Assessing the Avalanche ecosystem as AVAX hikes by 100%

- AVAX was up by more than 100% over the last 30 days.

- RSI was overbought, and a few indicators were also bearish.

Avalanche [AVAX] has shown consistent growth in its DeFi space of late as key metrics continued to climb. But will the blockchain’s growth in the DeFi ecosystem be enough to maintain its bull rally, or are other factors also supporting AVAX?

Avalanche is growing in this regard

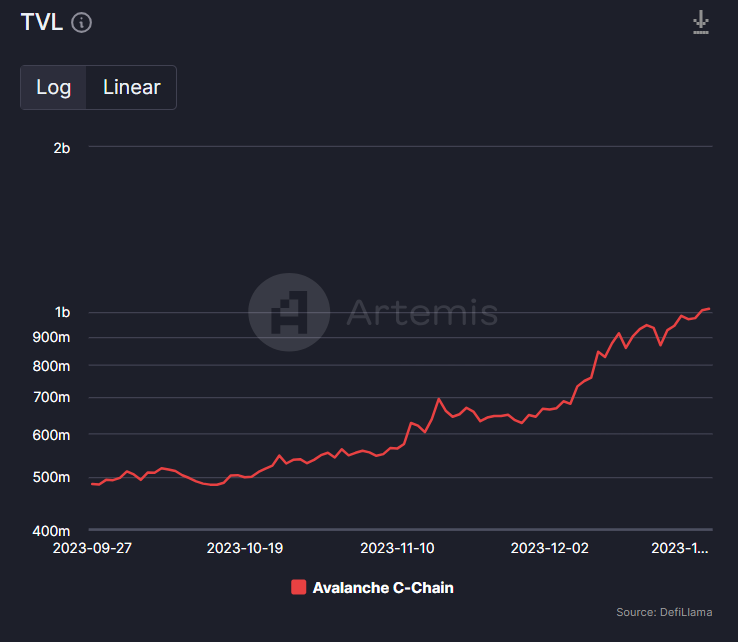

AMBCrypto inspected Artemis’ data to find out how Avalanche has been doing in the DeFi space.

Our analysis revealed that the blockchain’s TVL has been on steady growth for multiple months in a row. This was a positive development, as the higher the TVL of a blockchain, the more secure and valuable it is perceived to be.

CryptoDep recently posted a tweet that revealed the projects and dapps on Avalanche that helped the blockchain achieve this growth in TVL.

The tweet mentioned all the top dapps on AVAX in terms of volume over the last 30 days.

The top position was taken by Trader Joe as its volume surpassed $1 billion. Apart from Trader Joe, WooFi, Paraswap, GMX, and Uniswap also made it to the top five on the same list.

⚡️Top 10 dApps on @Avax by Volume (30d)

We present the top dApps on #Avalanche by volume in the last 30 days, according to the data from @DappRadar.$JOE $WOO $PSP $GMX $UNI $AAVE $STG $PNG $QI $AVAX #AVAX pic.twitter.com/ktgX3B3btO

— ?? CryptoDep #StandWithUkraine ?? (@Crypto_Dep) December 25, 2023

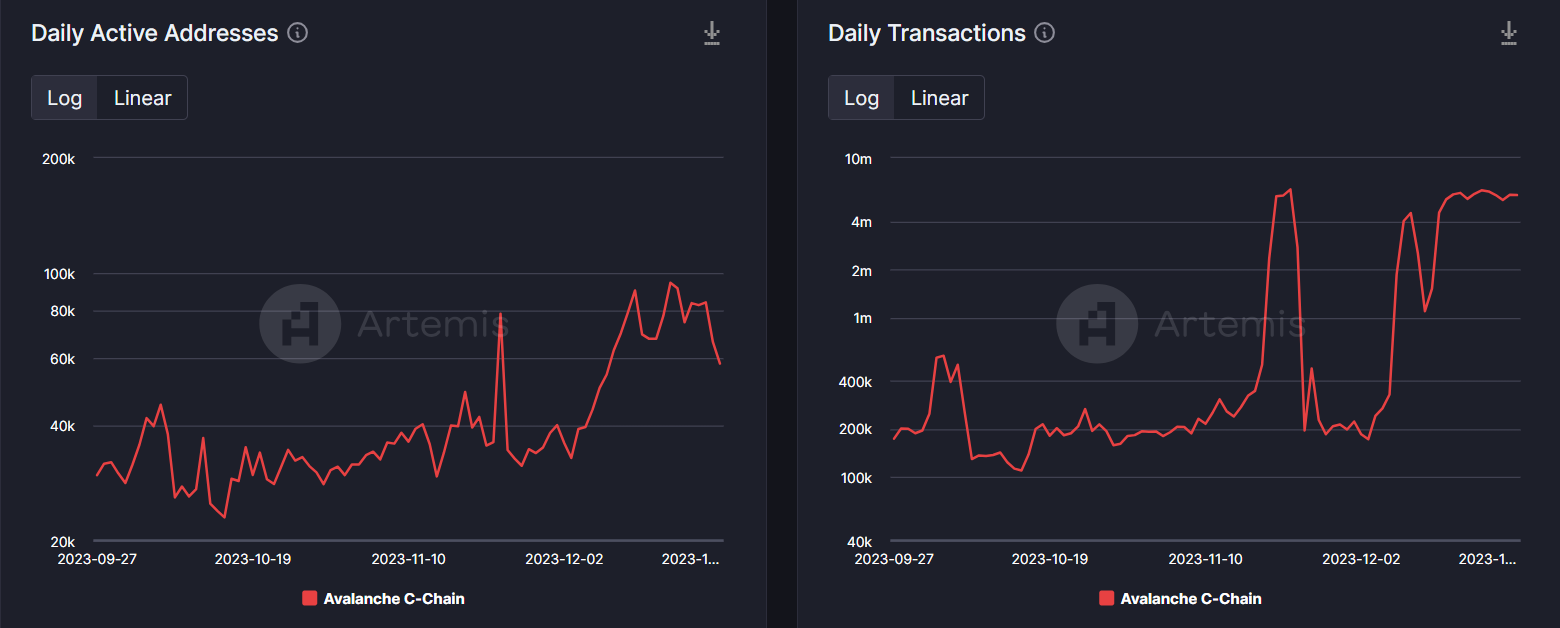

Apart from this, AMBCrypto also checked AVAX’s network activity. As per our analysis, the blockchain’s daily active addresses and daily transactions also gained upward momentum while its TVL rose.

This clearly indicated a hike in adoption and usage. Not only that, but the blockchain’s captured value also increased as its fees and revenue surged in the recent past.

AVAX’s going off the chart

While the blockchain’s network health was adequate, its price action gained bullish momentum.

In fact, in just the last 30 days, AVAX was up by more than 100%. At the time of writing, AVAX was trading at $48.35 with a market capitalization of over $16.8 billion.

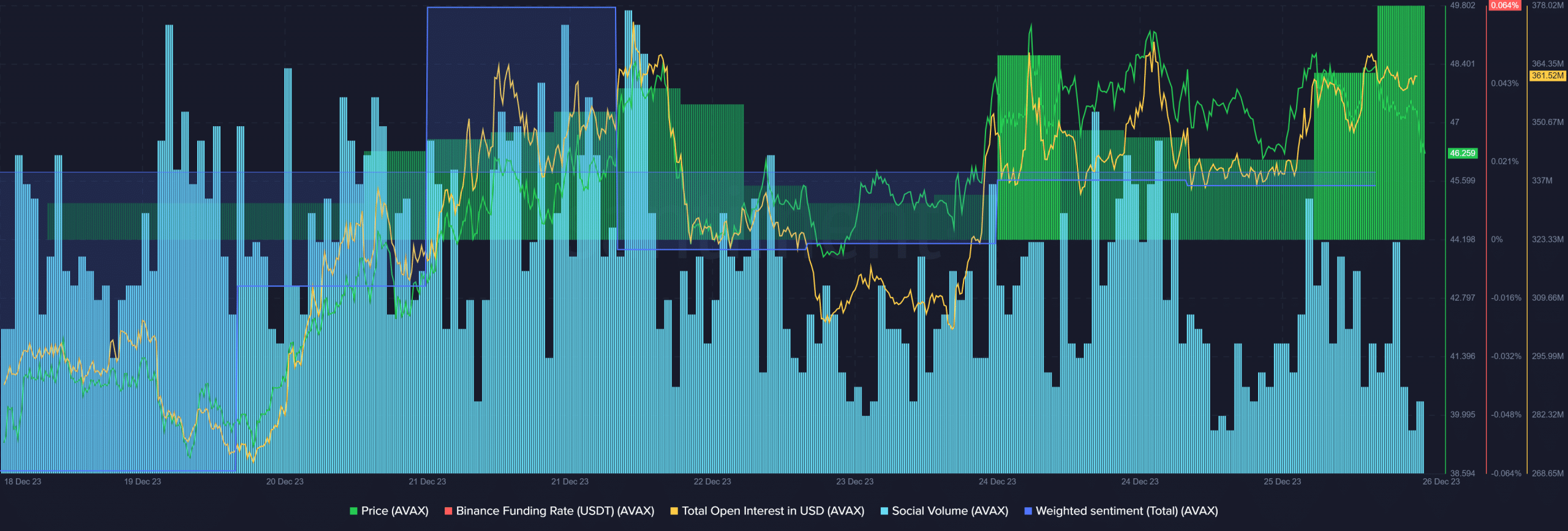

Avalanche remained in demand in the derivatives market while its price surged, which was evident from its green Binance funding rate and high open interest.

Its social metrics, like social volume and weighted sentiment, also remained relatively high throughout the last week.

However, the good days might come to an end soon, as according to CryptoQuant, both AVAX’s Relative Strength Index (RSI) and stochastic were in overbought zones.

Read Avalanche’s [AVAX] Price Prediction 2023-24

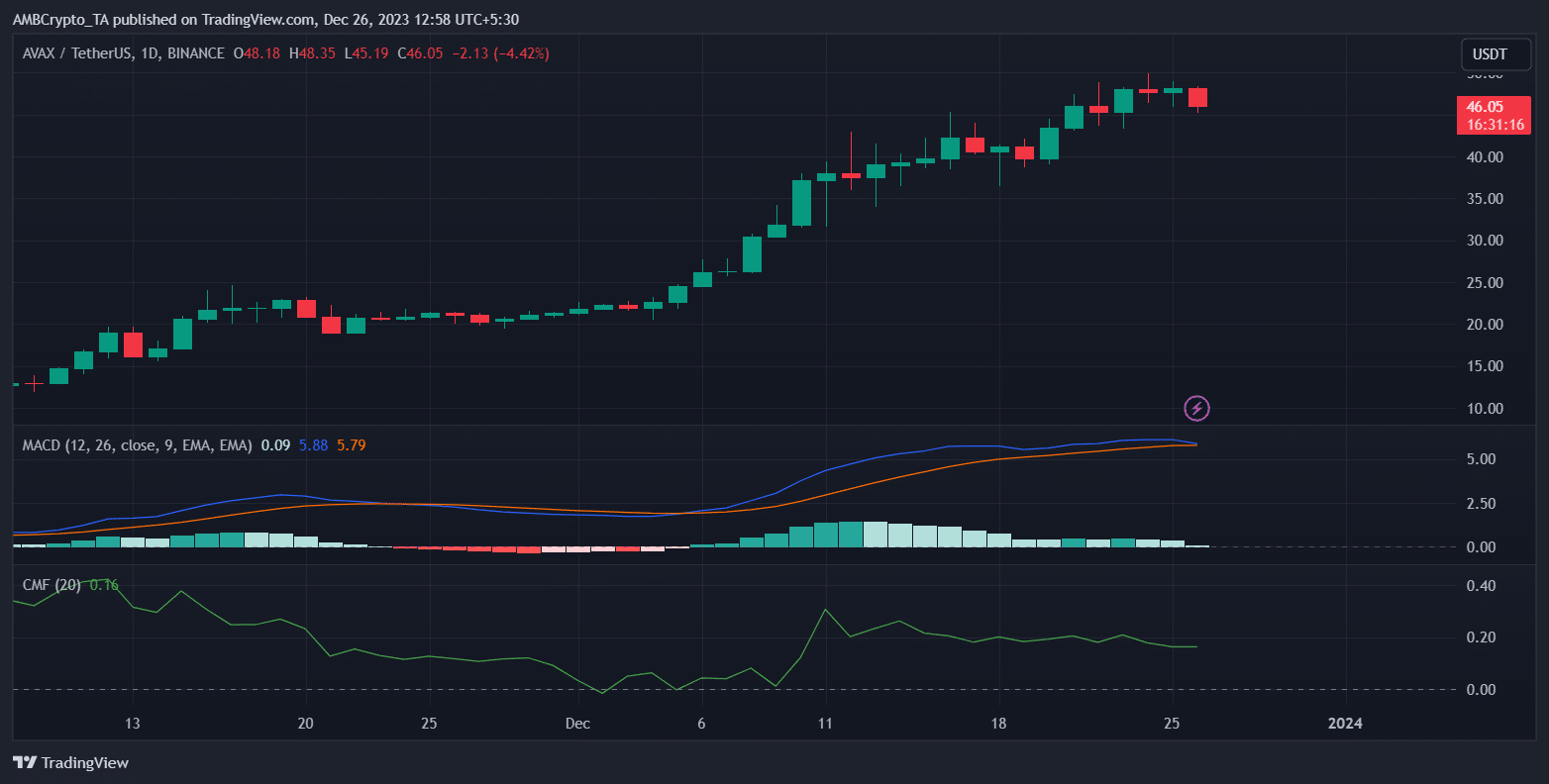

Therefore, AMBCrypto checked Avalanche’s daily chart to see whether a price correction is around the corner.

AVAX’s MACD displayed the possibility of a bearish crossover. Moreover, its Chaikin Money Flow (CMF) went sideways, increasing the chances of a price correction soon.