Assessing if BONK can rally past $0.000026 in July

- Bonk saw the most price growth in the past 24 hours.

- If the current trend continues, its price might rally to $0.000027.

Leading Solana [SOL]-based meme coin Bonk [BONK] ranked as the cryptocurrency asset with the most gains in the past 24 hours. Trading at $0.000026 at press time, BONK’s price was up 12% during that period.

According to CoinMarketCap’s data, the price surge was accompanied by a corresponding uptick in daily trading volume. During the period in review, the token’s daily trading volume totaled $522 million, rising by 67%.

BONK spikes in activity

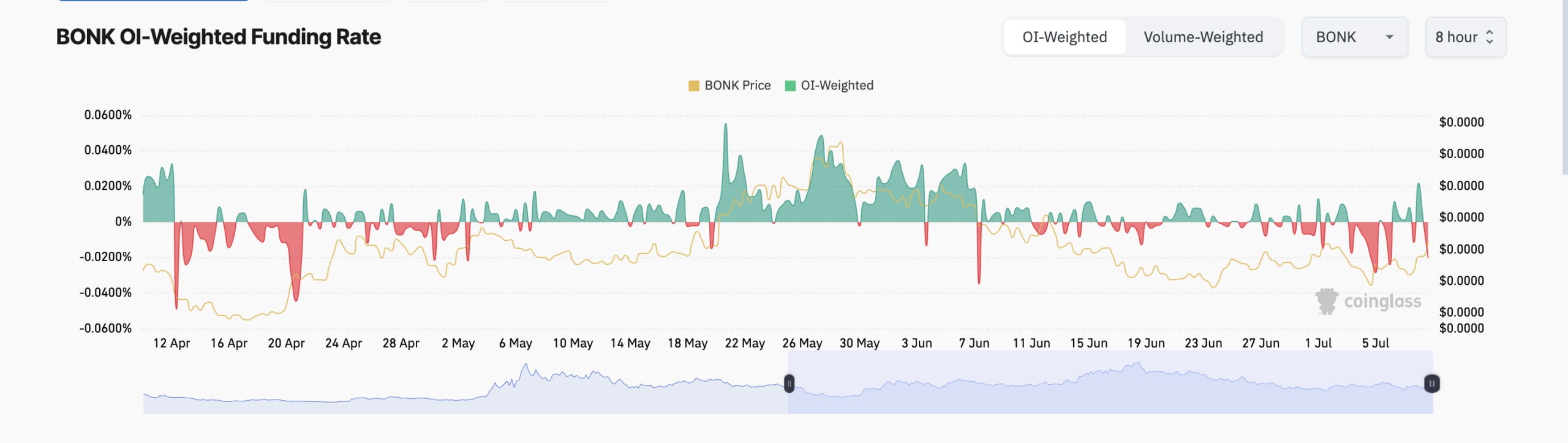

The double-digit rally in BONK’s price resulted in an uptick in trading activity in its derivatives market.

Trading volume totaled $206 million at press time, and according to Coinglass, it had increased by 77% within a 24-hour period.

Likewise, the memecoin’s Open Interest spiked by 24%, according to the data provider.

Open Interest measures the total number of outstanding derivative contracts, such as Options or Futures, that have not been settled. When it increases, it means that more traders are entering into new positions.

When an asset’s Open Interest and price increase, it is a bullish signal. It often confirms the strength and continuation of the uptrend.

However, BONK’s Futures traders do not seem convinced that the price rally would continue.

This was based on the readings from its Funding Rate across cryptocurrency exchanges, which was negative (-0.02%) at press time. This meant many BONK Futures traders demanded short positions.

Funding rates are used in perpetual futures contracts to ensure an asset’s contract price stays close to its spot price.

When an asset’s Funding Rate is negative, more traders are buying the asset, expecting a price decline, than those buying and hoping for a rally.

Bullish sentiment continues to climb

While BONK’s Futures traders opened short positions, the bullish bias toward the meme coin in its spot market gained momentum.

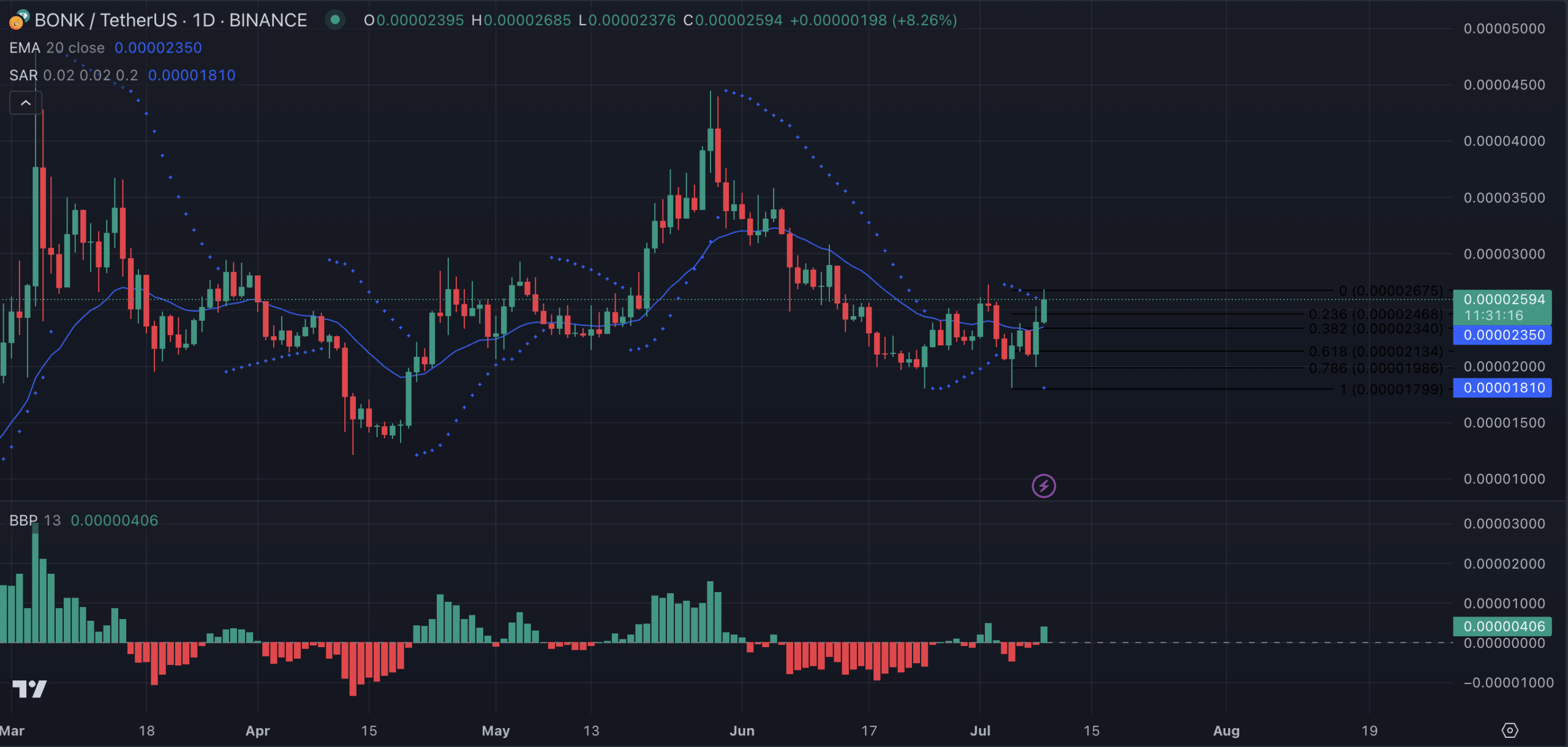

For example, for the first time since the 4th of July, the dot of the token’s Parabolic SAR indicator was spotted below its price.

The indicator is used to identify potential trend direction and reversals. When its dotted lines rest under an asset’s price, the market is said to be in an uptrend.

It indicates that the asset’s price is rising, and the uptrend may continue.

Read Bonk’s [BONK] Price Prediction 2024-25

If this trend continues, BONK’s price may rally to $0.000026.

However, if selling pressure gains momentum, its value may drop to $0.000024.