Assessing if Litecoin’s position as an inflation hedge can push it to $500

Litecoin, over the past year or so, has been gradually pushed out of the list of top-10 coins ranked by market cap. As expected, newer coins soon gained traction on the charts.

Over the last few months, the alt has kept a low profile, tempting the market with a potential breakout. Finally, over the last three days, Litecoin registered a close to 40% price jump.

Silver BTC following suit

The main driver behind this spike was the bullish momentum projected by the broader market. However, other factors too can’t be ruled out. As mega-cap coins like Bitcoin and Ethereum saw double-digit gains, hitting new all-time highs, LTC following suit didn’t come as a surprise.

Notably, LTC’s correlation to Bitcoin’s new ATHs played an important role in the recent price uptick. Interestingly, while the price soared, the correlation to BTC saw a decent uptick too.

What’s more, the 14th-ranked coin’s fundamentals look strong.

However, its annualized price volatility held lower values and presented a downtrend, alongside price gains. This made LTC more steady against dramatic price fluctuations.

In fact, Litecoin has been charting decent one-month and three-month ROIs v. USD of 50% and 62%, respectively.

Additionally, Litecoin’s Sharpe ratio too held high values. With a figure of 5.81, it was even higher than BTC’s (4.6 at press time). So, the question remains- Could this mean that LTC is a safer bet?

Inflation hedge?

Not to forget, Litecoin’s slow price momentum and comparatively lower returns have been widely criticized in the market. However, its legacy remains strong as LTC is often viewed as a potential commerce-oriented token.

U.S. inflation hit a 30-year high in October. In this context, it seemed, older and safer coins like LTC remained a good bet against inflation. Notably, in the past, Litecoin has risen in response to negative views about fiat currencies as investors look for asset classes to battle inflation fears.

This time though,0 Litecoin isn’t just an inflation hedge. In fact, its price is anticipated to reap higher gains for HODLers.

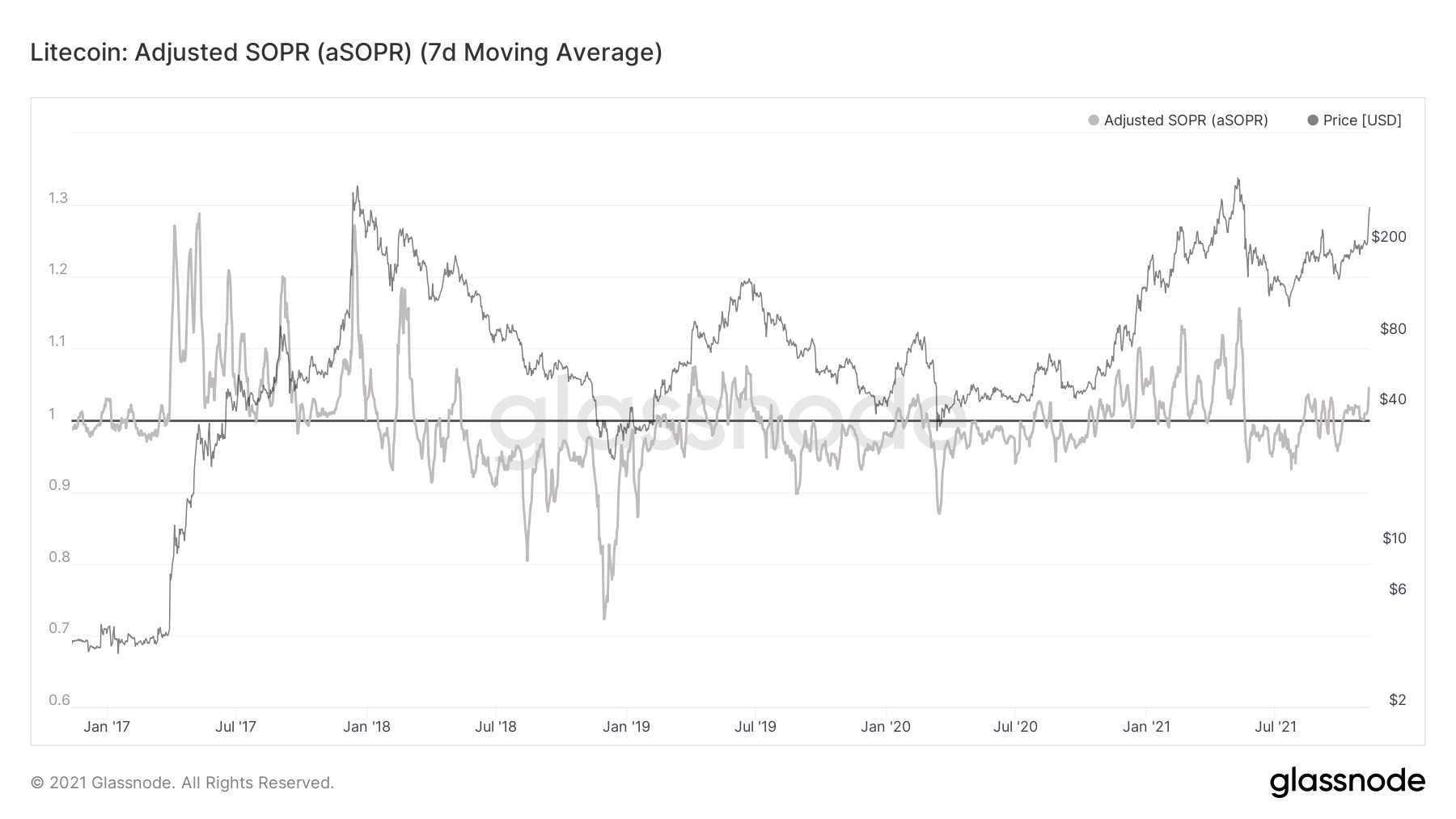

As highlighted in a previous article, LTC could easily breach the $500-mark. The same could also be confirmed by looking at the aSOPR for LTC. Here, the metric noted ATH values after 9 May. Further, the same implied that the coins moved on average were selling at a profit.

Moreover, the uptick in aSOPR looked similar to the 2017 uptick. Thereby, a manifestation of the 2017 rally, or in realistic terms, a move above $500, seems very likely.

However, despite the rise in price, retail euphoria is still lacking. A push from retail buyers would further confirm the rally. For now, LTC’s fundamentals look strong. And, if the larger market gains continue, LTC’s prospects of rallying would further strengthen.