Assessing if Cardano’s $0.37 price wall will hold up under pressure

- Cardano’s ADA stagnated in a tight range between $0.34 and $0.36 this month

- ADA previously registered a positive shift in momentum when it formed a higher high in late September

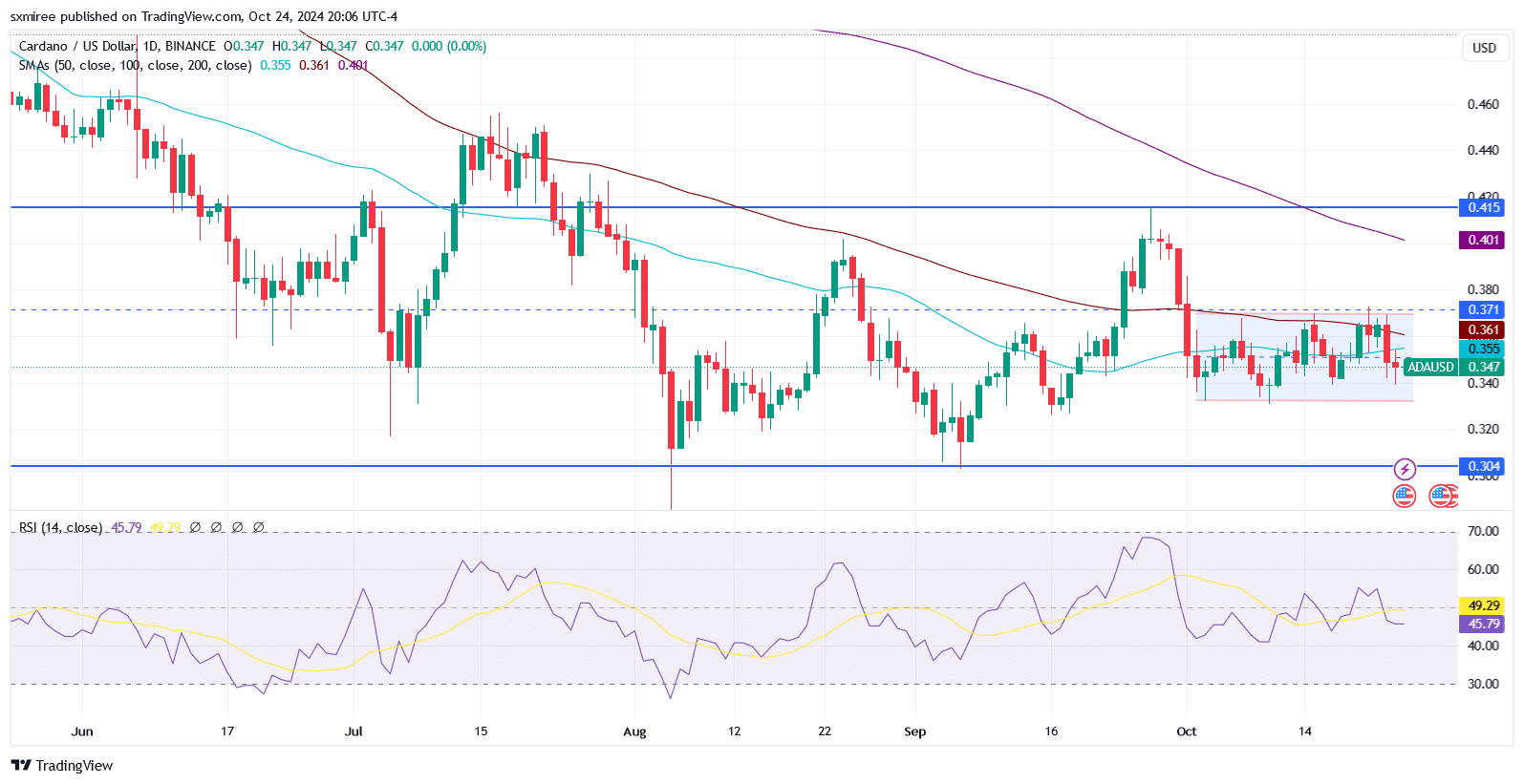

Bitcoin recorded minor gains on Thursday, reclaiming $68k after slipping to a weekly low of $66,300 on 23 October in a correction move that ignited selling in altcoins. Cardano (ADA) stood out among the top losers in the midweek session, with bullish speculators suffering another blow in their pursuit of the $0.40 psychological target.

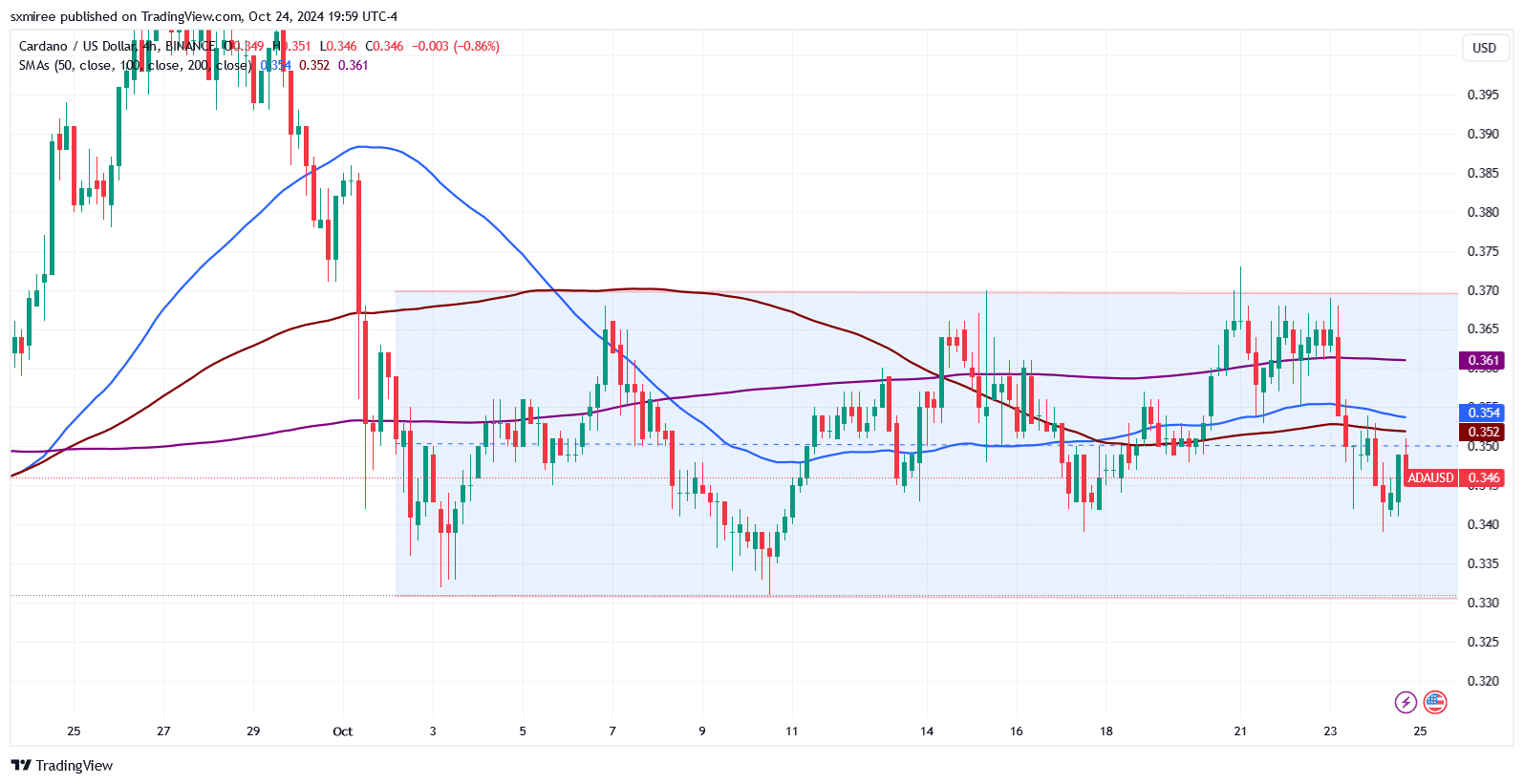

On TradingView’s 4-hour chart, ADA slipped below its short-term moving averages on 23 October after failing to sustain a breakout above the channel ceiling near $0.37.

ADA’s recovery attempt on Thursday was met with selling pressure, in stark contrast to the majority of altcoins, which advanced swiftly alongside Bitcoin.

The zoomed-out 4-hr chart revealed that the 50-day and 100-day moving averages were flat, indicating low volatility and market indecision at the altcoin’s press time range.

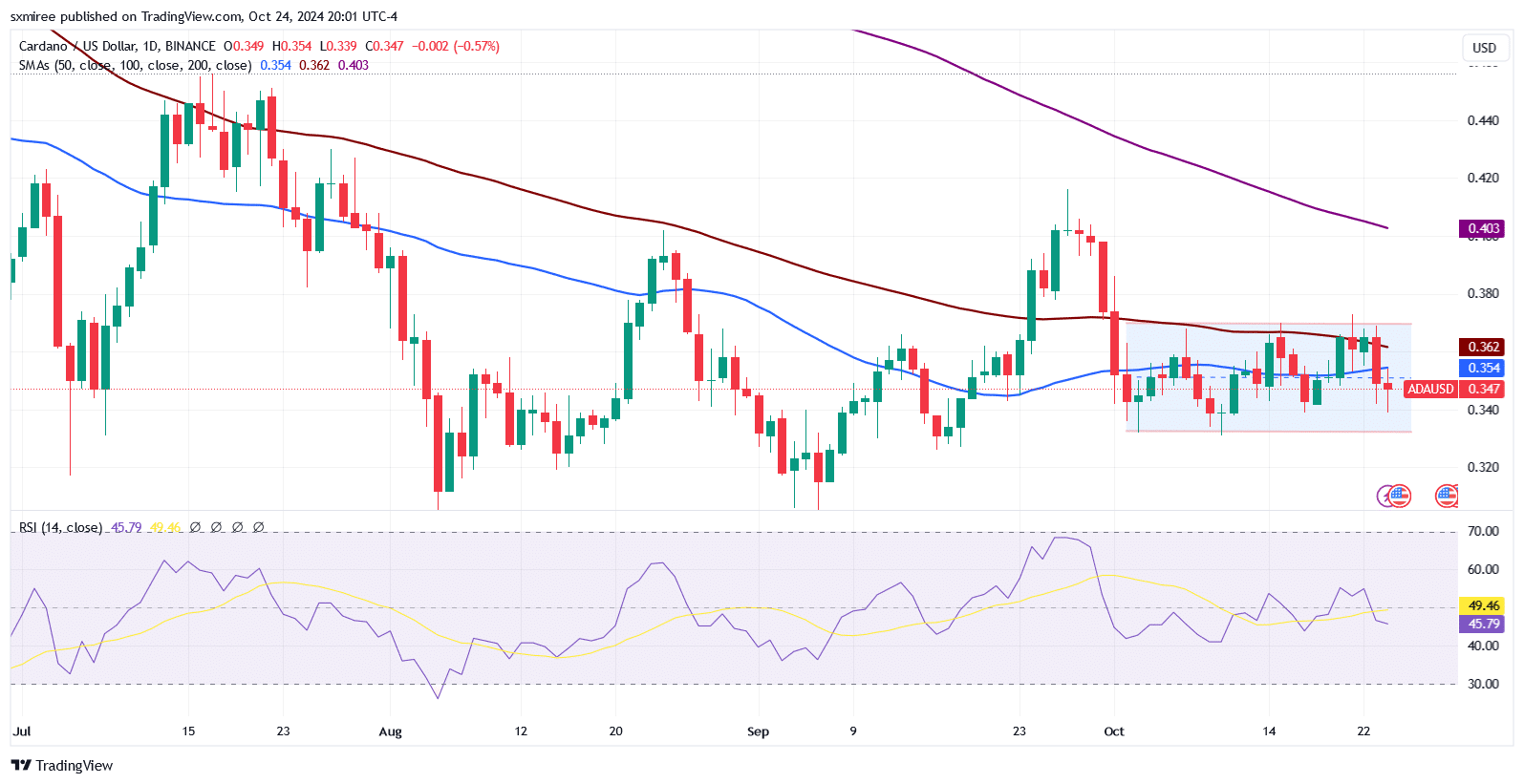

Additionally, the daily RSI reading, which has hovered close to the midpoint thus far in October, confirmed this lack of a strong upward or downward trend to lure market participants.

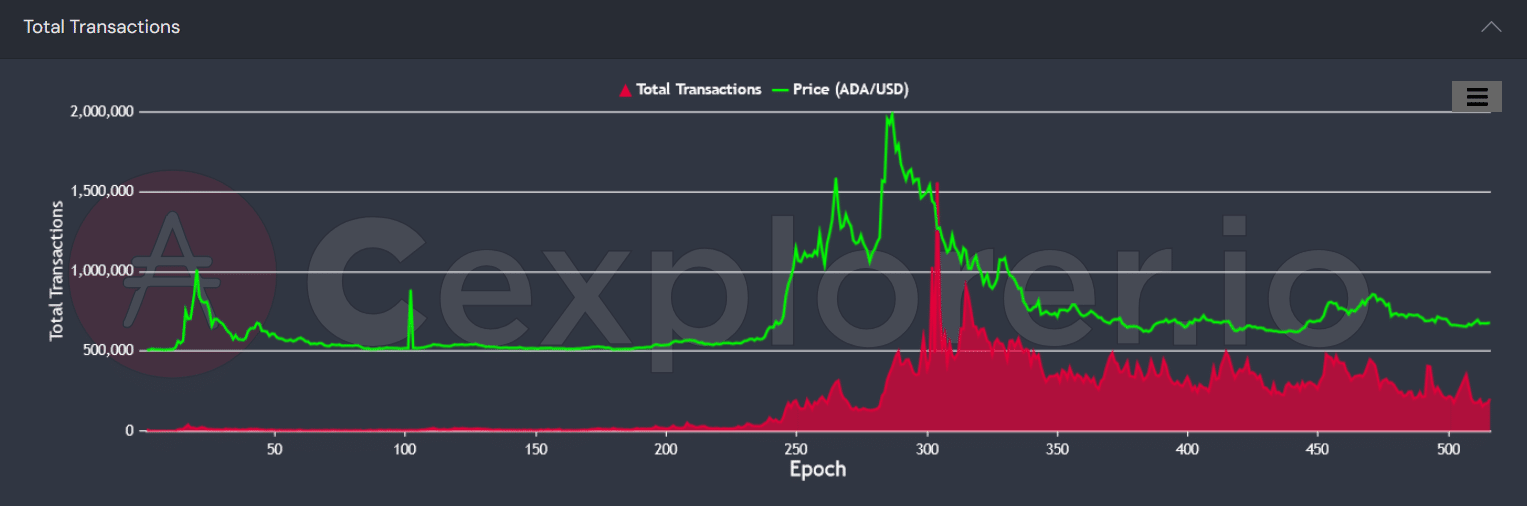

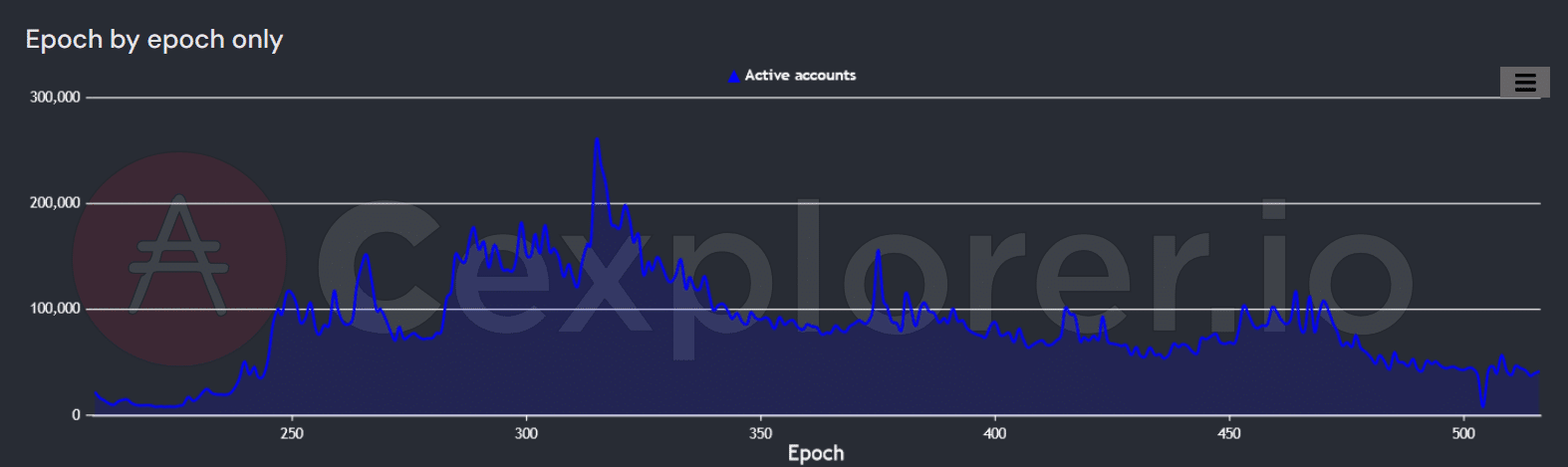

Onchain activity post-Chang phase 1

Onchain data from CExplorer revealed that the number of active accounts and total transactions has declined since the Chang hard fork’s activation on 2 September.

While the slowdown in on-chain activity has been contrary to general expectations that technical milestones typically lead to greater participation, it simultaneously reflects broader market trends too.

The crypto market’s growth has been contained for the better part of the year, making new entrants hesitant to engage. This, despite new developments within the altcoin’s ecosystem.

ADA/USDT technical analysis

Cardano’s native token, ADA, has been trading within a tight range between $0.33 and $0.36 since the start of the month. Though ADA’s price remains trapped in this narrow range, the implications of its latest higher high since mid-July cannot be ignored.

At the time of writing, bulls were eyeing a break above the $0.37 resistance level. This could pave the way for further bullish momentum and bring into view the $0.41 price level.

A drop below the lower bound will activate the crucial support at $0.31, which was tested on 6 September.

![Dogecoin [DOGE]](https://ambcrypto.com/wp-content/uploads/2025/01/Ritika-1-8-400x240.webp)