Assessing LUNA’s prospects as a good buy in the mid to long term

LUNA has been one of the cryptocurrencies that has registered strong recovery post the broader market slump. Since 21 February 2022, Terra’s LUNA has been on a roll and quite easily one of the top performers in the market. News surrounding the coin has also been very promising thanks to increasing popularity of its US dollar pegged stablecoin – the UST.

Its aggressive coin burning progress has played an immense role in making it a proper deflationary coin to invest in (more on this later).

Worrying technicals?

Technically speaking, the altcoin has been doing pretty well. It hit its 27 December 2021 highs less than a week ago and is currently waiting for an opportunity to break out of the stiff psychological resistance of its ATH around $104. The interesting point to note here is that it has been recovering steadily despite the humdrum state of the overall market too.

It even broke out of its 50 and 200 daily moving averages.

However, there are a few caveats too. The press time price structure seemed to be forming an ascending triangle pattern, one suggesting that a bout of correction may be on the books going forward.

Ergo, investors and traders getting into LUNA now shouldn’t expect price appreciation immediately. A period of consolidation or even a minor correction may also occur before invalidating the ascending triangle and rising up.

Strong fundamentals

However, fundamentals point to a positive outlook going forward. Data from Messari found both circulating market capitalization and market cap dominance have been steadily rising across the board. For reasons enumerated later on, LUNA is increasingly becoming a deflationary asset and its rising popularity of the UST stablecoin has helped too.

Along with that, data fetched from SmartStake.io underlines the reason behind this massive rise. Over the past month alone, $2.33 billion worth of LUNA tokens have been taken out of circulation.

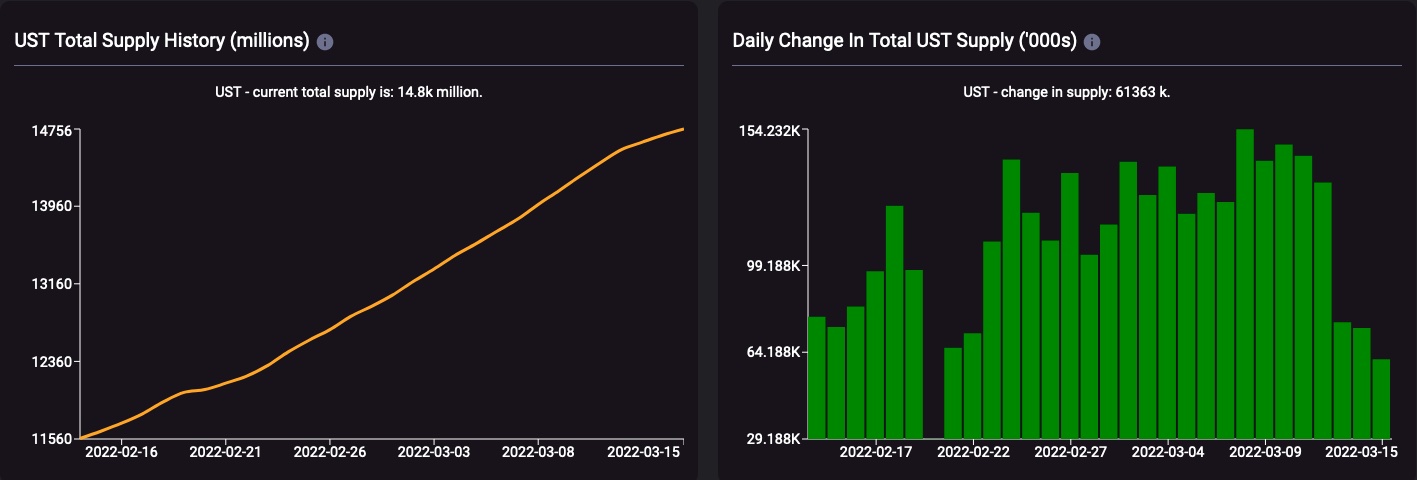

To add the cherry on the pie, take a look at how UST supply has also been steadily increasing on a daily basis – A sign of increasing market demand and popularity.

This would bring about further developer activity on the chain, thus uplifting the network as a whole.

Ergo, despite technical indicators pointing towards the possibility of a minor correction in the short term, the future looks bright in the medium to long term.

Therefore, the incoming dip may be taken up as a buy-the-dip proposition thanks to strong fundamentals across the board.