Assessing reasons behind MATIC’s unprecedented spike in its value

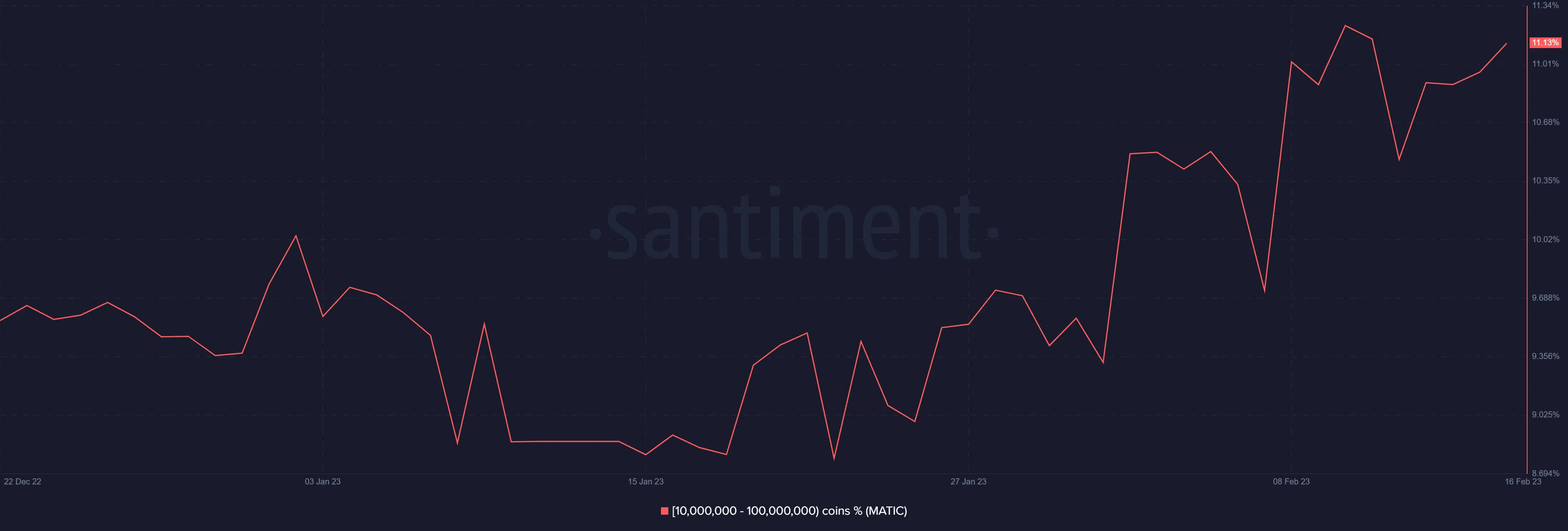

- MATIC whale supply distribution has risen to 11% in February.

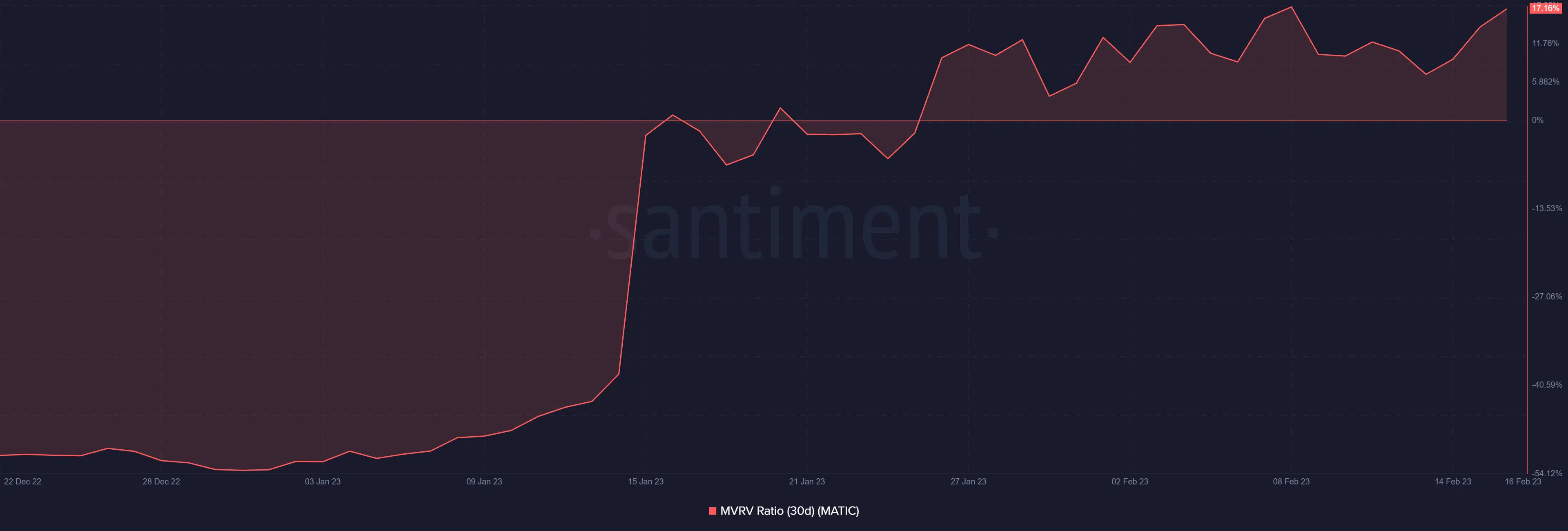

- 30-day MVRV reflects profits as active addresses decline.

Recently, there has been a rise in the price of Polygon [MATIC], and this increase appears to have been caused by the activity of some whale addresses.

What are some of the likely reasons behind the actions of these whales, and how could the price of MATIC be further impacted by their actions?

Read Polygon (MATIC) Price Prediction 2023-24

MATIC large holders continue accumulation

When analyzing Polygon (MATIC) on-chain data, it could be seen that institutional investors have been buying more of the token as of late.

Per Alicharts, investors holding between 10 and 100 million MATIC have purchased 55 million more for almost $60 million. Santiment’s graph likewise shows an increase in the token’s circulation inside that price band.

As of the time of this writing, the supply distribution statistic indicated an increase of 11%. It was also noted that the delivery of supplies began to increase in volume in February.

Over 75% surge in price to date

A daily timeframe chart shows that Polygon (MATIC) has been upward over the past few trading days. Up about 4% from its opening price, it was trading at about $1.38 as of this writing.

Based on the increase seen throughout the trading session, MATIC’s price rose by over 16% over the preceding three days. Even more impressive was that its current upswing meant it had increased by more than 75% since the beginning of the year.

The extension of the Bollinger band, along with the present price movement of MATIC, implied that the price was unstable.

Therefore, the visible support line was the one that was offered by the short Moving Average (yellow line). According to the Relative Strength Index, the asset was in a bull trend and on the verge of hitting the overbought region.

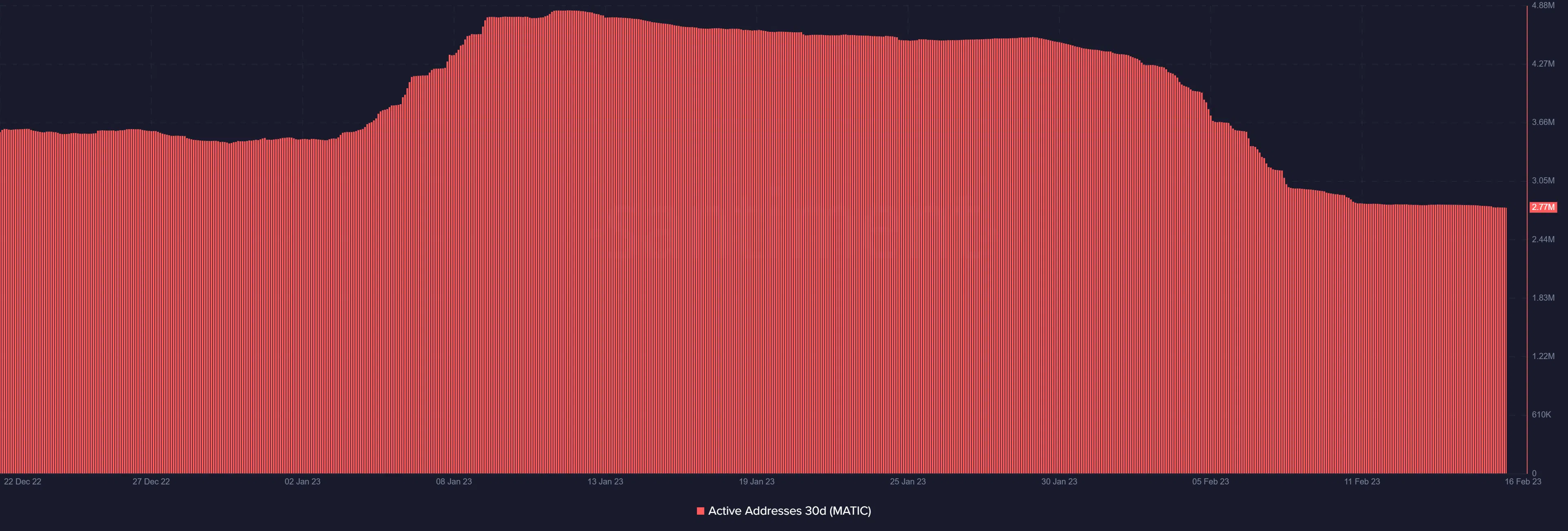

Active address declines as holders see profit

However, a look at the 30-day Active Address measure of Polygon revealed that the number of active addresses on the network had decreased.

Even though there were almost 2.7 million active addresses as of this writing, the figure showed an apparent fall.

The price increase had, however, provided Poygon (MATIC) holders with some profits during the same period despite the fall in the number of active addresses. As of the time of writing, the Market Value to Realized Value (MVRV) ratio indicated that MATIC was at 17.95%.

How much are 1,10,100 MATICs worth today

Accumulation motivation?

Even though there were no apparent causes for the recent uptick in whale activity, a recent announcement might be. A prior story detailed the report of the mainnet launch date for the Polygon zkEVM platform.

So perhaps the whales’ accumulation was motivated by their anticipation of the launch’s possible effects on the token.