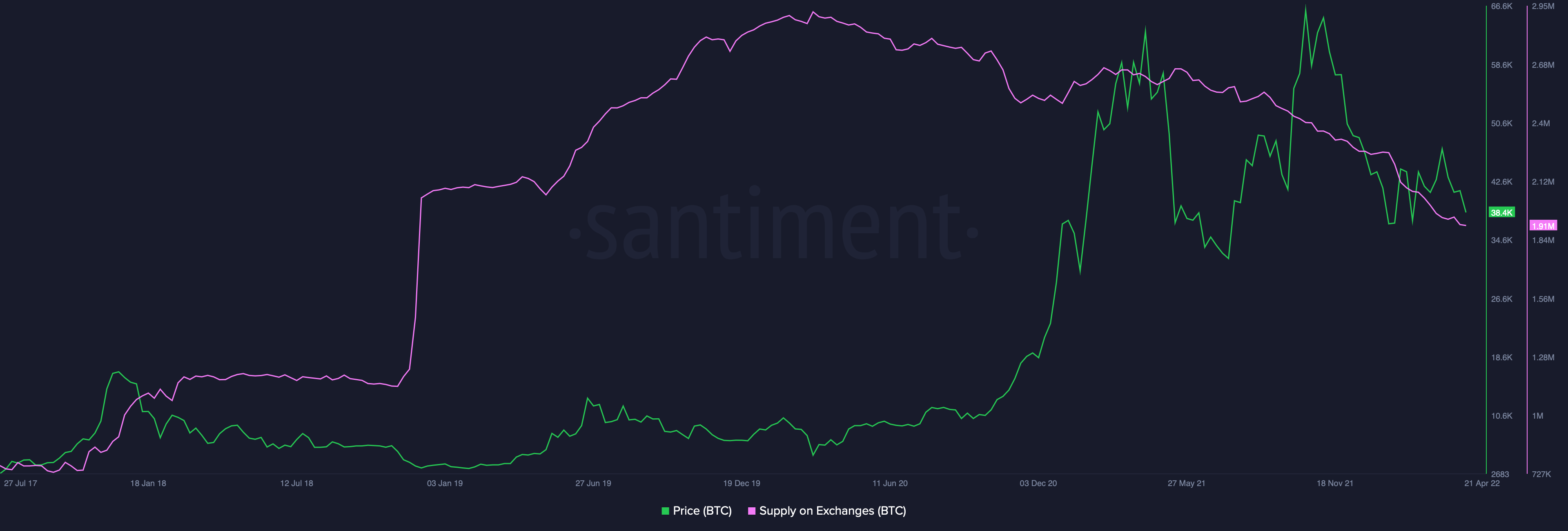

This theory becomes more solid when you note how Bitcoin supply on exchanges has been steadily falling since about March 2020, to reach levels last seen in late 2018.

Source: Santiment

As more and more Bitcoin goes into non-exchange wallets, Bitcoin’s liquidity will see a drop. This, in turn, could create a liquidity scarcity which might drive up prices again.

Leave some TPS after you eat!

Another report by Arcane Research pointed out a rise in Bitcoin on-chain activity. Transactions per day have grown by 4.58% in the past week alone, and 25 April saw 262,268 transactions.

What’s more, the average transaction value on 25 April was $20,487. The report put this down to a rise in spot volumes, as well as higher block production rates.

However, don’t be too quick to conclude that business is booming. In reality, the velocity metric for the king coin showed that activity levels associated with BTC had plunged after hitting highs of over 25.

Now, it seems BTC is switching between five or so wallets in a day. This, again, suggests that HODLers are doing what they do best.

Source: Santiment

Find me a find, catch me a sat

Still, the market seems primed for traders who want to “buy the dip,” as Santiment data revealed that interest in the trend had spiked to levels last seen around 13 March.

Adding to that, traders are watching both Bitcoin and the SP500 to see if the correlation between the two markets will go down soon – or become even stronger.

? Social interest in #buyingthedip has skyrocketed after #crypto's latest pullback. The #SP500 correlation is not working in the favor of the #cryptocurrency sector, and crowd fear will play a large part in the two markets breaking apart from one another. https://t.co/ET3G72MeW6 pic.twitter.com/sXuCPJAIj4

— Santiment (@santimentfeed) April 26, 2022