Polygon: Here’s where MATIC stands after zkEVM Mainnet announcement

- Polygon set the date for its Mainnet Beta launch.

- Network growth fell, but MATIC holders seem to be excited about the announcement.

On 14 February, Polygon [MATIC] finally announced the date for its zkEVM Mainnet. Dubbed as the “future of Ethereum scaling,” the Layer-two (L2) protocol pointed out that the disclosure would serve as a preliminary development stage to the Mainnet Beta launch billed for 27 March.

Roses are red ?

Violets are blue

Poems are hard ?

Mainnet Beta is hereON MARCH 27, Polygon #zkEVM launches the future of Ethereum scaling

????https://t.co/OqSOYTn8Uv pic.twitter.com/kpXavea3ff

— Polygon (@0xPolygon) February 14, 2023

Read Polygon’s [MATIC] Price Prediction 2023-2024

Network growth down, but numerous milestones ahead

In the lead up to the launch, Polygon mentioned several milestones, some of which included 300,000 blocks production, 75,000 ZK Proofs with over 84,000 wallets on its network.

However, there were also some downsides, even though the project considered it minimal. Notable was the lack of support for Ethereum developer tools. Despite the disclosure, Polygon network growth did not improve.

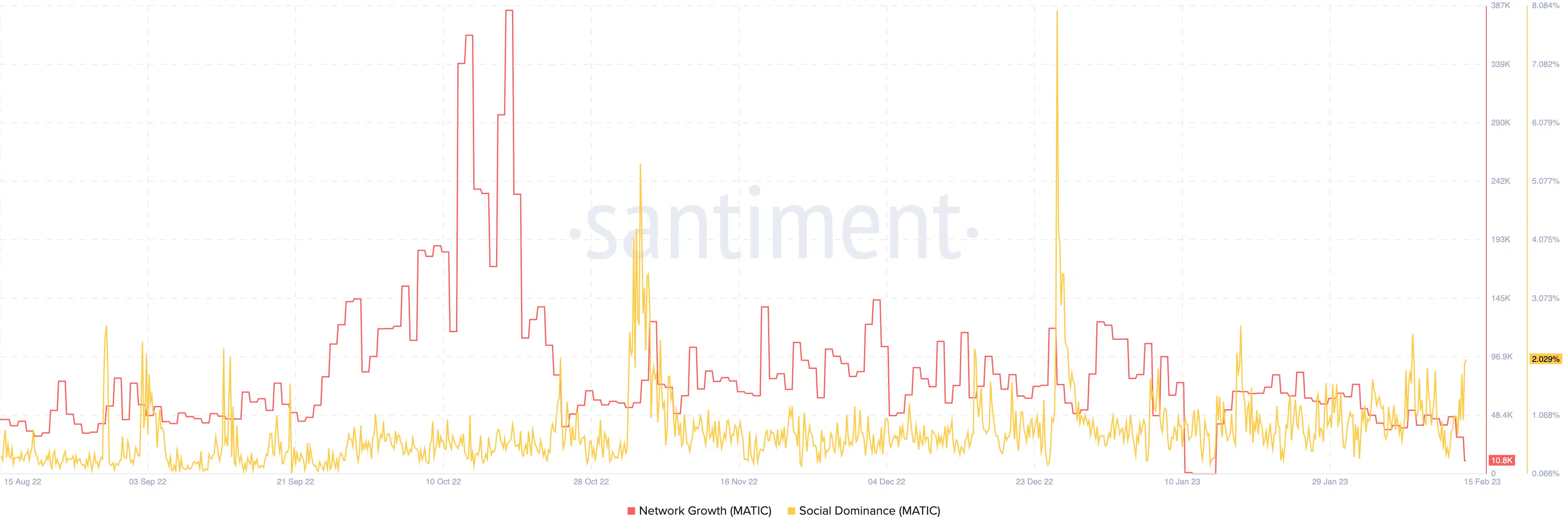

At press time, Santiment data showed that the metric was down to 10,800. The network growth acts as the metric, which illustrates traction gained on a project. Although Polygon boasts of several wallets and 5,000 deployed smart contracts, it seemed that new addresses created on the network were not so lucky.

But on the brighter side, it seemed that the Polygon statement had a positive effect per reaction from the crypto community. This was because the social dominance, as shown above, spiked to 2.029%.

The dominance displays the share of discourse related to an asset. So, this increase means that conversations around MATIC heightened to a level. This MATIC status minimally differed from the pre-announcement condition. During this aforementioned period, funding rate increased and total supply also moved in the upward direction.

ETH community to accept Polygon’s demands?

Meanwhile, Polygon failed to acknowledge Etheruem’s [ETH] on its current state. But it also mentioned that the Ethereum community would have to deal with compromise on some matters. The communique stated,

“In the meantime, the Ethereum community would have to compromise, with withdrawal delays and fraud proofs, with entirely new languages designed for ZK rollups.”

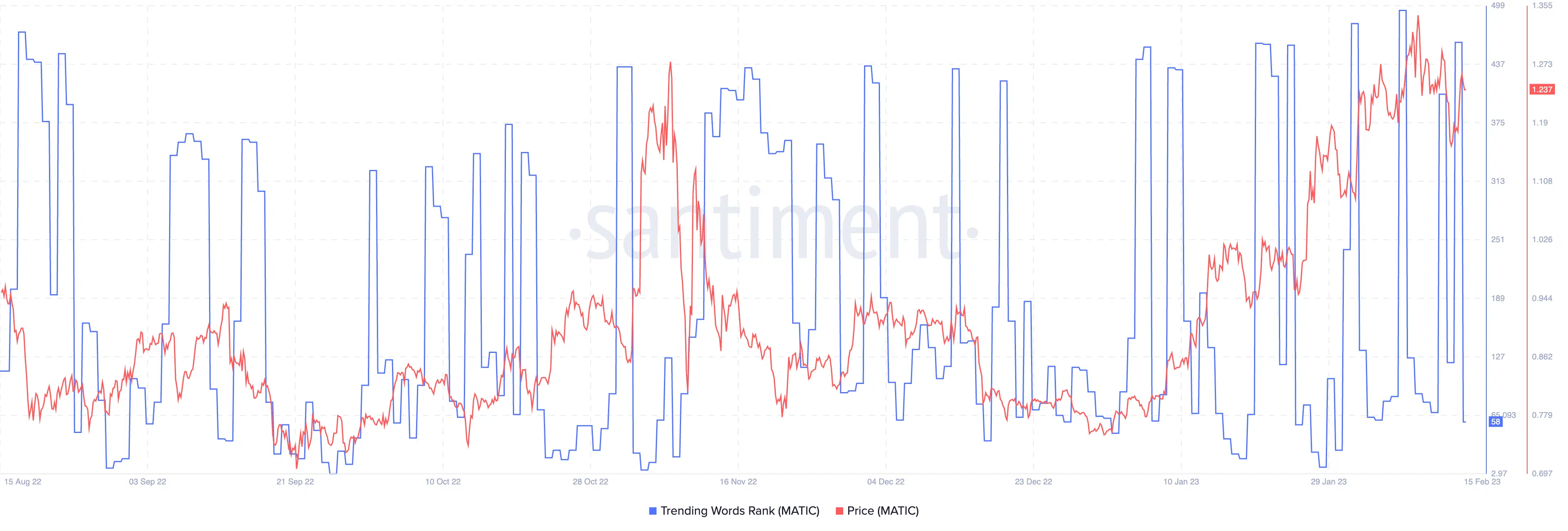

Despite the euphoria around MATIC, on-chain data showed that MATIC still ranked lower in terms of trending words. At the time of writing, the metric was down to 58.

Realistic or not, here’s MATIC’s market cap in ETH’s terms

This might, however, not be surprising, especially as the market did not react negatively to the Consumer Price Index (CPI) results. MATIC also gained 5.31% in the last 24 hours as it exchanged hands at $1.237.

However, Polygon noted that it would focus on a series of tests and audits as the Mainnet Beta data approached. It pointed out,

“Over the next few weeks, Polygon Labs will be releasing more details about Mainnet Beta. Security is the highest priority, which is why Polygon zkEVM has been run through a gauntlet of tests and audits.”